How To Find Upside In Downside

One of my favorite colloquialisms is “50% of something is better than 100% of nothing.” It’s best when said with a grizzled Southern accent with a big dip of Copenhagen wedged in the speaker’s lip.

| —Recommended Link— |

| Ex-Military Intelligence Officer Finally Reveals He Secret To Her 90.9% Success Rate Today only save 62% on the system that is helping smart investors like you make massive gains…hurry, wall street insiders hope to shut this down soon… Click here before it’s too late. |

Kidding aside, this phrase is one of the many mantras grown-up investors will use from time to time. Markets and stocks will and do go down at some point. It’s one of the few guarantees that come with the territory. We all want to do well on the upside. But with an unavoidable downside, the key is to do less worse than the market.

It’s doable.

#-ad_banner-#The fancy term money managers throw around is “downside capture.” As ridiculous as it sounds, it’s a thing. And it works.

There’s an actual portfolio called the downside capture ratio. However, rather than getting too far into those weeds, the ultimate goal of downside capture is for an investment portfolio to be down less than the overall market is down at its lowest point.

There are many different ways to protect an investment portfolio on the downside. Some are extremely complex and, frankly, seem like walking around the block just to get across the street.

In my two decades of professional experience, the simplest, most effective way to manage downside capture is to own dividend-paying stocks. Here’s an example.

Twenty years ago, two investors decided to put some money to work. Investor A bought shares of the SPDR S&P 500 ETF Trust (NYSE: SPY). Investor B bought shares of steady Eddy dividend payer Southern Company (NYSE: SO). Both investors held on to their shares through thick and thin over the 20-year period. How did they do?

Here’s a chart of the S&P 500 for the total period.

The worst periods are clearly marked. So how did our two investors do when the market was on its very worst behavior?

Here are the results.

However, drug stocks seem to perform a little better in choppier markets as they are more defensive in nature.

The Spyder holder didn’t do so hot. The dividend investor, on the other hand, won multi-generational, cocktail party bragging rights.

Now, I am by no means suggesting that you should stake your investment portfolio on just one stock. That’s financial suicide. Naturally, a portfolio must be diversified.

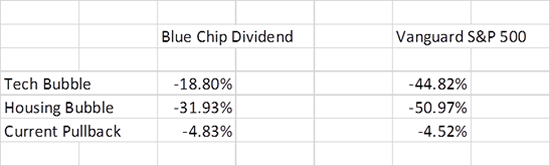

So how did a diversified portfolio of selected dividend-paying stocks do versus the S&P 500 at its worst points?

Pretty darned good.

I constructed an equally weighted portfolio of 17 widely held, dividend-paying blue chip stocks that included Coca Cola (NYSE: KO), Johnson and Johnson (NYSE: JNJ), and ExxonMobil (NYSE: XOM) to name a few. I back tested the portfolio using portfoliovisualizer.com. The portfolio was rebalanced annually, and all dividends were reinvested over an 18-year period.

When compared to Vanguard S&P 500 Index Fund (VFINX), not only did the blue chip, dividend outperform on the downside during the market’s worst times, it also beat the market on a total return basis.

Not only did the dividend portfolio go down less two out of three times, it delivered an average annual total return of 8.61% from 2000 to 2018. The index fund returned an average of 4.75% annually for the same period.

And they say stock-picking is dead. Hogwash.

Risks To Consider: As calm, cool, and collected as we all like to be, most investors do get at least a little nervous when markets go down dramatically, especially if the money we’ve invested is for an important goal like college or retirement. It’s normal. We’re human. The key is to make sure your investments fit your goals and time horizon and to remind yourself why you bought the stocks you are holding in the first place.

Action To Take: I know its unpopular to say to the passive indexing crowd, but, keep in mind that when you index, you are always at the mercy of the index. Up or down. If the market’s up, you’re up. If the market’s down, you’re down. Despite what skeptics say, while stock selection may not always outperform on the upside, avoiding the herd and owning solid dividend-paying stocks can provide some portfolio buoyancy when markets decline.