5 Small Cap Stocks With Major Insider Buying

The term “insider trading” often carries a negative connotation. And, of course, it is illegal to buy or sell shares of a company based on material, non-public information.

But insiders — company directors, officers or employees — who buy or sell shares based on non-privileged information are in the clear, although the activity is highly regulated by the Securities and Exchange Commission (SEC). For instance, the SEC prohibits insiders from entering and exiting positions quickly to capitalize on short-term price movements. The rules say that if an insider sells a stock, they cannot buy it back at a lower price for the next six months. On the flipside, if an insider buys a stock, they can’t sell it a higher price for at least six months.

Despite the heavy regulations, it’s important to pay attention to what insiders are doing. After all, they are on the front lines. Who else would better know the prospects of the company? They are privy to information regarding new products, competition, and the overall operating environment of the firm — the ultimate due diligence if you will.

| —Recommended Link— |

| Collect Regular Government-Backed Marijuana Payouts Of $6,751 Or More There’s a tiny Maryland company with a revolutionary new marijuana profit-sharing plan. And it’s consistently sending out checks of $6,751. Or more. The payouts are 100% backed by a U.S. Federal Law. And there’s no limit to how much you can collect. Get the full story here now. |

There is a catch, however…

Research has shown that insider buying is more useful in predicting future returns than insider selling — outperforming the market by over 7% annually in one 10-year study.

This makes sense because insiders who are buying their company’s stock would likely not put up their own money unless they believe the investment will be profitable. Yet, a decision to sell shares to raise cash could be based on any number of factors — a pending big personal purchase, a divorce settlement, a loan payback, to name a few.

Of course, it’s not wise to base your buy and sell decisions solely on insider data. But it doesn’t hurt to see what the inside money is up to…

Let’s Look For Some Insider Buys

Because of the tendency for insider buying to be a good indicator for future returns, I decided to find companies with a significant level of insider buying. I then ran those stocks through my Maximum Profit system to see which stocks had the most momentum, and thus the best chance of outperforming in the near term.

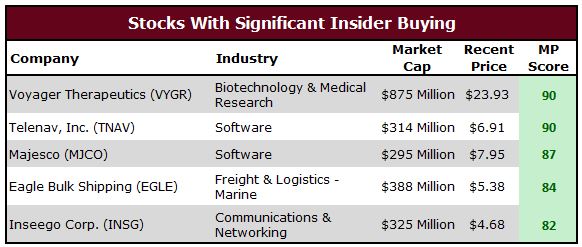

I found 102 stocks that were identified as having significant insider buys, defined in this case as at least three insider buys in the last six months. Of course, these companies also had to have had more shares purchased by insiders than were sold by insiders in the last six months as well. I also limited my search to small-cap stocks or those with a market capitalization of between $50 million and $1 billion.

I ran those 102 stocks through the system we use in Maximum Profit to see which ones are “buys” — which is defined as an MP score of 70 or greater.

Here are the five stocks that pass the test…

While all of the stocks in this table are technically considered “Buys” under my system’s criteria, there are two that stand out. Here’s a little more detail on them…

#-ad_banner-#1. Telenav (Nasdaq: TNAV) provides location-based products and services for connected cars and advertising. Its primary customer is Ford Motor Company (NYSE: F). Telenav’s navigation products are included in Ford models that are sold around the world. It also has agreements with General Motors (NYSE: GM) and its affiliates.

The company derives revenue primarily from automobile manufacturers, advertisers and advertising agencies. Telenav was among the first to bring GPS navigation to mobile phones. It’s now leveraging that expertise to bring its navigation systems to vehicles, where it then can use location-based data to provide smart navigation, as well as specific ads and commerce that pertain to that area.

The company’s goal is to help car manufacturers deliver a smarter, safer and more personalized user experience for drivers.

2. Voyager Therapeutics (Nasdaq: VYGR) is a clinical-stage gene therapy company that focuses on developing life-changing treatments for patients suffering from severe neurological diseases. The company’s pipeline consists of six programs for severe neurological indications, including advanced Parkinson’s disease, Huntington’s disease and Alzheimer’s.

This small company is still in the developmental and commercialization stages and therefore doesn’t currently have a product on the market. It’s still working its way through the rigorous three-phase FDA approval process, but Voyager has seen positive results in its clinical trials.

Action To Take

Keep in mind that the stocks presented here are intended to provide a starting point for further research, not a final recommendation. That said, my Maximum Profit subscribers shouldn’t be surprised if we see one or more of these stocks in our portfolio at some point.

In the meantime, if you’d like to learn more about how we use the Maximum Profit system to “hack” the market and earn bigger gains in less time, then go here to learn more…

P.S. Good news — there’s still time if you missed out on Jim Fink’s Ultimate Profits Summit… Due to overwhelming demand, we’re rebroadcasting the event — but for a limited time only. To see master trader Jim Fink show a small group of regular investors how to rake in gains of 114%, 211%, 246% and 433% — sometimes in as little as a single day — go here right now…