How To Deal With A Fickle Market Like This…

This market is almost as fickle as the weather: If you don’t like the way it’s going, just wait a day.

At least, this is how it has been as the month of June started. Stocks, already jolted by rising trade tensions, traded sharply lower on Monday on new antitrust fears — only to jump on Tuesday on the promise of lower rates.

Not that the month of May was a walk in the park. Trade concerns and worries about slowing worldwide growth sent the Dow Industrials on the longest losing streak — six weeks — since 2011; the S&P 500 declined 6.6% — the worst May performance in seven years.

#-ad_banner-#If you watch the news, you know the reason: the market’s optimism about trade-war resolution has been shattered, with the possibility of new, accelerating tariffs on Mexico now coming into play — and that’s on top of already-imposed 25% tariffs on roughly $250 billion of Chinese imports (as of last Friday).

This market reaction is rational: if existing trade relationships get truly disturbed, both corporate profits and consumer incomes (and spending, too) will be impacted. This can easily translate into the end of the record-setting economic growth in the United States (which is almost 10 years in duration and only one quarter away from becoming the longest period of economic expansion on record).

And Monday’s action had its own set of triggers: antitrust worries prompted the selloff in tech giants such as Apple (Nasdaq: AAPL), Amazon.com (Nasdaq: AMZN), Facebook (Nasdaq: FB) and Alphabet (GOOGL), the parent company of Google. The tech-heavy Nasdaq lost 1.6% and even slid into correction territory.

And then, the U.S. Federal Reserve came to the rescue.

The markets love the idea of the Fed executing a rate cut this year. Cheaper money means more attractive equities, all else equal.

No wonder that on Tuesday the market logged the best day since January as Fed Chairman Jerome Powell, speaking in Chicago, signaled that the central bank is open to an interest rate cut, if necessary, and pledged to keep a close watch on the trade dispute. This does not mean that the worst is over for the markets, of course — as powerful as the U.S. Fed is, monetary policies are not omnipotent.

And yet, I am not ready to establish an all-encompassing strategy of recommending trailing stop-loss protection on all portfolio positions.

Here’s why…

For one, in a news-driven market such as the one we have today, sharp selloffs can be followed by sharp and fast rebounds — just as we’ve had in the first trading days of June. In such a market, a stock can decline just because it’s part of a certain sector or because the market as a whole is under pressure — reasons not related to the company itself — and so once the market lets up, such stocks tend to rebound. A stop-loss can indeed protect your gains or save your portfolio from bigger losses. But it would also prevent the portfolio from participating on the upside (which, as we’ve seen, can come as fast as the selloff).

Second, small-cap stocks — like the ones we specialize in over at my Fast-Track Millionaire newsletter service — are more insulated from such issues as antitrust worries (for obvious reasons) or even trade policies (because of their largely domestic focus).

And here’s yet another reason I’m staying away from imposing trailing stop-losses across the board: lately, the persistent weakness of smaller-cap stocks that lasted more than a year has begun to let up.

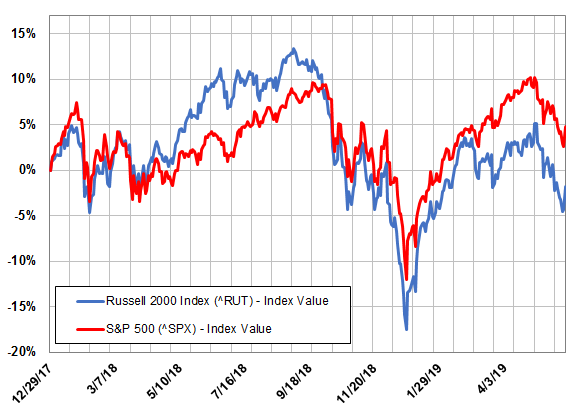

Take a look at the chart below.

As you can see, small caps have staged a comeback in 2019. If last year’s underperformance reflected growing recession worries based on trouble in small-cap land, the recent relative strength is a sign that there may be less to worry about on the recession front.

Action To Take

Let’s hope that’s the case. But I think it prudent that we start recession-proofing our portfolio in the event of an economic slowdown.

In Fast-Track Millionaire, we own the Vanguard Extended Duration Treasury Index ETF (NYSE: EDV) alongside our portfolio of aggressive growth stocks. And our strategy has paid off…. the fund, which owns long-dated treasuries, has gained more than 18% since we added it to our portfolio in late November (the 10-year benchmark Treasury yield recently declined to its lowest level since October 2017 — remember, price and yield move in the opposite directions for bonds).

But the best way to do this for a gaggle of small-cap stocks is to stick with the ones where future growth is largely independent of macro-economic trends. This does not mean these stocks are riskless — but for many of them, the risks lie in more internal factors, such as a finalizing a new drug discovery or in delivering a best-in-class product.

Better yet, my newest report shows investors how to get on the right side of one of the biggest trends we’ve seen since the dawn of the internet. By now, you probably know that marijuana has been legalized in several states — but this is just the beginning…

My research staff has collected intel that suggests a critical House vote could happen any day now that could be the first domino to fall in favor of nationwide legalization in the U.S. What’s more, we’ve pinpointed three stocks you’ll want to own before the vote takes place. Go here to read the full briefing.