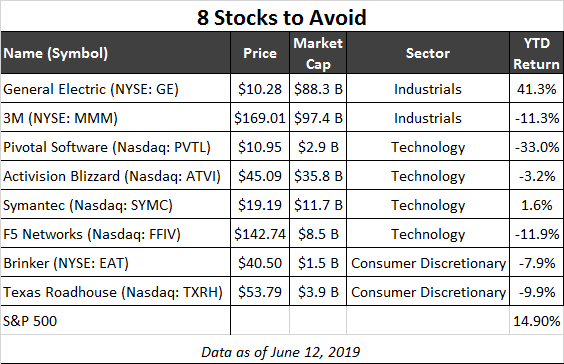

8 Stocks To Avoid At All Cost

The markets undergo rotation all the time. Whether it’s manifested as a change in leadership in a stock or in a sector, one thing is for sure: some of today’s small- and mid-sized companies are destined to become tomorrow’s blue chips.

This is what my Fast-Track Millionaire premium newsletter service is all about — finding tomorrow’s leaders while they still trade at relatively low levels. If you get it right, the rewards can be stunning.

While identifying the next Microsoft can be an arduous process, a few mistakes along the way can be forgiven if your best find appreciates by 100%, 200%, or even more.

The strategy of finding what we like to call “The Next Big Thing” is two-fold. The first step entails identifying relevant trends in their early stages and the companies that will be the likely beneficiaries. That’s obvious enough. But there’s a corollary to the process, an aspect of the search that is often underappreciated by investors. And this part is all about determining which stocks or groups of stocks are the most likely to deteriorate as time goes on. In other words, the companies to avoid.

This is what we’re going to focus on today: a few of the trends (and a few sample stocks) that can be in trouble longer-term simply because they are not leveraged to the growth trends of tomorrow. Let’s take a look…

Here are some of my thoughts on these stocks…

2 Industrial Stocks To Avoid

Some blue chips, for instance, are not likely to remain on top of the game for much longer. General Electric (NYSE: GE) trades at only $10 per share today. This makes for a market capitalization of only $88 billion, a far cry from the nearly $600 billion market cap in the glory days of this conglomerate 20 years ago.

#-ad_banner-#One of the problems with GE is just that — it’s a conglomerate. And while it’s been shedding businesses and cutting dividends (GE again slashed its quarterly payout to just a penny in December 2018), the future of this company is far from certain. Down 25% year-over-year, GE has rallied more than 40% in 2019. This makes it fairly valued, in my view, and I would avoid the stock at this time.

Another conglomerate that I would avoid buying at this time is 3M (NYSE: MMM). This company had thrived on innovation — and its valuations have been high accordingly: over the past five years, it has traded at a forward P/E as high as 26. Today, its valuation is comparable to the market (a P/E of just over 17), which reflects its diminishing growth expectations. The market expects long-term growth of just 6.4% — which makes MMM fairly valued at current levels. The stock looks like a strong “Hold,” and its prospects might improve if MMM returns to its innovative roots.

Tech Stocks To Avoid

With technology stocks leading the market, it might seem as if every software company or anything tech-related is a “Buy.” This would be a mistaken assumption — the tech sector, as much as anything else in the market, is subject to both growth and stagnation. Choose a stagnating company or a company with inadequate technology and you might see its share price plummet.

That’s what happened with Pivotal Software (Nasdaq: PVTL), a cloud company that saw its price cut nearly in half over the month of June, and IT security company Symantec (Nasdaq: SYMC), which lost 35% of value over the past two years, despite the tech boom.

A company that lost 40% of its value over the past year, computer-game maker Activision Blizzard (Nasdaq: ATVI) still does not look attractive enough to be a buy. The company is in a hit-driven business, its growth is slowing (analysts expect the company’s long-term profits to grow at only a 6.6% annual pace) — and it’s trading at a P/E of almost 20. The company’s value is underwhelming, and I would avoid it at this time.

A software company slow to adapt to the cloud, F5 Networks (Nasdaq: FFIV) is another stock to avoid at current levels. Trading at a deceptively low P/E of 13, FFIV isn’t growing anywhere as fast as its cloud competitors (at an estimated 5.6% long-term rate), and it is likely to keep losing market share. I would avoid it at this time.

2 Restaurant Stocks To Avoid

The Restaurant business is notoriously hard. And these days, as increases in minimum wage and cost pressures serve as headwinds to many food businesses, some stocks look overvalued. Add to that the explosive growth of food-delivery applications and the need to spend heavily on technology (such innovations as personalized menus cost money to implement) — all of which chip away at profits — and the industry looks less attractive than, say, a year ago.

While industry leaders such as McDonald’s (NYSE: MCD) or Starbucks (Nasdaq: SBUX), with long-term expected growth rates of 8.8% and 13.3% respectively, look well-positioned to weather the headwinds, a few of their smaller competitors might not be as well positioned going forward.

Brinker (NYSE: EAT), owner of the Chili’s and Maggiano’s brands, is one such stock. While its generous dividend of 3.7% seems safe, there isn’t much upside for the company’s profits in today’s competitive environment.

A company that seems outright overpriced — and hence better to avoid — is Texas Roadhouse (Nasdaq: TXRH), a steak restaurant chain with two main brands, Texas Roadhouse and Aspen Creek. The company blamed the unexpected rise in workforce costs for a recent decline in margins and profits. The stock, which is down 11% year-to-date (versus the nearly 15% increase in the S&P 500) might remain under pressure for some time. Avoid.

Action To Take

While these stocks have not been researched thoroughly, based on the overall trends in the market and a cursory study of these stocks, I’m telling my readers to stay away.

But now that we’ve discussed what stocks to avoid, let me tell you about what me and my subscribers are buying…

In this eye-opening report, I’ve uncovered four stocks that could throw off double or even triple-digit gains from four separate unique and industry shattering breakthroughs in the next few months. If you’re happy with the tiny gains that most stocks are throwing off right now… then this isn’t for you. But if you want to learn more right now, go here for the full story.