How To Profit From Falling Stocks Without Taking Too Much Risk

Want the rewards of betting against a stock without all the risks associated with shorting? Then buying put options may be the answer.

Today, let’s focus on the basics of buying put options. We’ll cover the reasons to buy put options, how they work, and the various reasons a trader might use them…

What Are Put Options?

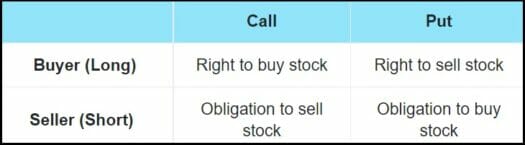

A put option is a leveraged trade that gives the trader a chance to enjoy relatively large rewards for a defined amount of risk. It gives the owner the right, but not the obligation, to sell 100 shares of the underlying stock at a specified price (known as the “strike price”) at any time before the expiration date.

Changes in the price of the underlying stock will lead to a change in the value of the put. So will changes in the volatility of the underlying stock. (All else equal, if the stock experiences volatility, the put should go up in price.) This is because there is a greater chance it will reach the strike price by the expiration date. Falling volatility lowers this chance, so it should decrease the value of the put.

In addition, the put will also change in value based on how much time is left until the expiration date. All else equal, the put will be less valuable as it gets closer to the expiration date.

How Traders Use Put Options

Buying put options gives the trader a chance to enjoy the benefits of leverage, paying relatively large rewards for a defined amount of risk. Traders who buy puts are typically bearish on a stock. There are also option contracts available on some ETFs, indexes, and futures.

Let’s consider a hypothetical example. If stock ABC is trading near $600 a share, 100 shares would cost $60,000. A trader who thinks ABC will fall could sell the stock short, but that would require a large amount of margin and the risk a trader faces in a short position is unlimited. Instead of selling ABC short, a trader could buy a put contract.

If traders think ABC will fall within the next few weeks, then they could buy a put option that allows them to sell 100 shares of ABC for $600 (the strike price) at anytime in the next two months (the expiration is 60 days away) for a price of about $32 per share (the option premium). This would allow them to participate in any price decline while limiting their risk to only $3,200.

If ABC fell to $500 a share at the expiration date, the traders would make $6,800. This assumes that traders could sell short the 100 shares for $600 and immediately buy them back in the market for $500. The premium of $3,200 would be deducted from the profits. Put traders can close their positions by selling a put contract without having to sell the stock short first and then buy it back. The profits would be the same. The options trader would make a return of 112% on their investment.

If ABC closed above $568 on the expiration date, the trader would suffer a loss of their entire investment. This is because selling short to cover the put contract and buying the shares back to close the short position would not cover the cost of the premium. However the trader’s loss is limited to $32 per share no matter how high ABC goes. If the stock rises to $700, then the trader who shorted 100 shares would lose $10,000 while the put holder would only lose $3,200.

The actual price move in ABC would determine the price of the option. Puts can be bought or sold at any time and the trader would be able to take a profit or cut their loss at any time during the trade.

Closing Thoughts

The potential profits for a trader owning a put are significant, but are limited because the underlying stock can not fall below zero. This is different from bullish option trades that use call contracts and have unlimited profit potential. The maximum possible risk on a put is limited to the total price paid for the option contract.

Because puts have various expiration dates, a trader can make a short-term bet or a longer-term trade. They also help traders hedge their portfolios and profit in bear markets. Put options are also appealing because of their limited loss potential. They are often preferable to selling individual stocks short, since shorts carry (theoretically) unlimited risks for traders.

Editor’s Note: Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality… specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

To find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

Don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.