How Strike Price Affects Risk And Reward For Options Trades…

If you are new to options trading, it can be easy to feel overwhelmed at times. For one thing, there’s a new universe of terms and strategies. But the important thing is to focus on the essentials and keep it simple.

That’s why we periodically publish explainers to break down the basics. By defining terms in detail, or showing how a particular trading strategy might work, our goal is to make these concepts digestible.

The Strike Price, Explained

The Strike Price, Explained

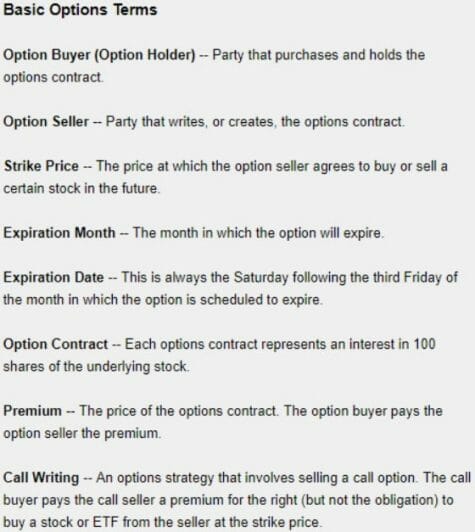

An option contract gives the buyer the right to buy or sell the underlying security at a predefined price for a specified amount of time. That predefined price is known as the strike price.

To put it simply, this is the price at which an option buyer will be able to exercise an option contract. For this reason, you may also hear it referred to as the exercise price.

As we’ve explained before, options trades are defined by three critical factors: the price at which it would be executed (strike price), the date it would occur (expiration date), and the premium (or cost) for the trade.

Let’s dive in further to understand how to use strike prices for maximum effect…

How Traders Use Strike Price

Options analysis can be a difficult task. Traders use the strike price in their analysis to meet the goals of their trading strategy. It’s critical in determining the best combination of risk and reward in an options trade.

Traders may find that a strike price near the market price has a high probability of being exercised. Or they may prefer a one that is far away from the market price in order to limit risk.

What’s more, the relationship between the strike price, the underlying stock price, and the time left to expiration can help traders determine the intrinsic value of an option.

Let’s take a look at the table below. It illustrates a fictional “XYZ” stock trading at different prices in relation to call and put options at a $100 strike price. The relationship between the strike and the stock price determines the stock’s “moneyness” (i.e., “in the money,” “at the money,” or “out of the money “):

Let’s consider another example. A trader might pay a premium of $17 in July to buy a call option on Company XYZ at $400 that expires in October. At the expiration date, the call buyer can buy 100 shares of XYZ for $400. This is true regardless of the market price of the stock.

Let’s say XYZ is trading at $420. The call buyer would pay $400 and have an immediate profit of $3. (The $20 difference in market price from the exercise price minus the $17 paid in premium.)

Put option buyers are given the right to sell the underlying security at the strike price. In this example, let’s say XYZ is trading at $400 on the expiration date. A put option buyer with a $380 strike price could sell 100 shares at $400. This would make a profit equal to $20 minus the premium they originally paid for the put.

Why This Matters To Traders

The strike price is a critical factor in determining whether a trade is profitable. If the underlying security is close to the strike price at expiration (at the money), the trade will likely be only marginally profitable.

For call buyers, the biggest profits will be earned when the market price of the underlying security is substantially above the strike price (in the money). Put buyers see their biggest gains when the market value is significantly below the strike price.

Option sellers will minimize the risks associated with exercise by using strike prices far away from the market value (out of the money). Traders exercise options when they can make an immediate profit. Distant strike prices minimize the chance that an underlying security will offer this potential at expiration.

Editor’s Note: Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality… specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

To find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

Don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.