6 Stocks With Positive Momentum In A Weakening Market

Spooked by the threat of trade war acceleration and despite the quarter-point interest rate cut Wednesday, the market sold off practically all off all week. Then, on Monday morning, we learned that the Chinese government had allowed its currency, the yuan, to slide to its lowest levels in more than a decade.

The market sold off sharply as a result.

Despite this slide though, large-cap indices still trade close to their all-time highs. The market is losing momentum, but the buyers can return as fast as they retreated if the market senses that the worst of the trade war is over or if the Fed indicates more dovishness. In the meantime, investors have clearly become more cautious, booking profits on their best stocks of the year and taking losses on some of the laggards.

| —Recommended Link— |

| The Real Reason Most Americans Can’t Retire by 65 |

Let’s Go Hunting For Momentum

In a normal market environment, this creates opportunities. One way to take advantage of a buying opportunity is to position yourself to benefit from temporary weakness in strong stocks. This is why I’d like to spend some time today focusing on the positive and look for a couple of momentum stocks that look fundamentally attractive.

Thus, today’s quest is all about finding promising, growing stocks trading close to their 52-week highs.

Because I wanted to find higher-quality stocks, I looked for growing companies that are profitable or on the verge of becoming profitable. I searched for companies that have been growing their revenues at a 20% average annual pace (or better) over the past five years, have positive operating margins (in essence, positive earnings before interest and taxes), and are expected to deliver a 25% earnings per share (EPS) growth over the next year. As a valuation metric, I chose a price-to-sales measure; only companies selling at five times annual sales or less made the cut.

Further, I limited the search to small caps only (market capitalizations less than $2 billion), and only to companies trading on U.S. exchanges.

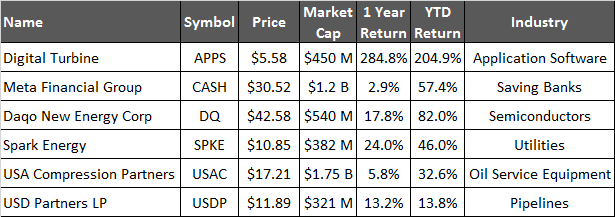

Only six companies made it through all these hurdles for this month’s screen. Here’s the list…

Data as of August 1

Interestingly enough, only two companies on this list belong to the tech sector. That’s likely because of the strict rules I applied to this screen, including the price-to-sales ratio of under 5 (many tech companies trade at a much higher P/S multiple).

Both of these tech stocks are interesting at their current levels.

My Two Favorites

Digital Turbine (Nasdaq: APPS) works at the intersection of tech/mobile and media, with a focus on original equipment manufacturers (OEM) and mobile operators.

Digital Turbine (Nasdaq: APPS) works at the intersection of tech/mobile and media, with a focus on original equipment manufacturers (OEM) and mobile operators.

APPS’ mobile delivery platform is adopted by more than 30 mobile operators and OEMs worldwide. With that adoption, which essentially means that APPS’ applications get preinstalled on new phones, the company has already delivered more than one billion preloaded apps. And those apps have been used for tens of thousands of advertising campaigns by phone operators and OEMs.

While this sounds like a huge number, the company notes that its apps can only be found on about 10% of all Android phones — which means that further market penetration is possible and that the overall market opportunity is huge. Moreover, while APPS had historically not been engaged with Samsung, a major Android phone manufacturer, it has recently made inroads in breaking into Samsung’s space, having established a new strategic relationship with the South Korean giant.

While this is a recent development and it’s still immaterial for the company’s financial results right now… but if this changes, then the sky is the limit for APPS’ future growth. Digital Turbine’s stock rallied strongly this year and over the past year, so some profit-taking might be in the cards, but I would keep an eye on this game-changer for a potential entry point.

China-based Daqo New Energy (NYSE: DQ) is in the business of manufacturing polysilicon products for solar cell and module manufacturers. Its China location is a positive for the company, as Daqo should be able to take advantage of that country’s solar energy policies, its booming solar markets and new solar panel installations.

China-based Daqo New Energy (NYSE: DQ) is in the business of manufacturing polysilicon products for solar cell and module manufacturers. Its China location is a positive for the company, as Daqo should be able to take advantage of that country’s solar energy policies, its booming solar markets and new solar panel installations.

Of course, just as with any China-based stocks, Daqo requires an extra dose of caution when reviewing its prospects and its financials and when evaluating its potential. But given DQ’s valuations (the company is profitable and its stock trades at only 12.2 times next-year per-share earnings) and the growing state of China’s solar industry, the risk might be well worth taking.

Action To Take

Keep in mind that the investing ideas presented here are intended to provide a starting point for further research, not a final recommendation. If either of these stocks proves to be worth adding to your portfolio, then my Game-Changing Stocks readers will hear about it first.

P.S. This opportunity is completely unlike any pot investment you’ve ever seen… When you sign up for this company’s plan, you’ll have the chance to collect checks of $9,974 or more. Over and over again. The payouts are backed by the full force and authority of the US. Federal Government. And the next check run is just days away. Find out more here…