Are Naked Options Worth The Risk? Here’s What You Need To Know…

Every decision you make in the market carries the potential profit or loss, and this “risk vs. reward” must be weighed before taking action.

One strategy you need to be keenly aware of this is with “naked” options.

This refers to writing an option on a stock you don’t own. This strategy is mainly used for speculating. You must be very confident about the stock’s direction and have the resources to cover any mistakes.

In this article, we’ll delve into the nuances of naked options, contrast them with their “covered” counterparts, and weigh their inherent risks and rewards.

Covered vs Naked Options

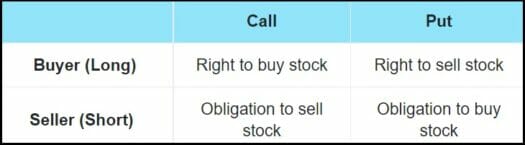

Covered calls and covered puts are written if the seller of the option actually owns the underlying securities. With a naked option, the writer (or seller) does not own the underlying security.

Consider an investor looking at options in Apple (NSDQ: AAPL). An investor buys a call contract if they expect the shares of AAPL to move higher. The seller of the call contract would believe that AAPL will fall.

At expiration, if the price of AAPL is above the strike price of the option, the buyer can exercise the option and buy the shares of AAPL at the strike price. The seller of the option is obligated to deliver those shares. If the seller of that contract does not own shares of AAPL, they have written a naked call option and will be forced to buy shares at the market price, resulting in a loss.

If AAPL falls, the writer’s profit is limited to the premium they collected for the option sale. But they can face significant losses if AAPL moves up before expiration. In fact, the risk with this strategy is theoretically unlimited.

Traders buying put options expect prices to fall. The seller of the put option most likely believes that prices will rise. Naked put option sellers will lose on the trade if the underlying security declines in price. Their risk is limited because prices can only fall to zero, so the maximum loss is equal to the strike price. In contrast, the maximum gain is limited to the premium collected when the trade is initiated.

Why It Matters To Traders

Most option contracts expire worthless. This could be because many options buyers use them as insurance against a sudden market crash. This can involve buying deep out-of-the-money puts, for example. In this case, the buyers would expect the options to expire worthless since crashes usually occur infrequently. The rare winning trade for these put buyers will be very large, but many losing trades will likely be very small losses.

Naked option writers are taking advantage of the fact that most options contracts will expire with no value. They’re selling option contracts they believe have a slight chance of being exercised. These traders think that selling deep out-of-the-money options seems like a low-risk way to collect small premiums without an assignment at expiration.

If a trader can do a number of these small trades successfully, it could add up to significant profits over time. However, occasional large losses could erase the small gains accumulated over many trades.

Closing Thoughts

Naked options offer potentially large profits over time. Since most options do expire worthless, several relatively low-risk strategies can be applied to sell naked options. But if a large market move occurs suddenly, then you could face substantial losses. In a market crash, put sellers would suffer and could see the profits from thousands of small trades lost in minutes.

Success in selling options could depend on when you begin selling naked options. If you enjoy a long bull market before any put contracts are exercised, the large loss could be paid from accumulated profits. If the market crashes shortly after you begin to follow this trading strategy, the large loss could be catastrophic.

We suggest looking into covered calls if you are determined to hold on to a particular stock for the long haul. This technique will help you add real income to your portfolio. The worst that can happen is you might be forced to sell your stock at the end of the month (but for a price you would gladly have accepted anyway).

Editor’s Note: In a new presentation, my colleague Jim Fink can show you how to receive regular payments of $2,950 or more. He calls it his “I.V.L. System” and it generates winners at a mind-boggling clip.

Jim Fink is the chief investment strategist of the premium trading service, Options for Income. His system works for beginners and for seasoned trading experts alike.

Even if you’re still unsure how options trading works…this system is for you. Or if you’re a pro who trades 10 contracts a day…this is for you, too. Jim’s I.V.L. system works in up or down markets, when inflation is elevated or low, and regardless of Federal Reserve monetary policy.

Jim likes to keep it simple. Every week, he’ll send you easy-to-follow instructions that’ll put you on Wall Street’s payment list. You’ll get the money right away, up-front, in your trading account.

Jim Fink made himself rich trading options. Now he gets his kicks helping other people get rich. Want to earn life-changing income? Click here.