Why Stop-Loss Orders Could Be Dangerous (Here’s What To Do Instead)

Years ago, market makers were the people who stood on the floor of the New York Stock Exchange.

Their job was to “make a market” for any investor who wanted to buy or sell one of the stocks that fell under their responsibility.

When prices were falling, market makers were buying; when prices rose, they would sell shares from their inventory.

Market makers were beneficial to investors — there was always someone available to take the other side of your trade. But they were also expensive. Because market makers were obligated to buy and sell under any circumstances, exchange rules allowed them to charge $0.125 per share, or more, on every trade to make up for the high amount of risk they undertook.

However, the main job of a market maker was ensuring that every trade was executed whenever possible — including stop-loss orders.

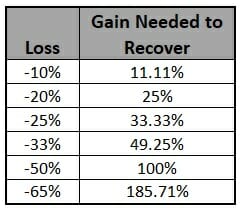

Usually, investors enter stop-loss orders to ensure their shares are sold when prices start to fall. Stop-loss orders are designed to lock-in losses during fast-moving declines, but they do not guarantee the loss will be limited. In fast-moving markets, prices often show large gaps. And it is possible the stop-loss order will be filled at a price well below the level it was entered.

Price declines often seem to end after the last stop-loss order is executed. For a time it was believed that market makers were trying to hit the stop-loss orders to create losses for individuals and profits for themselves. But as mentioned earlier, market makers were trying to hit the stop-loss orders because their job was to execute as many orders as possible.

Where Do I Get Out?

A key question for traders is where to place a stop loss. In other words, how far should you put the stop below your purchase price? Many traders will tell you to set a predetermined “maximum acceptable loss” amount based on your personal account rather than a technical analysis of the stock in question.

One line of thinking says that you should not lose more than -2% of your equity on any one trade. So if you have $100,000 in stock market capital, then the maximum loss you would accept on any trade is $2,000.

If you risked $8,000 by buying 100 shares of an $80 stock, you would limit your risk to no more than $2,000. In that case, you would set your stop loss at $60 and would have $6,000 left if you exited the position at the maximum loss allowed.

Another method of setting stop losses is to predetermine an arbitrary percentage of your purchase price you are willing to lose. One well-known figure — suggested by William O’Neil, publisher of Investor’s Business Daily — states that you should never lose more than -8% of your position on any given trade. In the case of the above example, you would set your stop loss at $73.60, or 8% below $80.

Whatever you decide is ultimately up to you. But having predetermined amounts help prevent unacceptably large drawdowns in your account balance. They have nothing to do with the stock’s behavior itself. The market doesn’t know at what price you bought the stock or your overall account balance, nor does it care.

Alternatives To Stop-Loss Orders

Today, market makers have largely been replaced by high-frequency trading (HFT) firms. While technology has replaced people on the exchange floor, the stop-loss order is still a magnet for prices.

Despite the drawbacks, some individual investors would never consider foregoing the comfort of stop-loss orders. Many individuals simply don’t have the option of following the markets in real-time so they can sell when prices crash.

Recent crashes actually show the danger of stop-loss orders. In the past few years, rapid declines have often been followed by at least partial recoveries. Not only can stop-loss orders be a factor in accelerating declines, but they can take away an investor’s opportunity to benefit from a rapid recovery.

Rather than using a standard stop-loss order, consider using a “stop-limit” order. With a limit order you are setting the worst price you will accept. For example, a stop-loss at $25 will be executed at any price below $25. If there is a quick move, you could get filled at $24 or lower. With a “stop-limit $25” order, you will be filled at $25 or above after the price falls to $25.

There is no guarantee a limit order will be filled, but it would have helped in the market crashes that have occurred in recent years.

Mental stops can also be a way to avoid taking losses in a short sell-off. With a mental stop, you check the markets after the close and sell the next day if the price is below your stop level.

Mental stops can use daily or weekly closing prices. Sell orders can be entered at the market price for the next morning or a limit order can be used to try for a slightly better price when selling.

The main thing is to sell before losses grow too large. But traditional stop-loss orders could be a costly way to do that. Stop-limit orders or mental stops could be a better alternative and save you a great deal of money on most trades.

Editor’s Note: In a new presentation, my colleague Jim Fink can show you how to receive regular payments of $2,950 or more. He calls it his “I.V.L. System” and it generates winners at a mind-boggling clip.

Jim Fink is the chief investment strategist of the premium trading service, Options for Income. His system works for beginners and for seasoned trading experts alike.

Even if you’re still unsure how options trading works…this system is for you. Or if you’re a pro who trades 10 contracts a day…this is for you, too. Jim’s I.V.L. system works in up or down markets, when inflation is elevated or low, and regardless of Federal Reserve monetary policy.

Jim likes to keep it simple. Every week, he’ll send you easy-to-follow instructions that’ll put you on Wall Street’s payment list. You’ll get the money right away, up-front, in your trading account.

Jim Fink made himself rich trading options. Now he gets his kicks helping other people get rich. Want to earn life-changing income? Click here.