This Outperforming Strategy Is One Of The Best-Kept Secrets In Investing…

Today I want to tell you about an investing strategy that defies logic. It shouldn’t work based on everything you’ve learned about the stock market.

Yet it does. In fact, for over half a century, investors and traders have used this strategy to produce unparalleled results.

And no, this strategy doesn’t involve options, derivatives or any other obscure financial product, for those who may be wondering.

What’s more, what I’m about to show you can be used as part of any general investing strategy — regardless of whether you’re focusing on income, growth, blue chips, small caps, or commodities.

Specifically, I’m talking about relative-strength investing.

Relative Strength 101

Longtime readers might already be familiar with relative-strength investing. We’ve talked about it before in previous articles. But allow me to provide a brief recap…

Relative-strength investing is simply a type of momentum investing. It involves buying the best-performing stocks (relative to the market) and holding them until their momentum changes course.

This strategy probably sounds ridiculous to most investors, especially those who consider themselves value investors. After all, most people have heard the phrase “buy low, sell high.” Since relative-strength investors buy stocks th

at are already outperforming today, many view this investing style as counterintuitive.

But that’s a mistake… and it’s one many people make whenever they approach a stock pick.

Most investors have been trained to think that the stocks with the most upside potential are those that are the most “undervalued.” The definition of undervalued varies by the investor. But normally, people define it using metrics like low price-to-earnings ratios, price-to-book ratios, or discounted price-to-sales values.

The problem is that this approach leads investors to pass up the market’s best-performing stocks in favor of the ones doing the worst. Since underperforming investments usually sport the “lowest valuations,” we tend to think these stocks are the more attractive buys.

Metaphorically speaking, this is like abandoning a luxury yacht in favor of sailing around the world in a leaky shrimp boat because buying a ticket on the shrimp boat can save you half the cost of your trip. Don’t get me wrong, I like saving money. But I’ll gladly take the yacht if it means I will enjoy my vacation and get back home alive.

Unfortunately, most people don’t look at stocks like that when it comes to investing. They see a great-performing company with an average or premium valuation (the yacht) as riskier than an underperforming stock with a low valuation (the leaky shrimp boat).

Research has proven that this is a terrible fallacy. It turns out that the best-performing stocks, the ones already beating the market today, are the best investments to own… at least in the medium term.

A Thoroughly Studied Strategy

One of the best studies on this phenomenon was by the asset-management firm AQR Capital Management. They looked at U.S. stocks going all the way back to 1927. They found that at any given time, the stocks that were outperforming 80% of the market continued to outperform for at least the next 12 months.

The same thing goes for underperforming stocks. The bottom 20% of performers continued to underperform over the same period.

This idea is the central concept underpinning relative-strength investing. Relative-strength investors rank stocks based on performance, buy the best performers, and sell that stock when the momentum changes course.

If it sounds too easy, that’s because it is. Yet, despite its simplicity, this strategy has been executed with staggering results.

For example, AQR found that using a relative-strength strategy allowed the firm to outperform its benchmarks in nearly every investing category (including mid-caps, blue chips, and small caps).

What’s more, James P. O’Shaughnessy, author of “What Works On Wall Street,” discovered that using a relative-strength-based system would have beaten the market by an average of 3.7 percentage points per year over 83 years.

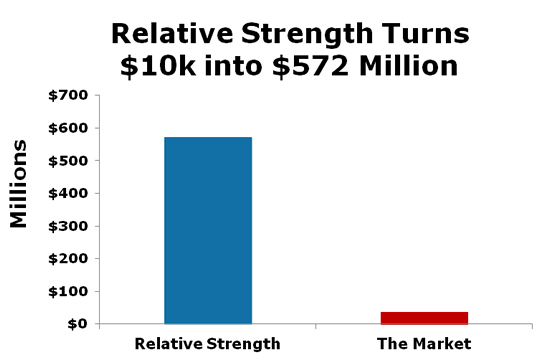

To put that into perspective, that performance would have turned any $10,000 invested into more than $572 million. The market would have only turned that $10k into about $38 million — nearly 15x less than a relative-strength-based system.

Closing Thoughts

With that kind of track record, it’s hard to deny the benefits of relative-strength investing.

Of course, not all stocks with high relative strength will jump higher. There are never any guarantees in investing. But more often than not, they can deliver outstanding results.

You don’t have to use the exact relative strength strategy we use over at Maximum Profit, either. The main thing you should take away from this is that momentum investing can be profitable, contrary to popular belief. Very profitable. And to reap the best results, you need a reliable system with clear buy and sell signals working for you — and you need to be disciplined enough to act on them.

P.S. In my latest report, I uncover an “off the radar” investment developing one of the most disruptive technologies we’ve seen in years…

I’m talking about flying cars. That’s right, we’re talking about a total revolution that could change the face of our way of life forever. It may sound like science fiction… but it’s coming sooner than you think.

The best part is that one of my top picks for this emerging technology is being totally ignored by most analysts right now, which means we have a unique opportunity to get in before the crowd catches on. Go here to learn all about it right now.