How To Keep Your Head In This Market…

The timing couldn’t have been worse…

Before I left the country, the stock market was hitting record highs. So were many of our own holdings over at Maximum Profit.

Then COVID-19, or coronavirus, came along and wreaked havoc on the market in a matter of days. It took only six days to go from record highs to correction territory (defined as a pullback of 10% or more), a stock market record.

As the market tumbled, the Federal Reserve slashed interest rates by 0.5% on March 3, to a range of 1%-1.25%. The goal: to try and help prop up the economy and get ahead of the effects of the coronavirus.

It didn’t help much…

The Dow Jones shed nearly 1,800 points and the S&P 500 lost 2.8% on the day the Fed announced rate cuts, wiping out the previous day’s rally.

Typically, I would be more proactive during black swan events like we’re witnessing with the coronavirus. But unfortunately, I was traveling out of the country with little or intermittent internet access. So, I wasn’t able to return emails and be more proactive. But I did send an alert telling my Maximum Profit subscribers to increase their trailing stop-loss orders to 20%.

But if you’ve followed my analysis for a while, then you know I’m big on helping investors prepare for times like this. I constantly preach the importance of a systematic, rational approach to the market. I’m going to briefly reiterate the same points I’ve mentioned recently. But I encourage you to go back and click on each of these links and re-read them in full. Print them off and set them next to your computer if you need to as a daily reminder if you need to.

A Reminder On What We’ve Talked About…

Back in January, I told you about how an innocent conversation with my wife reminded me about the danger of high expectations when it comes to investing. Here’s the crux of what I said in that piece:

Many folks begin their investing/trading careers with expectations of making easy money and striking it rich overnight. They expect to easily beat the market every year… win every trade. But the problem with this line of thinking is that they can’t admit when they’re wrong. They hold onto losers and often watch them swell into larger losses because if they sell at a loss it concedes defeat. They can’t handle the failure.

But as I’ve said many times before, selling a loser short is actually a win. It’s a win against a larger loss. You need to be okay with booking a loss once in a while. It’s going to happen. It’s part of the process. Just keep those losses small and you’ll be able to stay in the game — and build wealth — much longer and quicker.

Also in January, I gave readers a list of five resolutions to make for the new year. In that piece, I argued that if each of us can implement these, we’ll be far better off as traders and investors in the long run. Here’s the short list (to read my full analysis, again, go back and read the piece in full):

1. Ignore The Daily Market Chatter

2. Understand What You’re Investing In

3. Your Best Investment Might Already Be In Your Portfolio

4. Don’t Be Afraid To Sell

5. Set Small Milestones To Reach Your Ultimate Goal

And finally, I talked about the importance of allocation in this article. I discussed how just one overly aggressive allocation in a trade can wipe out all the good work you’ve done. (I even shared a personal story from my own experience in the past.)

The Little-Known Indicator I’ll Be Keeping My Eye On

No one knows where the market will be in a week, month, or even a year from now. But there are a couple of good indicators to help us know when things are on the mend and a bullish trend is underway.

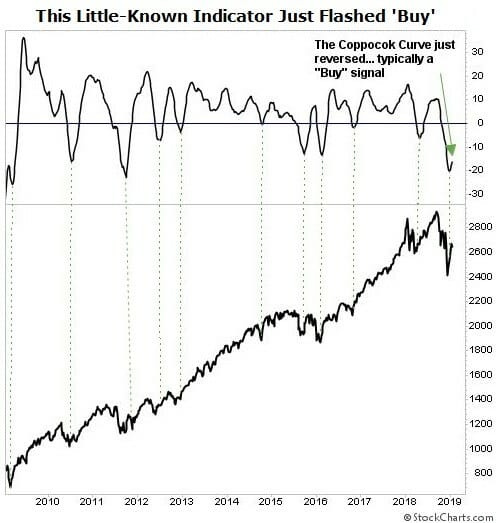

One of my favorites is an indicator I talked about in January 2019.

You might recall that during this time we were witnessing major volatility. The S&P 500 had tumbled nearly 20%, and investors were worried that this great bull market was coming to an end.

But in January 2019 a momentum indicator called the Coppock Curve was giving a “Buy” signal, and so was my Maximum Profit system. Here’s what I said back then…

“This little-known momentum indicator was originally developed in 1962 by Edwin S. Coppock. While its calculation is cumbersome, it can be best understood as “a measurement of the market’s emotional state.” In other words, when investor sentiment begins to change, the Coppock Curve reverses course.

While some may use it as a sell signal, its real value comes at identifying market bottoms (it’s usually too early to signal market tops). Understanding the prime buying opportunities with this indicator is rather simple. Once it drops to “0”, the next upward reversal almost always signals a buying opportunity and the start of an uptrend. As you can see in the chart below, it has identified every significant buying opportunity over the last decade.”

We loaded up on stocks and were handsomely rewarded. For instance, we added Okta, Inc. (Nasdaq: OKTA) to the portfolio in January 2019 and booked a nice 42% return in just under nine months. We made 45% from Tandem Diabetes Care (Nasdaq: TNDM) in less than three months, and 89% from Shopify (Nasdaq: SHOP) in eight months.

Right now, the Coppock Curve is telling us that we haven’t reached the bottom of this pullback yet. But once it reverses course, we will quickly add more stocks to our portfolio to take advantage of the next bullish trend.

Action To Take

If you sold any of the stocks you really liked in a panic before reading this, then that’s okay. Understand that you can either buy those same stocks again or stay on the sidelines until the dust settles from the coronavirus. It really depends on how much volatility you can stomach.

I will be closely monitoring our holdings over at my premium services. Should any of our holdings fall below our trailing stop loss or their fundamental position materially deteriorate, then I will immediately issue an alert.

In the meantime, over at Maximum Profit we remain on the sidelines with no new buys last week and roughly 50% of our portfolio in cash.

Until then, we will continue to cut losers short, follow our rules, and try our best to remain calm. Once the dust settles, we will have plenty of dry powder on hand to put to work and make money.

P.S. If you’re looking for ways to manage risk even further, then I recommend checking out my colleague Amber Hestla’s “bonus dividend” strategy. By using one of the most conservative income strategies on the market, Amber and her followers are able to pocket thousands in extra income each month.

If this sounds enticing to you, that’s because it should… It’s the closest thing you’ll get to a win-win when it comes to investing. Best of all, it only takes a few simple steps to learn how it all works…