The Shocking Wealth Chart Every American Needs To See…

A few months ago, I came across an amazing chart. It was the kind of thing that once you see, you just can’t unsee.

I happened across it by perusing one of my favorite corners of Twitter, known as Fintwit. This is shorthand for people on Twitter, from financial professionals to Venture Capitalists to individual investors, who use the social media platform to talk about the markets.

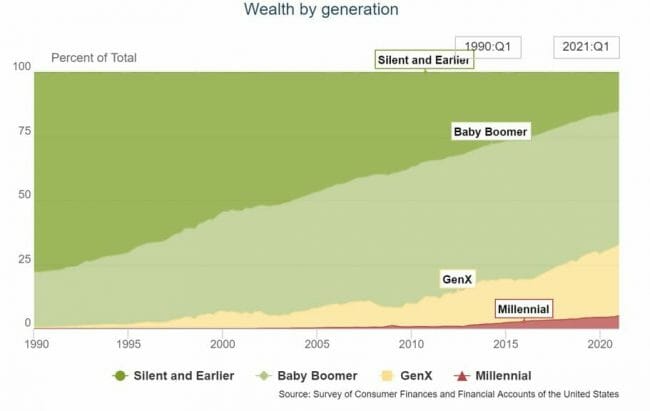

The chart below explains so much about where we are at as a nation. Particularly, it speaks to the state of the millennial generation, which is now the largest generational cohort in the U.S., the largest share of the workforce, and is entering its prime years in terms of earning (and consuming) power.

Take a look and see if you notice anything strange…

Source: U.S. Federal Reserve

Takeaways

Here’s what’s disconcerting about this chart. The first millennials turned 40 this year (the youngest are 25). This means they are entering what should be the sweet spot for wealth accumulation. But in terms of net worth, millennials have been lagging far behind previous generations.

This CNBC article sums up the situation:

While it’s not abnormal for older generations to be wealthier than younger generations — they have had longer to earn money and accumulate assets, after all — the Fed’s data also shows that millennials have far less wealth than boomers did at the same age.

Now, I want to encourage you to think for a moment before you dismiss these findings. I somewhat sympathize with what an older American reading this might think… But there is also another side to the story, of course. After all, as the article points out, each generation encounters its own unique set of challenges and opportunities.

For millennials, especially older ones like myself, you could go back as far as the financial crisis. This (partially, at least) explains why millennials lived at home longer, got married later, and bought homes later than previous generations.

There’s also the student debt problem. According to the Institute for College Access & Success, the average college student graduated with $29,290 in student debt last year – a figure that’s been steadily on the rise. The average Gen X-er had $12,800 in student debt, by contrast.

Throw in an increasingly competitive global marketplace, stagnant wages, rising costs of living, and then a global pandemic that upends the economy — plus a few other factors — and you wind up with this chart. Add it all up, and it speaks to the precarious position that many younger adults in America find themselves in — and it has a clear impact on the economy.

But as the previously mentioned CNBC article states, there are signs of optimism:

Five years ago, older millennials were 40% poorer than previous generations were at the same stage of life. That wealth gap has shrunk in recent years, but it’s still too soon to tell if obstacles such as student loan debt burdens, rising living expenses and the effects of the Covid pandemic will push this generation permanently off course.

It goes on to point out that older millennials have started to close the gap and are now only 11% behind previous generations. A good portion of that gain can be attributed to gains in home prices, as millennials have (finally) started becoming homeowners in recent years.

Closing Thoughts

We’ll see whether this gap closes over time.

Why should we care? Well, aside from wanting our fellow citizens to prosper, this has a broad range of social, economic, and political effects. For example, it’s hard to have the confidence to take a risk and start a new business at a younger age if you don’t heave wealth.

Some of that is beyond the scope of this column. And I’m not here to offer any policy prescriptions, either. But when you see a chart like this, it begins to explain a lot — from recent social unrest to the “meme” stock craze. And it should concern us…

All that being said, this chart has clear economic implications that we can’t ignore.

It’s interesting food for thought – and something to keep an eye on.

In the meantime, one of the best ways for Americans of any age to build lasting wealth is through the market. Especially when you can have a group of “bulletproof” dividend payers at the core of your portfolio…

With stocks like these, you can build your portfolio around them, let compounding do its thing, and not have to lose sleep at night. No need for cryptocurrencies, “meme” stocks, or any other sort of market fad. And if you’d like to know where to start, then you need to check out our latest research…

We recently told readers about a group of “bulletproof” dividend payers that has survived every downturn of the past few decades… and still raised dividends and delivered amazing returns to investors. And if history is any guide, they’ll continue to do so for years to come.