2 Stocks That Could Raise Dividends In July

Yesterday marked the first official day of summer — a time when many pack their bags and hit the road for a long-deserved vacation.

According to the Stock Trader’s Almanac, the market usually takes a bit of a vacation in the the summer, too. Historically, stocks usually enter a bit of a lull period, drifting along lazily or even dropping.

If the old saying “sell in May and go away” rings true, it’s because the bulk of the market’s returns do indeed occur November through April.

I’d never recommend taking action based on this alone, which is why I’ll never take a vacation from looking for stocks that are set to put more cash in my pocket.

As Chief Strategist of High-Yield Investing, it’s part of my job. Each month, I flag these stocks first for my premium readers so that they can research them and get a head start. Then, I share them with the public. Ideally, I’m looking for hikes that could happen over the next four to six weeks. I also highlight noteworthy special distributions on the horizon.

We don’t do this just for fun. In a perfect scenario, we find great ideas for consideration in our premium portfolio… Companies posting outsized double-digit increases, and reliable dividend-payers that have been steadily growing payouts for a decade or more.

This month, I have two stocks I’d like to highlight. So if you’re looking for a potential addition to your income portfolio, consider looking at these names further…

2 Upcoming Dividend Hikes

1. Illinois Tool Works (NYSE: ITW) – Founded over a century ago, ITW manufactures a wide range of specialized machinery and industrial equipment. The product lines, which are grouped into seven different segments, are too numerous to list here… auto parts, welding tools, restaurant dishwashers, and refrigerators.

It may seem like a hodge-podge, but this proud American company has become a global leader, operating in more than 50 countries worldwide. And its operating metrics speak for themselves. ITW is expecting another year of healthy double-digit revenue growth and just upped its full-year earnings guidance to a minimum of $9.00 per share.

And from every dollar of profit, it returns $0.50 to investors.

This Dividend Aristocrat has raised its payouts like clockwork for 57 consecutive years… and counting. And while most of its peers offer little more than a token hike of a penny or two, ITW has doubled its quarterly payouts from $0.65 per share in 2017 to $1.22 currently.

That’s a healthy compounded annual growth rate of nearly 14%.

Having the financial wherewithal to lift payouts for over half a century without a single cut (or even a pause) speaks to the firm’s ability to generate cash even in recessions. It doesn’t hurt that it also has over a billion in cash on hand and zero short-term debt.

I think this shareholder-friendly company will come through again with another hike next month.

2. Deere & Company (NYSE: DE) – Nothing runs like a Deere. That’s got to be one of the more memorable slogans around. And there’s more than a nugget of truth to it, which explains why the heavy equipment maker did $40 billion in global sales last year.

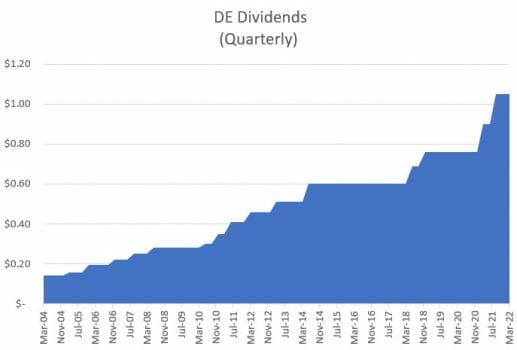

More importantly, it churned out $6 billion in operating cash flows, a new record high. Since 2004, the company has generated $55 billion in cumulative cash flows and returned $30 billion to stockholders – more than half. Along the way, dividends have risen 10-fold, climbing from $0.11 per share to the current $1.05 per share.

That includes not just one, but a pair of hikes last year totaling nearly 40%.

It’s no secret that I’m an ardent farmland bull. Longtime readers know that I’ve recommended several ways to profit from this space over the years. Well, you can’t run a farm without tractors, combines, tillers, and other equipment to plant and harvest crops. Deere has a dominant 50%+ share of this lucrative field, to say nothing of timber, road construction, and other attractive end markets.

Sales over the past six months are running more than 10% ahead of last year’s pace. And management has just confidently raised its full-year profit outlook to $7.2 billion. Thanks to hefty buybacks, that net income is being shared by a shrinking number of shares – which in turn makes each more valuable.

Yet, despite the robust earnings forecast, the stock has been caught in this selloff, dropping from $430 to $320 in a matter of weeks. I think this could be an attractive entry point – particularly now that dividend distributions are rising yet again to $1.13 starting next month.

Action To Take

We’ve had a pretty good run of finding solid ideas from this exercise, so it pays to follow along each month. Some of them end up paying off big time. So if you’re looking for a potential addition to your income portfolio, then I can’t think of a better place to start your research…

But remember, just because I highlight stocks that are likely to increase dividends doesn’t necessarily make them “buys.” These are merely ideas to get you started in the hunt for high yields.

If you want to know about my absolute favorite high-yield picks, you need to check out my latest report…

In it, you’ll find 5 “Bulletproof Buys” that have weathered every dip and crash over the last 20 years and STILL handed out massive gains. And each one of them carry high yields, with dividends that rise each and every year. Go here to check it out now.