What’s Next For The Market? I’m Turning To My “Green Light” Indicator…

It’s important to know just how important oil prices are crucial to the overall economic equation. High oil prices add to the costs of doing business, whether it’s higher transportation costs, more expensive plane tickets, or the most visible impact coming when we fill up our gas tanks.

But as you’ll see in the chart below, spikes in oil prices also have a strong correlation with major financial events and economic recessions.

The shaded areas indicate recessions. And the term “backwardation” is when the current price is higher than the futures price. Every time backwardation has occurred, oil prices eventually come crashing back down. That’s what happened when our sell triggers hit last week — the price of benchmark West Texas Intermediate Crude fell by about 15% in the span of a couple days.

Prices have recovered a bit since then, but if history is any guide, we can expect some sort of recession event.

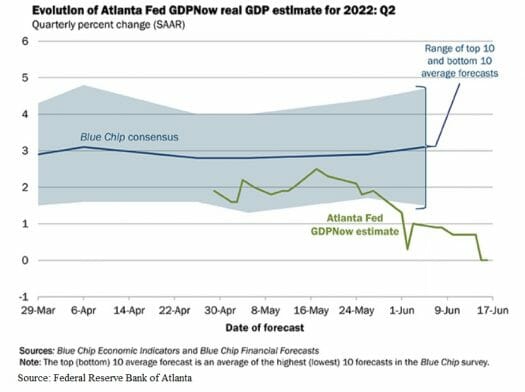

We are seeing slowdown in discretionary spending, layoffs at many tech firms are popping up in headlines, and the GDPNow model estimate for real GDP growth in the second quarter of 2022 is 0%.

Furthermore, the Federal Reserve continues to ratchet up interest rates to combat inflation while simultaneously reducing its balance sheet. Both of these moves will extract liquidity from the market.

Finally, even Federal Reserve Chairman Jerome Powell mentioned to Congress that a recession is possible as it hikes rates.

So, the question will now shift from “are we headed towards a recession and bear market in stocks” to where will stocks bottom?

My “Green Light” Indicator…

A few days ago, I weighed in on that question. I encourage you to go back and read that piece, but based on recent history (and EPS estimates), we can look to a price-to-earnings target of around 14x.

The current multiple is around 17. This suggests the S&P 500 could fall another 14% from recent levels. But keep in mind that estimates are just that… estimates. Either one of these — prices or earnings — could always go lower.

Only time will tell, but regardless the outlook doesn’t look good.

In the meantime, I will be keeping my eye on one of my favorite indicators for times like these. It provides the “all clear” signal for when it’s best to really get back into the market.

I’ve touched on this indicator before (here, here, and here).

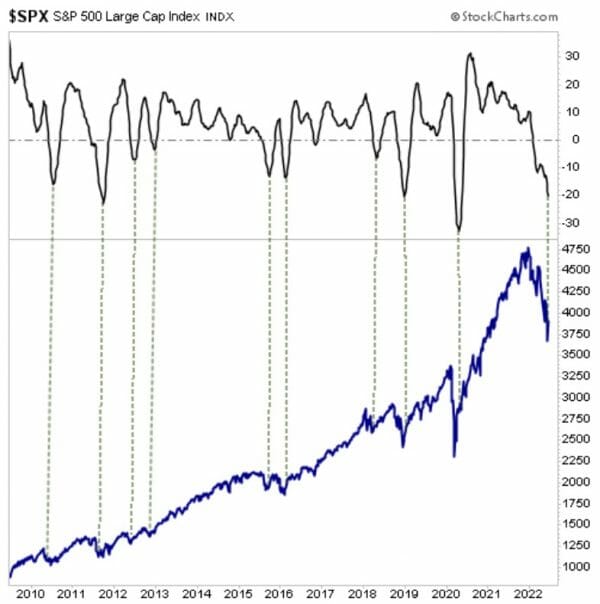

The indicator I’m referring to is the Coppock Curve, which is a momentum indicator that measures the market’s “emotional state.”

While some may use it as a sell signal, its real value comes at identifying market bottoms (it’s usually too early to signal market tops). Understanding the prime buying opportunities with this indicator is rather simple. Once it drops to “0”, the next upward reversal almost always signals a buying opportunity and the start of an uptrend. As you can see in the chart below, it has identified every significant buying opportunity over the last decade.

Right now, the Coppock Curve is still trending south and well below zero. When the Coppock Curve makes its infamous U-turn, that will be my green light that a new uptrend is taking place. I will then confirm the uptrend with various other indicators that I follow, which will allow me to confidently put our cash to work.

Closing Thoughts

It doesn’t matter how many bear markets a person has gone through, they are always unsettling. And they seem to last forever (minus the Covid-19 crash). That’s why I’m largely going to stay on the sidelines for now.

Yes, I know it might be frustrating. But sometimes the best option is to do nothing. Remember, we can always get back into trades at a later date when the dust settles. What we can’t make up for is a massive black eye in our portfolio.

In the meantime, I recommend checking out my colleague Robert Rapier’s latest report…

Robert has a track record of generating outsized income regardless of market conditions, allowing him to extract multiple payments from the same stock over and over again, whether the broader market is going up, down or sideways.

By arming yourself with his money-making system during the bear market, you’ll not only survive…you’ll also thrive.