How This Simple Options Strategy Can Protect A Winning Stock Position

Just about everyone who buys a house ends up purchasing homeowner’s insurance, right?

Other than the fact that most lenders require it, why exactly do we do this?

Most of us have relatively small odds of our house being destroyed. The chances are minuscule that a fire, flood, or any other hazard would cause us to make a claim against our policy in a given year. However, we all continue to pay our insurance premiums.

Why do we go on paying these premiums year after year? This may seem like a foolish investment to make.

The answer, of course, is obvious: our homes are valuable to us. We would be devastated by any major catastrophe. So we happily pay someone else to bear this risk, no matter how remote the chances of loss might be.

If you hedge your portfolio, you are essentially doing the same thing.

Hedging is like buying insurance. You buy it to protect against unforeseen events, but you hope you never have to use it. The fact that you hold insurance helps you sleep better at night.

With put options, you’re essentially paying someone to protect you from unforeseen risks. Let’s see how this can work, using a hypothetical example.

How To Use Puts To Hedge A Position

Let’s suppose it is January, and shares of IBM (NYSE: IBM) are currently trading at exactly $100 per share. An investor who owns 100 shares wants to hedge against a loss over the next few weeks. They could purchase a February 100 put option contract on IBM that on the 3rd Friday in February. This means they would be insured against a loss below $100, less the option cost.

In this example, we will assume the option cost is $3. This means no matter what happens, the position will not be worth less than $97 ($100 – $3 option cost) by expiration in February.

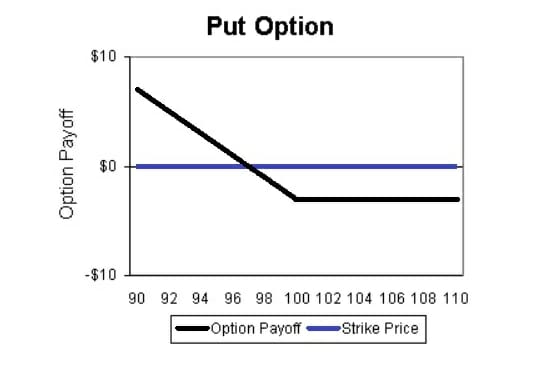

In this example, we can see that the put option increases in value as the stock price declines below $100. If IBM is trading above $100 on the third Friday in February (the expiration date), the option will expire worthless. This means the investor will lose the entire option premium. But since the investor in this example actually owns IBM shares, this will likely be of little consequence.

However, if IBM tumbles to $90 at expiration, the investor will have lost $10 on the stock. Thankfully, this investor decided to hedge their position by purchasing a put option. And since put options rise in price as the underlying security falls, this option will have soared in value. It will now be worth $10. Subtract the cost of the option, $3, and we can see that the investor’s net position will be worth exactly $97.

Why This Matters

It’s important to note that the value of the investor’s position will remain $97 even if the price of IBM drops to zero. This illustrates how purchasing put options against stocks that you own can protect you from catastrophic losses. Yes, you will have to pay option premiums, but if the market nosedives, you’ll be glad you did.

This strategy can be advantageous if you’re looking to lock in gains after a stock has experienced a significant run-up. You may still believe the stock will appreciate more, but you might also be unwilling to let it decline below a certain point.

Sticking to our same example above, consider what would happen if IBM had skyrocketed to $100 in a short time (before the investor purchases the put option). In this case, the investor might be tempted to exit the position to lock in their gains. Although the investor could sell the stock immediately at $100, they could also use the option strategy above (purchasing a FEB 100 put option) to limit potential future losses to just $97.

If the stock shoots up to $120, the investor who sold their shares will not participate in the additional $20 gain. However, by buying a put option, they would have enjoyed the safety of locking in a minimum stock price (in this case, $97) while still participating in further gains. In this case, the investor’s net position would still be worth $117 ($120 for the stock minus $3 to purchase the option). That’s a small sacrifice to make for securing a gain.

Editor’s Note: In a new presentation, my colleague Jim Fink can show you how to receive regular payments of $2,950 or more. He calls it his “I.V.L. System” and it generates winners at a mind-boggling clip.

Jim Fink is the chief investment strategist of the premium trading service, Options for Income. His system works for beginners and for seasoned trading experts alike.

Even if you’re still unsure how options trading works…this system is for you. Or if you’re a pro who trades 10 contracts a day…this is for you, too. Jim’s I.V.L. system works in up or down markets, when inflation is elevated or low, and regardless of Federal Reserve monetary policy.

Jim likes to keep it simple. Every week, he’ll send you easy-to-follow instructions that’ll put you on Wall Street’s payment list. You’ll get the money right away, up-front, in your trading account.

Jim Fink made himself rich trading options. Now he gets his kicks helping other people get rich. Want to earn life-changing income? Click here.