How To Use Covered Calls To Effectively And Reliably Generate Income

It’s the closest thing to being “the house” in a casino full of gamblers. It also happens to be one of the most reliable ways to generate income in your investment account.

We’re referring to covered call options.

This investment approach captures income by selling calls to speculators. Those speculators are hoping to generate outsized returns as stock prices advance. By selling these calls, we allow these speculators the chance to make large profits. In return, we collect high-probability income.

Here’s how it works…

The Basics

We purchase shares of stock the same way a traditional investor would. We then sell call option contracts against these shares (one for every 100 shares that we own). This obligates us to sell our stock at the option’s strike price if the market price is above this level when the option expires.

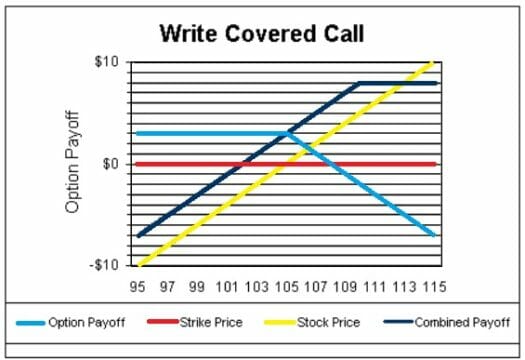

This approach puts a cap on our potential return. Regardless of how high the stock trades, we still have to sell at the strike price. However, in return, we receive a payment from selling the call contract in return. This is known as a premium. This income is very reliable and gives us a much higher probability of a positive return on our investment.

Risk Vs. Reward

Let’s say that in January, you own 100 shares of XYZ stock, which trades at $100. Over the course of the next month, you don’t believe that XYZ will trade for more than $105. You could sell an option on IBM for $105. Suppose that an XYZ Feb 105 option sells for $3. By writing this option, you will receive $3 today (or $300 total, since each option represents an interest in 100 underlying shares).

As you can see from the diagram, you are limiting your upside to $8 in return for a guaranteed $3 premium. If shares of XYZ tank, then your losses can still be significant. But you will be $3 better off than if you had merely held the stock alone.

Now consider the following scenarios:

– XYZ trades at $110 at expiration. In this scenario, you were too conservative in your estimate of where XYZ would trade this month. So you will have to sell 100 shares to the buyer of the call option for $105 each. The net impact is $105 (for selling the stock) + $3 (for selling the option) to yield $108. This is your profit no matter how high XYZ’s shares soar. You have limited your upside potential, but in return, you received $300 for the sale.

– XYZ trades at $103 at expiration. In this scenario, you were accurate in your estimate and you are not obligated to sell your shares. The buyer would not want to buy them at $105 when they could purchase them on the open market for $103. The net result is this generates $300 in additional income while still keeping your shares, which also gained $3.

– XYZ trades at $95 at expiration. In this scenario, you suffered a $5 loss on the stock. But this is offset by the $3 premium, and you will still hold your shares. You will only be down $200 in total, compared with $500 if you hadn’t sold the call option.

Choosing Which Call Option Contract to Use

Option contracts are available on a monthly (and in many cases, weekly) basis. This gives us more choices in terms of which contracts we want to sell. Traditional call option contracts expire after the third Friday of each month.

When implementing a covered call trade, we must choose an expiration date. Typically, the more time left until expiration, the higher the price will be for the call option. This contract is more attractive to buyers. That’s because a longer time horizon allows the stock more time to trade higher, giving the owner a greater chance to profit. From our perspective as call sellers, a higher price means that we receive more income from selling the contract.

While more income is certainly desirable, we need to always think about how much time is required. We might set up a covered call trade that pays an 8% return over the course of six months, but that’s less attractive 4%in just two months.

As a general rule, we typically like to sell call options that expire over the next four to eight weeks. These contracts tend to offer the best per-year rate of return because they expire relatively quickly. Once the contracts expire, one of two things will happen. We will either be obligated to sell our stock and will then have the capital available to invest in a new covered call setup, or the calls will expire worthless and we will have the option of selling additional contracts to create more income.

While this relatively short-term approach can yield very attractive rates of return, the strategy embraces a bit more risk depending on the strike price of the calls. This is because the stock could trade significantly lower while waiting for the option to expire. And because shorter-term contracts are sold at a lower price, we don’t have as much income from selling this contract to offset the potential losses in the stock.

During turbulent, high-risk market environments (especially during bear markets), it sometimes makes more sense to sell longer-term option contracts. Remember, the longer the time frame, the higher the price for the call options. So by selling longer-term contracts, we are collecting more income.

This way, even if the stock trades a good bit lower, we have more income to offset the losses in the stock. Of course, selling long-term contracts can have a drawback as well, namely that our capital is tied up in the trade for a longer period. This is especially frustrating if the market begins to move sharply higher, because our gains are capped by the covered call structure.

The Takeaway

On balance, however, longer-term covered call trades make sense. During periods of uncertainty, the additional income and increased stability may be well worth the risk of missing out on the next leg higher. As is usually the case with investing, the protection of capital should be your first and foremost concern, with the appreciation of capital being the secondary objective.

Using longer-term option contracts during high-risk periods gives you a chance to continue to collect reliable income. It also protects your initial capital and bypasses much of the volatility that traditional stock-only investors must endure.

P.S. If you’re looking for a steady source of income amid these uncertain times, consider the advice of our colleague, Jim Pearce.

Jim Pearce is the chief investment strategist of our flagship publication, Personal Finance. Jim has unearthed a once “secret” income power play that’s giving everyday investors the opportunity to collect huge payouts, regardless of Fed policy or the ups and downs of the markets. To claim your share, click here.