Make This Simple Portfolio Move By Year-End To Save A Lot On Taxes…

Today, I want to talk about something that is especially important as we enter the final stretch of the year.

In between making plans to spend time with family for the holidays and shopping, this is a matter that may require your attention. While everyone’s situation is different, I’m more than willing to bet you could benefit from this advice.

It has to do with taxes on your portfolio, and how just a couple of smart moves can help limit your bill for this year.

I know there’s a lot going on in the market. And frankly, this year has been an absolute dud for stocks. But how we manage our portfolio with things like allocation and knowing when to sell can have just as much impact (and sometimes even more) than knowing what to buy. So what I’m about to tell you is an important part to successful investing — yet a lot of investors tend to ignore it.

Let me explain…

Tax-Loss Harvesting, Explained

Let’s say you find yourself in the fortunate position of sitting on a big winner. Maybe you’ve held it for a while — but in this tough economic environment, you’re ready to sell and take your profits. Nobody can blame you for that.

There’s just one problem… We we can’t forget about Uncle Sam, as he’s eagerly awaiting his cut. It’s a good problem to have, of course, and this is where tax-loss harvesting can help us out…

As much as we would all like to bat a thousand, the cold hard truth is that not every investment will be a home run. When we do strikeout, the only silver lining is that we could use that loss to lower our tax liability.

Generally, tax-loss harvesting looks like this:

- Sell an investment that’s underperforming and losing money.

- Then, use that loss to reduce taxable capital gains and potentially offset up to $3,000 of ordinary income (more on this in a sec).

- Finally, reinvest the money from the sale into a better opportunity.

We’re entering the time of year that’s otherwise known as tax loss harvesting season. And considering the fact that we’ve spent most of 2022 in a bear market, I’m betting there will be quite a lot of it this year.

Now, before I go any further, I do want to point out that tax-loss harvesting is NOT useful in retirement accounts, such as a 401(k) or an IRA, because you can’t deduct the losses generated in a tax-deferred account. So, tax-loss harvesting is only good for regular brokerage accounts.

Typically, a savvy investor will look to harvest some tax losses when they’re sitting on a big winner they want to sell or when the market is booming and just about everything is up (remember those days?). Afterall, those gains could all add up to a nice windfall — but on the flip side, it could also trigger a significant taxable gain.

To help offset those gains, you should take a look at the losers in your portfolio. Have you lost faith in them? Maybe you have a holding you just want to get rid of but haven’t quite mustered up the courage to cut it from your portfolio…

Whatever the case might be, tax-loss harvesting just might be your answer. It might be what you need to get you over the hump and make the decision to cut the losing position once and for all.

You Can Still Save Big This Year…

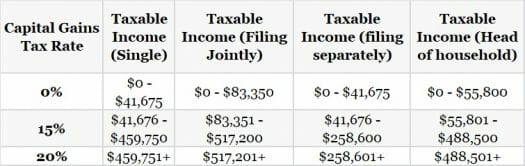

A quick reminder: When you sell an investment for a profit, you owe capital gains taxes on the profits based on how long you held the asset. If it was owned for less than one year, it’ll be taxed at your normal income tax rate. If held for more than one year, it’ll be taxed at the preferential long-term capital gains rate, which could be as low as 0% and no higher than 20%, even for top earners.

Again, tax-loss harvesting is usually something you may occasionally hear about in years when the market is booming. But this strategy could be beneficial even in a down year where losses outweigh gains. In this case, you can use the losses to offset up to $3,000 or your ordinary income for married couples and $1,500 for single filers. Any amount over $3,000 can be carried forward to future tax years to offset income down the road.

Mutual fund managers and hedge funds routinely use this tax-loss harvesting strategy every year to help lower their taxes bill. And it could save you a pretty penny when it comes to taxes this year.

Again, this strategy isn’t helpful for tax-deferred accounts. And I’m no tax expert, so you should always check with a pro to see if tax-loss harvesting is best for your situation… (and no, Turbo Tax isn’t a tax pro).

But take my advice and carve out some time to look over your portfolio before the end of the year. See if there are any losers you’d like to cut in order to offset the liability you may be facing from some any big wins you may have scored this year. By taking a page from the pros, you could lower your overall bill this year (or carry forward some losses into next year). Chances are, you’ll be glad you did.

P.S. My research staff and I regularly read through SEC filings, and we recently found something that leaped off the page…

It has to do with a little-known satellite technology company that may have scored the deal of the decade. And we found it “hidden” in a tiny footnote of one company’s report.

Right now, it’s going completely unnoticed — but that could change very soon. And it could lead to a massive windfall for investors.