How This Simple Hedging Strategy Can Protect Your Profits

For the past couple of weeks, we’ve been focusing on options strategies that go a step or two beyond the basics.

Continuing with this thread, today we’ll discuss collars.

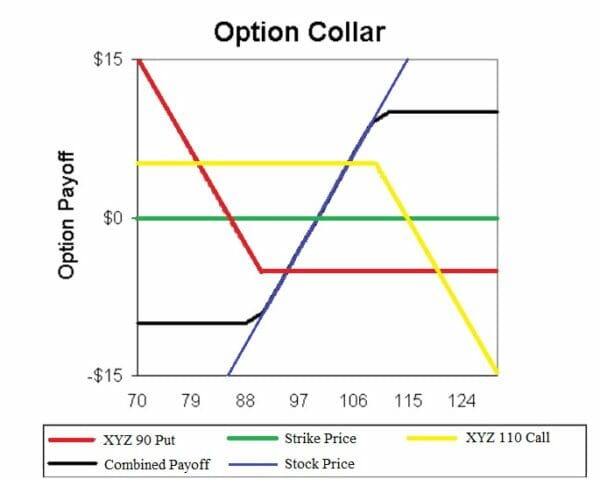

Let’s suppose you are long a stock and want to protect profits. One way you could do that is by selling a covered call at a strike price above the current stock price and buying a put at a strike price below the current stock price.

Although not as widely used as the other strategies we’ve detailed, it can often prove very useful when the situation is right.

Let’s dive in and learn more…

How A Collar Works

Major investment banks and corporate executives often use collars. But individual traders may find it useful, too. You simply sell a call option at one strike price and use the proceeds to purchase a put option at a lower price. The cost to make this trade is essentially zero.

Let’s say you own a significant amount of XYZ stock currently trading at $100. You feel strongly about XYZ’s prospects over the next three months, but you worry about losing a substantial portion of your investment. After careful consideration, you decide that while you can’t afford to lose your entire investment, you still want to get a little more out of your position.

So you decide that you would like to try to get $10 more per share for the stock or $110. On the other hand, you determine that you cannot afford to sell your shares for anything less than $90.

To hedge this position, you can implement a collar trade. (This trade gets its name because the position is essentially “collared” between two prices.)

It is currently January, so to collar this position for three months, you sell one XYZ MAR 120 call for every 100 shares you own. With the amount you receive from this sale, you simultaneously buy one XYZ MAR 80 for every 100 shares you own (we assume that both sides cost $5 each).

Since both options cost the same price, the net cost of this initial trade was $0 to you. With this trade, you know that no matter what happens, you will receive between $90 and $110 if you decide to sell your XYZ shares when the options expire in March.

As the graph shows, your total profit or loss from the combinations of these positions is limited to $10. This means that if XYZ rockets up to $200, the most you will receive is $110. Conversely, if XYZ crashes to $20, the least you will receive is $90.

Closing Thoughts

This is an excellent hedging strategy if you’re comfortable with either of the two scenarios.

To sum up, a collar can help lower your volatility during an uncertain time. It can also help you lock in a range of sale prices for a stock you own.

Investors who hold a large position in a stock and wish to sell in the future may use this trade. That’s because it allows you to lock in a particular sale price ahead of time. (It actually ends up being a range between two prices.) In other words, you know the highest and lowest amounts you could receive when you sell the underlying stock.

Speculators do not commonly make this type of trade. It is a high-risk, low-reward scenario unless you hold the underlying stock. However, if you own the underlying stock, the trade is very low-risk and low-cost.

P.S. If you’re looking for a steady source of income amid these uncertain times, you need to see this…

Our colleague Jim Pearce has unearthed a once “secret” income power play. It’s giving everyday investors the opportunity to collect huge payouts, regardless of Fed policy or the ups and downs of the markets. To claim your share, click here.