Why You Should Pay Attention To Buffett’s Timeless Advice For Uncertain Markets…

My wife is always concerned about money.

One positive from this money anxiety is that she works her tail off to make as much — and save as much — money as she can.

To help with this, we have a Google sheet where we keep a close eye on our finances. Every year, we do a “Financial Retreat,” where we take a small vacation and discuss our financial goals for the next year… Our savings goal… what big expenses we might incur during the year… and, of course, make sure we are on track to hit our retirement goals.

We routinely check in and update this worksheet throughout the year as we work toward that year’s goals.

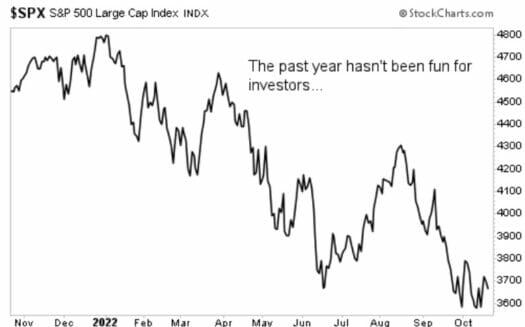

As you can imagine, this year has been more difficult on my wife’s psyche regarding money. Not because we aren’t hitting our savings goal (we are) but because she is quickly learning how the market can impact our finances.

You see, my wife doesn’t follow the markets. She has little knowledge of what the S&P 500 is doing and might not even know what the Nasdaq is. This is the first time she — along with most Millennials — has seen firsthand the impact of a bear market on one’s retirement and savings.

With every major index in bear market territory, this has translated into receding brokerage and retirement account balances. She doesn’t like it. For her, it’s like filling up a leaky bucket. As we put savings in, our brokerage accounts shrink by more.

Of course, I reassure her that declining stock prices are actually a good thing for us (and for most people). Yes, this sounds like me putting a good spin on a bad situation to calm her down (which is partly true). But for most people, lower stock prices shouldn’t be stressful. It should be a time of opportunity.

I know that may sound a little crazy. But in just a moment, I’ll let the Oracle of Omaha, Warren Buffett, explain why this is great advice right now…

Buffett’s Advice For Uncertain Markets

I know many investors are nervous and anxious about the market. You may wonder if we are nearing a bottom — or if you’ll be forced to continue watching your account balances shrivel.

You may even be on the verge of throwing in the towel.

If this is you, I want you to read Buffett’s sage advice below. Then go back and read it again.

As he explains, if you’re a long-term investor, you should be thankful that you can buy shares of your favorite stocks at lower prices. Here’s what he had to say in his 1997 letter to Berkshire Hathaway (BRK-B) shareholders:

“A short quiz: If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef?

Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices?

These questions, of course, answer themselves.

But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?

Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall.

In effect, they rejoice because prices have risen for the “hamburgers” they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

So smile when you read a headline that says ‘Investors lose as market falls.’

Edit it in your mind to ‘Disinvestors lose as market falls — but investors gain.’ Though writers often forget this truism, there is a buyer for every seller and what hurts one necessarily helps the other. (As they say in golf matches: ‘Every putt makes someone happy.’)”

What To Do Instead Of Worrying…

Remember, bull markets last a lot longer than bear markets. Those that take advantage during turbulent times are often rewarded handsomely years down the road.

This is why I preach the value of owning a set of stocks you could buy today and hold for the long haul. With stocks like this in your portfolio, you will worry less about inflation or deflation… bear markets or recessions… flash crashes, or rising interest rates.

Remember that you can’t just buy any stock, hold it forever, and expect to come out ahead. The market is littered with companies that left investors high and dry. But when you own companies with a strong moat and produce buckets of cash, you’re more than likely to come out ahead.

Take a stock like Mastercard (NYSE: MA), for example.

MasterCard is simply a “toll” operator. The company doesn’t have anything to do with the debt consumers put on their credit cards — banks own that liability. MasterCard simply earns a small percentage of users’ transactions on its cards. In other words, MasterCard makes more money as the number of people worldwide using its cards grows.

And right now, growth in electronic payments is one of the most unstoppable trends on the planet. According to the Federal Reserve, more than 111 billion payments are made annually in the United States using credit or debit cards, with a value of almost $6 trillion, which continues to grow. But here’s the real kicker… It’s estimated that 85% of payments worldwide are still made with cash or check. That’s a big market waiting to be tapped.

The move toward more credit and debit card payments is unmistakable… and still has years — if not decades — to go.

But this is all just one part of MasterCard’s appeal. In addition to tapping into one of the world’s strongest growth stories, the company’s financial standing is as good as it gets. You can see how this has worked out for investors over the years…

Closing Thoughts

There are no guarantees when it comes to investing, of course. But I’m confident that stocks like this have the potential to deliver steady, market-beating gains for years to come.

If you don’t already have a stable of stocks in your portfolio that you can simply forget about when times get tough, then maybe it’s time to take advantage of these lower prices and load up. It sure beats worrying day after day about your investments.

P.S. In my latest report, I uncover an “off the radar” investment developing one of the most disruptive technologies we’ve seen in years…

I’m talking about flying cars. That’s right, we’re talking about a total revolution that could change the face of our way of life forever. It may sound like science fiction… but it’s coming sooner than you think.

The best part is that one of my top picks for this emerging technology is being totally ignored by most analysts right now, which means we have a unique opportunity to get in before the crowd catches on. Go here to learn all about it right now.