Here’s A Peek At One Way I Find Big Winners That Most People Miss…

Every so often, I get an email from a reader asking me about my process for finding picks over at my premium newsletter, Capital Wealth Letter. So I figured I would give it a shot and try to answer this question as best I can.

While there are some commonalities, the truth is, the path to each pick looks a little different. For example, I found my latest pick thanks to cocaine and prison. And no, before you ask, I wasn’t doing cocaine. Nor was I in prison. (I’ll explain in a second…)

The truth is, I wish I had a simple roadmap for selecting a new investment. Perhaps, a simple screen with a few parameters and the perfect investment would pop out on the other side.

But I don’t.

Sure, I utilize screens. They are far from perfect, but they can help narrow down the search. Other times I might find a particular sector in which I would like more exposure. This approach also helps whittle down the list of prospects.

But more often than not, I do what’s called a “bottom-up” approach. In finance parlance, that just means I focus on individual stocks. I learn as much as I can about how it makes money. It’s total addressable market. Fundamentals and valuations.

With this approach, I don’t focus on what the economy is doing or where we might be in the market cycle. This approach can be difficult because, quite frankly, there are an astronomical number of stocks in the universe. More than 6,000 stocks are listed on the NYSE and Nasdaq alone.

Unfortunately, there’s a lot of failure involved. I find a stock. Begin researching it. It may show promise… But a big red flag pops up halfway through this process, making it an unworthy investment choice.

So, I must toss that ticker symbol in the trash and start over. It’s a lot of reading and a lot of research.

Where To Find A Treasure Trove Of Ideas

I also have a list of stocks that I find interesting shelved away for future research. These are stocks that I might stumble across when researching other stocks or industries.

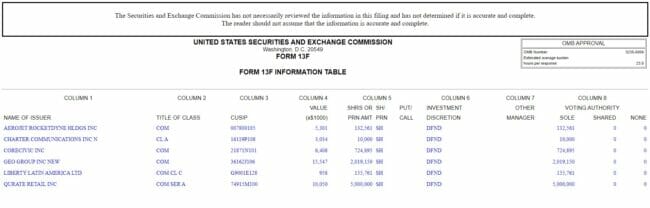

Other times, I might find an interesting name stuffed away in the 13-F filing from a notable investor. A 13-F filing is what major investment firms must file quarterly with the Securities and Exchange Commission (“SEC”) to show what they have invested in.

In this case, I came across our most recent Capital Wealth Letter recommendation in a November 2020 13-F filing.

The SEC filing I was rummaging through was from Scion Asset Management. It’s a private investment firm founded and led by Dr. Michael J. Burry.

Yes, the Dr. Burry made famous in the “Big Short.”

I was actually looking at his 13-F filing because I couldn’t remember the name of this prison stock he invested in. Incidentally, the name of that pick is The Geo Group (NYSE: GEO) if you’re interested.

This led me to think about my time in South America, where I almost visited a prison in Bolivia.

Why would I want to do this? Mostly out of curiosity. There’s a fascinating book about this prison and the “thriving” economy inside its walls called Marching Powder.

You see, this particular prison is where supposedly some of the world’s greatest cocaine is made. You can apparently “tour” this prison for a small bribery fee to the prison guards, and for a little more money, you can sample their prized export: cocaine.

Roll Up Your Sleeves…

But the point is that this is how I discovered another ticker symbol stuffed in Dr. Burry’s 13-F filing. It was a company that I wasn’t familiar with. And in my decade-plus of investing, I rarely see a ticker symbol that catches me off guard like this one did.

I scribbled the ticker on my whiteboard for further research. Over the last couple of months, I’ve learned more about the company and its future prospects. Now, the company is not particularly fascinating (it’s not building cutting-edge technology or selling some revolutionary product). But the good news is that the upside potential in terms of performance is fantastic… we are talking about possibly doubling, even tripling, our money.

This isn’t the first time I’ve found a potential big winner like this. A few years ago, I came across a small company called Amphastar Pharmaceuticals (Nasdaq: AMPH). It was one of the few companies that made naloxone — a drug that could be used by first responders to save the life of someone overdosing from opioid abuse.

The opioid problem in the U.S. was just starting to get headlines. And at the time, hardly anybody outside the company knew Amphastar produced naloxone. I dug through AMPH’s 10-K filing with the SEC and found the company had naloxone grouped in its financials with its “Other Marketed Products” segment.

I couldn’t believe nobody else was talking about this. So I bought AMPH, and sure enough, the stock took off. I sold the stock for an 80% gain in less than a year.

Closing Thoughts

The point is, you never know what you’ll find when you roll up your sleeves and do some hardcore research. A lot of times, it will lead to a dead-end. But when you find the one gem others have missed, the payoff can be worth it…

Again, not everyone has the time (or patience) to comb through these filings like I do. That’s okay because it’s my job. In fact, I’ve been telling my readers about a little-known satellite company that just made a game-changing acquisition. And buried in the details of the deal was a stunning revelation that could be worth billions…

Go here now to get a full briefing and learn how you can profit.