These Stocks Are Finally Recovering From Covid (There’s Still Time To Profit…)

If you haven’t been following along and reading my articles recently, you may be surprised to learn that the cruise industry is making a comeback. And as a result, cruise stocks are near the head of the pack in terms of performance this year.

This shouldn’t come as a total shocker if you read my article back at the end of January.

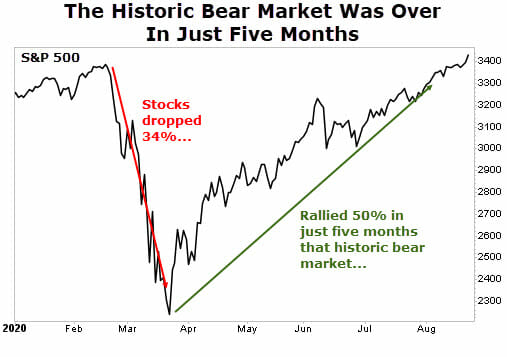

But what is shocking is that it’s been three years since the coronavirus put our world into a tailspin. We suffered through the most brutal stock market selloff in history. But the sudden bear market only lasted five months. You see, after the S&P 500 cratered 34% in only a month, the index only took five months to recover all of its losses, a 50% rally. (Remember, a 34% loss requires a 50% return just to get back to even.)

Except for cruise liners… they have yet to trade at the same levels seen before the pandemic started.

And it makes sense. The coronavirus stuck around much longer than many of us anticipated. And being stuck on a giant cruise ship, often nicknamed a “Corona Cruise,” wasn’t appealing to many. Or really even possible with all the mandates.

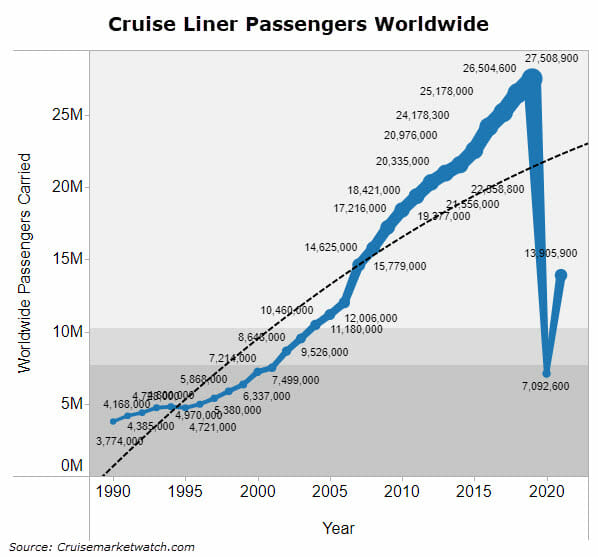

As you can see from the chart below, worldwide cruise ship passengers topped out at 27.5 million people in 2019 and quickly plummeted to levels not seen since 2000.

It’s common sense. These companies don’t make any money with nobody hopping on cruise ships. To stay afloat, they had to pile on debt and hope for the best.

Well, it seems those better days (at least for shareholders) are finally coming around.

Not only are share prices rebounding, but so is the cash flow — which longtime readers know is my favorite fundamental metric.

So let’s dive in and see exactly what’s going on that has stocks in the cruise industry surging with momentum. We’ll do that by zeroing in on one that I think is a particularly good target for a trade right now…

This Cruise Stock Has Serious Momentum…

Royal Caribbean Cruises (NYSE: RCL) is the second-largest cruise ship operator in the world. It controls 25% of global cruise ship capacity.

The company is about to finish up its newest (and largest) class of ship which it calls “Icon of the Seas.” This ship is set to debut in 2024 and will be the largest cruise ship in the world by gross tonnage. It will be able to hold 7,600 passengers and will have an incredible 20 decks.

If you’re into cruises, this thing looks like a blast.

But we’re not here to be awestruck by its ships. We’re here to make money from its stock.

First, let’s hit on some financial highlights, so we know what we are dealing with…

Financial Highlights

Before Covid struck, so 2019, Royal Caribbean pulled in $10.9 billion in revenue, $2.1 billion in operating profits, and $1.9 billion in net income. It also generated $3.7 billion in cash flow that year.

In 2020 revenue shriveled to $2.2 billion, an 80% decrease from 2019. Cash flow in 2020 went deep in the red, coming in at -$3.7 billion.

2021 wasn’t any better… revenue slipped further to $1.5 billion. The company trimmed a considerable amount of fat and lost “only” $1.9 billion in cash flow that year.

These stats alone tell us why shares of many cruise liners haven’t made it back to their pre-covid levels.

But last year, the company finally saw the light at the end of the tunnel. Sales clocked in at $8.8 billion, and Royal Caribbean squeaked out $482 million in cash flow. That’s a massive improvement over the two prior years.

2023 is shaping up to be even better… estimates are calling for nearly $13 billion in sales (better than the $10.9 billion in 2019) and over $2.8 billion in cash flow.

Action To Take

Cruises are back. In fact, Royal Caribbean sold out its Icon of the Seas debut voyage in just 24 hours. The company’s financial turnaround and the possibility of the cruise liner operating under more normal conditions have provided considerable momentum.

As you can see, shares are up over 140% since their July low but are still trading way below their pre-pandemic highs.

Of course, another pandemic or virus mutation could scare potential cruise passengers away and hurt sales of cruise stocks. Cruise ships are also at risk of other things like accidents or natural disasters.

With that said, there’s plenty of optimism and momentum in cruise stocks, which bodes well for investors looking for a high-upside trade.

In the meantime, my team and I have just released a report of “shocking” predictions for 2023 (and beyond)…

This report is easily one of the most hotly-anticipated pieces of research we release each year. And if history is any guide, it could be one of the most profitable things you read all year…

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for ideas that could turn a modest investment into a small fortune, this is where you’ll find it.