How The Fed Caused The Banking Crisis (Plus: What I’m Concerned About…)

It’s Monday, September 15, 2008. The financial system quakes as the 160-year-old investment bank Lehman Brothers falls into bankruptcy.

That day will be forever etched into financial and economic history books. But what happened the following day is reminiscent of the current banking problem…

Tuesday, September 16, 2008, was the day that the $62.6 billion Reserve Primary Fund “broke the buck.”

Investors were panicking, and the run was on. Except this wasn’t a bank run — it was a run on money-market accounts — seen as the safest of investments (much like Treasury Bills).

You see, money-market funds maintain their share price at a $1 value. That’s its benchmark. If a money market fund falls below $1, it’s called “breaking the buck,” meaning investors would lose money if the fund was sold. Only two money market funds have ever broken the buck. The first was a small institutional fund in 1994. The second was the Reserve Primary Fund in 2008.

By September 19, 2008, when the U.S. Treasury finally acted, investors had withdrawn a record $172 billion out of money market funds.

It was a catastrophe.

But as I said a few days ago, that’s what happens when investors panic. And we’re seeing it happen again…

Why Did SVB Collapse?

First, let’s quickly cover what happened. I’ll try and make it brief because you can read about the recent bank collapses everywhere in the mainstream media.

A little more than two weeks ago, there was a bank run on Silicon Valley Bank (SVB). $42 billion was pulled from the bank in 24 hours — an astronomical and historic amount. By Friday, March 10, the bank collapsed. It is the second-largest bank failure in the United States.

The contagion quickly spread. Signature Bank collapsed two days later, and by Monday morning, March 13, regional banking stocks were getting clobbered. Customers were panicking and pulling money out of the banking system.

Silicon Valley Bank was a niche bank that catered to tech startups. For years tech startups were flush with cash as venture capitalists pumped money into these companies. Silicon Valley Bank saw its deposits skyrocket. In 2018 it had $49 billion in deposits. At the end of 2021, it had $189 billion in deposits.

Banks make money by taking a portion of those deposits, investing them, and loaning them out. These tech startups didn’t need loans since they were flush with venture capital. So, Silicon Valley Bank invested the deposits in super-“safe” Treasury Bonds. Because interest rates were so low, these five- and 10-year bonds yielded 1.5%. Which is fine. After five or 10 years, the bank will get its principal back plus 1.5%.

But then the Federal Reserve raised interest rates… fast.

The Contagion Spreads…

Now, you can buy bonds that offer 4.5%. Which means nobody wants to buy a bond yielding 1.5%. So, those bonds that yield 1.5% aren’t worth as much if you had to sell them today. For example, if you bought a $1,000 bond with a 1.5% yield and had to sell it today, you might only get $800 for that bond. That’s a 20% haircut.

Deposits at Silicon Valley Bank dwindled since these tech stocks were burning cash and no longer receiving funds from venture capitalists. Silicon Valley Bank had to sell some of these bonds they purchased during the low-interest rate era at a loss (nearly $2 billion is what was reported on their latest — and last — conference call).

That spooked folks, and the run on banks started.

We saw Credit Suisse (CS) nearly fail — and get purchased for pennies on the dollar by UBS Bank. For the record, Credit Suisse’s demise wasn’t for the same reasons as Silicon Valley and Signature Bank. It’s been in trouble for years. This was just the final breaking point.

One final thing I want to point out is that bank failures happen almost every year…

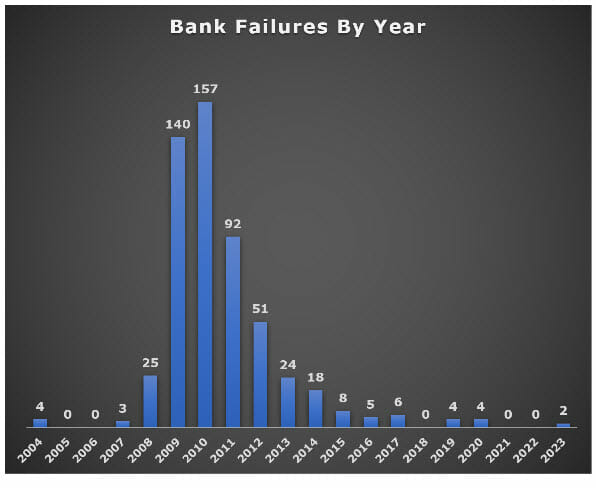

Usually, it’s only a few financial institutions per year, and they are small banks. For example, in 2017, six banks failed and closed their doors. In 2019, four banks went under. But during times of economic uncertainty, we see a massive spike in bank failures. In the wake of the financial crisis, more than 320 banks shut down with more than $640 billion in assets.

Should We Be Concerned?

There’s an unsettling feeling in the air… are more banks going to fail? What will the Fed do? What will the government do? Is my money in the bank safe? Should I buy gold, bitcoin, or stash cash under my mattress?

People are already taking sides, sometimes extreme ones.

For instance, one guy has made a $1 million bet that the banking sector will fail, the global economy will collapse, and we will see hyperinflation, and Bitcoin will soar to $1 million… All within the next 90 days.

That’s pretty extreme.

On the other side, you have folks like hedge fund guru Bill Ackman who believe that if the FDIC temporarily guarantees all bank deposits, it will calm nerves while they update the insurance deposit guarantee (aka increase the current $250,000 FDIC limit). If the government does this, this will all pass within weeks.

My sense of the situation falls somewhere in the middle…

One of my biggest concerns is that if a bunch of these regional banks go under, or get gobbled up by bigger banks, then we have even more power centered in the biggest banks in the world (i.e., JPMorgans, Citi, and Bank of Americas of the world).

Regional banks play a vital role in our economy. They drive home, construction, farm, and equipment loans. They often offer these loans at cheaper rates than the big guys. And they have superior customer service compared with the big banks. If they suddenly disappear, that’s not good for Main Street.

My other big concern is the Fed… and its balance sheet.

I’ll touch this in a follow-up piece, which will be out shortly. You don’t want to miss it, because this is a concept that doesn’t get enough attention in the mainstream financial media.

In the meantime, if you’re looking for game-changing investment ideas with serious upside, then you should check out my investment predictions for 2023…

This report is full of research that challenges the conventional wisdom. And while we don’t have a crystal ball, many of our past predictions have come true, allowing investors the chance to rake in gains of 622%, 823%, and even 1,168%.

From the U.S. dollar to driverless trucks to breakthrough cancer treatments and more… If you’re looking for some “home-run” ideas for your portfolio, then I can’t think of a better place to start.