How To Earn Double-Digit Income From Blue-Chip Stocks Like Microsoft

Right now you can earn big, double-digit “bonus dividends” from some of the safest stocks in the world.

In the past, we’ve found yields as high as 9.9% from Coca-Cola (NYSE: KO)… 12.4% from AT&T (NYSE: T)… and even as much as 17.5% from Microsoft (Nasdaq: MSFT).

This isn’t some investment gimmick, either. The payouts I’m talking about are settled in cash. That is, every time you get one of these payments, the money is added to your brokerage account immediately.

At first glance, these payouts may seem impossible. After all, a quick look at Yahoo Finance will tell you that these stocks pay much less in dividends.

So how have we earned so much income from giant blue-chip stocks like Coca-Cola, AT&T and Microsoft?

It’s easy. By selling covered calls.

The ABCs Of Covered Calls

On the surface, selling covered calls may seem complex. It’s not. Yes, it involves options, an investing tool most investors don’t know much about to begin with. But we’re here to change that.

When we sell calls, we create a contract that says we will sell the underlying shares to the option owner at a specified price (called the “strike price”), if it rises to that level. In return, we receive a cash payment upfront from the buyer. (That’s our “bonus dividend”.)

A “covered” call is when you personally own the underlying shares for the option you write. This helps reduce your risk, making it easier for most investors to safely generate income from writing call options.

Best of all, if the stock stays below the “strike price” you specify in the option contract, then the option expires worthless. That’s good for us, because it means we keep our shares and sell another contract for more income if we want.

When used properly, selling covered calls can be one of the most lucrative investment strategies for income investors. To see how covered calls work, let’s take Microsoft (Nasdaq: MSFT) as an example.

“Bonus Dividends” From Microsoft?

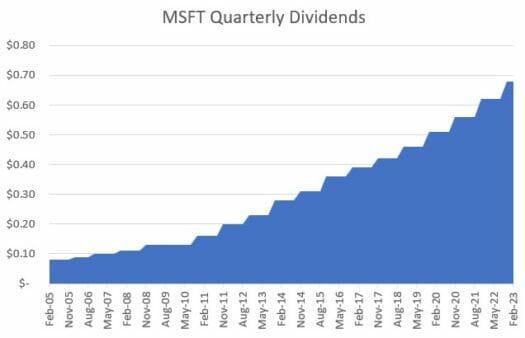

The long-term case for Microsoft is easy to make. The tech giant is a dominant force. The stock itself has rewarded investors with incredible gains, not to mention a steadily rising stream of dividends each year.

In other words, it’s exactly the kind of solid stock you want to own for the long-term.

Of course, Microsoft doesn’t offer much in terms of the current yield. The company pays $2.72 a year in dividends — giving the stock a sub-1% annual yield. Now, if history is any guide, that income stream will continue to grow. And we like MSFT, so let’s say we want to hold it for the long haul. But we want more income right away…

We can do just that with covered calls. In fact, I’ll show you how to collect $350 in cash with just one covered call trade on MSFT.

Here’s a step-by-step breakdown of how that trade would look…

The Trade Setup

The first step to executing any covered call strategy is to make sure you first own 100 shares of the underlying security (that’s what the “covered” means). For Microsoft, if you don’t already own it, you would need to buy the stock at today’s prices. As I write this, the stock is at $288, so we’ll use that for our example.

This would require an outlay of $28,800 on your position ($288 x 100). Once you’ve bought the shares, now you’re ready to write one call option on your position. This is not as difficult of a process as you might think. Just tell your broker (in person, online, or on the phone) that you like approval to sell covered calls. (You may already have approval and not even know it!) They’ll be happy to execute the trade for you. You can even use this strategy with most retirement accounts.

The amount of money you receive from selling the option will depend on how far the strike price is from the stock’s current price. The closer the strike price is to its current price, the more money you receive in premiums.

At the time of this writing, you can sell May 26 $305 calls on Microsoft for about $3.50. That’s a call option on MSFT that expires on May 26th with a strike price of $305. Since each contract represents 100 shares, we would collect the $350 premium upfront when we sell the option ($3.50 x 100 shares). Think of this as a “bonus dividend” you receive for agreeing to enter the contract.

2 Win-Win Scenarios

If Microsoft is trading below $305 a share on May 26 (the day the option expires), then you keep the shares. And the money you collected from selling the option is yours to keep as pure profit. And you can turn right around and make another similar trade if you wish.

Technically, the premium you receive lowers your cost basis. So if you bought at $288, your cost basis is now $284.50 ($288-$3.50). Another way to think about it is that we’re already up by about 1.2% as soon as we collect our premium ($3.5/$288).

If you continue writing covered calls on a rolling six-week basis, you could potentially repeat this eight times over the course of a year. Assuming we receive a similar amount for each contract, the options would generate $2,800 (8 x $350) in additional income each year. Considering your initial investment of $28,800, you could generate a 9.7% annual yield on your investment.

And that’s not even factoring in MSFT’s regular dividend (which would boost your income to about 10.67%).

Now for scenario two. If Microsoft is trading above $305 the day the option expires, then you would still get to keep the $350. But you would also be required to sell the shares for $305 — $17 above where we purchased them (about 5.9% higher). If we factor in our premium, we end up with a gain of about 6.7% ($17 + $3.50 = $20.5; $20.5/$288 = 7.1%.)

When you think about it, this isn’t really that bad. You’re selling the stock for a profit.

Closing Thoughts

Keep in mind, option premiums will fluctuate throughout the year depending on a number of factors. So there’s no guarantee you will get the same premium every time. But as you get used to trading this way, you’ll learn what trades to target depending on your own risk tolerance and income goals.

This is just to give you an idea of what’s possible. The point is, covered calls are about as close as you can get to a win-win strategy when executed properly. Regardless of whether the option you sold expires worthless or not, you’re still going to make money on the trade if the stock goes up. And if it goes down, then that premium you earned will soften the blow, leaving you in a much better position than if you simply bought and held onto the stock.

Could you miss out on a bit of upside? Sure. But if you value downside protection and the opportunity to get upfront cash, then it’s a worthwhile trade-off.

P.S. If you’re looking for more income and want to learn how to make trades like this every single week, then consider the advice of my colleague Robert Rapier.

Robert’s trading service cranks out steady income regardless of inflation, interest rates, wars, or recession. Anyone who follows Robert’s time-proven strategy could earn three times as much as they would with dividends alone (sometimes even 20x).

The result: more cash in your portfolio, more often, with less risk. And for a limited time, Robert is pulling back the curtain to show everyone how it works. Get the details here now.