Why My First Impression Of Bitcoin Was Wrong (And Yours May Be, Too…)

My longtime readers know that I like to talk about the importance of keeping an open mind.

It’s easier said than done, of course. But I try to do my best. But the truth is that deep down, we all tend to quickly categorize. As we move throughout our day, we’re making assessments. Passing judgment. It’s instant and reflexive.

Our brains are just wired that way. A long time ago in human history, when the stakes were a lot higher, it served us pretty well. But today, those first impressions can be tough to overcome — especially when it comes to investing.

Regardless of how hard we try to remain open-minded regarding investing (and life), we all have prejudices regarding certain stocks, industries, and asset classes. It’s hard to change those beliefs. Many stubborn folks would rather miss an opportunity to profit than change their mind about something.

So if you can, I’d like you to keep an open mind, even though I’m sure you already have an opinion on what I’m about to cover. Just remember… Preconceived beliefs can often blind us to what could be a great investment.

My First Impression Of Bitcoin Was Wrong…

When Bitcoin began popping up in earnest in 2010, I shrugged it off. Thought it was a fad. Another tulip-mania.

Those beliefs hardened in February 2011. That was the date one Bitcoin was worth one dollar, a major milestone as the cryptocurrency reached parity with the world’s leading sovereign nation. (For the record, a $100 investment in Bitcoin back then would be worth $4.2 million today.)

This is when I should have really begun studying and understanding Bitcoin. But instead, I simply mocked it as a kind of digital tulip. A Ponzi scheme even. Sure, I looked into the technology behind Bitcoin — the blockchain — and realized the potential there. But I still wasn’t convinced that Bitcoin had a place in our future.

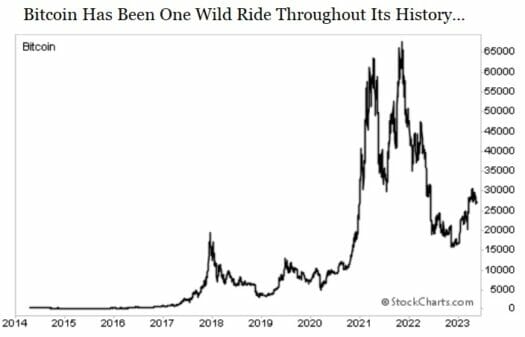

Then in 2017, the price of Bitcoin really took off, racing from less than $1,000 and peaking at nearly $20,000 by year’s end. The following year it collapsed to less than $5,000.

The nostalgia — at least in the media — wore off. But as it fell out of favor with most investors and the media, I quietly began to look into it. I wanted to understand how and why so many people were willing to trust Bitcoin and were eager to use it.

So I read Satoshi’s white paper. I opened my first wallet, where I could invest in Bitcoin and other cryptocurrencies. And I have invested — and currently own a variety of cryptocurrencies.

You see, my preconceived (negative) perception slowly changed. I was just slow to adapt to this evolving technology. I’m glad I finally got in. But you can see what might have happened if I had been able to change my mind sooner…

Are You Ready To Get Serious About Cryptocurrency?

If you’re one of the folks who cringe whenever Bitcoin or cryptocurrencies are brought up, I want to encourage you to reconsider, ideally, with an open mind. I even urge you to look into the technology yourself — doing so without assumptions.

Sometimes our negative impressions about things are simply rooted in a lack of understanding. And if you’re willing, I — along with my staff over at Capital Wealth Letter — would like to help change that.

I’m not going to dive deep into Bitcoin and cryptocurrencies today. That’s not the purpose of today’s essay. But I will tell you that I will be covering cryptocurrencies more often. After all, I’ve been in this space personally for a little while now. So I would be doing a disservice if I didn’t share some of my experiences and knowledge with my readers.

Make no mistake, though… Over at Capital Wealth Letter, our primary focus will continue to be finding and recommending wonderful companies trading at reasonable prices. In that respect, nothing will change. But I do hope to expose my readers (those who are willing) to the world of cryptocurrency. And if you haven’t already, I hope you’ll at least consider dipping your toe in the water, too.

I firmly believe that the value creation made possible by the blockchain has only just begun. And it will unlock enormous opportunities that I feel obligated to share with you.

Make no mistake, Bitcoin may be the most fascinating and controversial development in money and finance in generations… if not centuries. And the underlying blockchain technology has the potential to revolutionize aspects of our economy, upending many established companies — and even entire industries.

The only question is… will you keep an open mind and evolve? Or will you stand rooted in your first assessment of the technology and watch it pass you by?

If you’re looking to get into cryptos, I just released a new briefing about what you need to know and how you can profit…

My team and I think cryptocurrencies will surge again in the coming months. That’s because three “blue chip” cryptocurrencies are getting major upgrades this year, and they could unleash a massive crypto boom…

This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain. Sounds unbelievable, I know… but the numbers don’t lie. Get the details here…