Bitcoin: The Most Fascinating (And Controversial) Monetary Development In Centuries

A few weeks ago, I told my Capital Wealth Letter readers we should start paying attention to the cryptocurrency world again.

For the record, I’ve been personally dabbling in this space for a few years now. But I first ventured into this realm with my readers in 2021, when I made a crypto prediction that gave readers a chance for a 400% gain.

But as you may know, there have been several setbacks in this space over the last year or so, which is why I warned readers to stay on the sidelines.

But things move fast and change on a dime in this part of the financial world. I won’t get into all the details today, but I believe investors are about to get a “second chance” at profiting from cryptocurrency in the months ahead. And to prepare our readers for that, I will spend some time talking about the basics and the latest developments in this space.

Today, however, I want to start from the very beginning. Literally.

If you’re not familiar, I want to give you a brief overview of the cryptocurrency that started it all: Bitcoin. We’ll talk about how it came to be, a little about the technology and the ideas behind it, and what it could mean for how we think about and use money in the years to come.

The Bitcoin Origin Story

In August 2008, someone anonymously registered the bitcoin.org domain name. That was the first known appearance of the word “bitcoin.”

Then, in October 2008, a coder named Satoshi Nakamoto published a white paper describing the basics of Bitcoin. He is said to have been writing the computer code for a year and a half.

In January 2009, the world’s first cryptocurrency — bitcoin — was born.

How It Works…

Bitcoin is purely digital. It’s just zeros and ones (known as “bits”) on a computer network… hence the name “bit”-coin.

Being purely digital isn’t as radical a departure from today’s currency as it sounds. In fact, it’s estimated that 92% of the world’s currency is digital. In other words, only about 8% of fiat currency is physical money.

Think about the U.S. dollar… When you swipe your card to purchase groceries, or even write a check, no physical bills exchange hands. The value exchange (money for goods) happens behind the scenes on a network with your bank communicating with a merchant provider who then communicates with another financial institution. And then everybody hopes to collect as some point.

Think about how convoluted this is, and how easily it can be (and is) defrauded. We’ve all probably had a check “bounce” — whether it was one we wrote or one that we were cashing.

If we pay with a credit card, there’s no verification that those goods will actually get paid for by the card holder. Sure, the store still gets its money and doesn’t care, but now the financial institution that issued the credit card must collect the funds.

Bitcoin — and cryptocurrencies — solve a lot of these problems.

The Promise Of Bitcoin

Bitcoin exists entirely outside of the traditional banking system. It doesn’t rely on banks to manage accounts or verify transactions. As a result, there are no middlemen, such as JPMorgan Chase or Visa.

Bitcoin is transferred via a peer-to-peer network, which doesn’t have a central computer server or authority. Unlike dollars, bitcoins aren’t a central bank’s liability (or “IOU”) — a characteristic it shares with gold, which means it isn’t a liability of the central bank either.

But bitcoin is much easier to transfer than gold…

Another characteristic it shares with gold is that there is a limited supply. Gold is scarce. Miners continue to extract more, but the total supply is limited by nature. The Earth’s crust only holds so much gold.

Bitcoin’s supply is limited by computer code. Ultimately, there will be 21 million bitcoins. No more, no less.

Bitcoin is also fungible: one bitcoin is equivalent to any other.

This eliminates the need for currency conversions. We don’t have to worry about how the U.S. dollar stacks up to the euro or the peso when traveling or when companies purchase product from overseas.

This standardization makes it so we can easily measure the value of goods and services. And although bitcoin is far from universal, the attributes of bitcoin make it a good medium of exchange.

[Related: Why My First Impression Of Bitcoin Was Wrong]

Closing Thoughts

More and more businesses and even countries are recognizing bitcoin as a legal payment method and currency. Even nation states are experimenting with using Bitcoin as a recognizable form of payment.

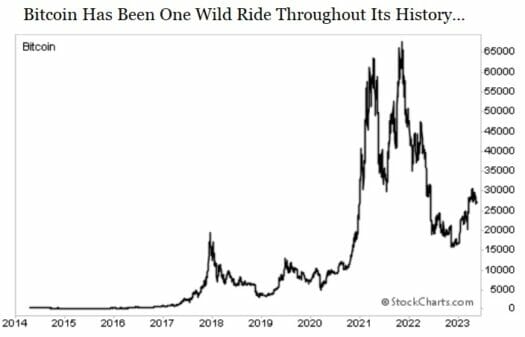

Granted, currently, bitcoin is not an ideal medium of exchange because its price is so volatile. But over time, if bitcoin’s volatility moderates and more merchants accept it as payment, it will better serve as a medium of exchange.

Let me be clear… I firmly believe that the value creation made possible by the blockchain has only just begun. And it will unlock enormous opportunities.

As I’ve said before, Bitcoin may be the most fascinating and controversial development in money and finance in generations… if not centuries. And the underlying blockchain technology has the potential to revolutionize our economy.

Like I mentioned earlier, I’ll have more to share with you in the days (and weeks) to come. My goal is the same as it always was: Whether you decide to invest in cryptocurrencies or not, I want you to have a better understanding of this new alternative asset class. So stay tuned.

In the meantime, I just released a new briefing about how you can profit from the next cryptocurrency “boom”…

My team and I think cryptocurrencies will surge again in the coming months. That’s because three “blue chip” cryptocurrencies are getting major upgrades this year, and they could unleash a massive crypto boom…

This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain. Sounds unbelievable, I know… but the numbers don’t lie. Get the details here…