Regulators Crack Down On Crypto Platforms… Should Investors Be Worried?

I wanted to do a quick update on the cryptocurrency market. There’s been some major news in the space in the last week or so.

Over the past couple of months I’ve touched on how regulators have been cracking down on major players in the crypto space like Coinbase, Kraken, Gemini, and Binance.

For example, in February cryptocurrency platform, Kraken, got sued by the SEC and was forced to shut down its staking service.

Then Coinbase received a Wells Notice from the SEC. A Wells Notice is a warning from the SEC that it has identified violations of securities laws and is often followed by legal charges.

Well, Coinbase got hit with legal charges last week. In fact, the SEC hit Binance — the world’s largest cryptocurrency exchange — with a lawsuit, and then 24 hours later they hit Coinbase with a lawsuit.

The SEC has been busy…

Now, I’m going to focus on Coinbase since that’s the platform we talk about most over at Capital Wealth Letter…

So, what exactly is the SEC accusing Coinbase of?

- One, that they haven’t registered with the SEC as a securities exchange.

- That Coinbase has been acting as an unregistered broker.

- Coinbase is an unregistered clearing agency.

- And finally, Coinbase didn’t register the offer and sale of their staking program.

That last one, is what they shut Kraken down for, so it makes sense that Coinbase would be next in line.

Here’s The Crazy Part…

So, here’s the thing… the SEC claims that Coinbase has been breaking the rules since 2019.

But the SEC is the same entity that approved Coinbase to go public in 2021. And as a reminder, when a company goes public it takes at least a year, and it must file all sorts of paperwork and financial documents with the SEC.

What’s more, the U.S. government has been using Coinbase to sell confiscated Bitcoin and will continue to do so throughout the year.

You just can’t make this stuff up.

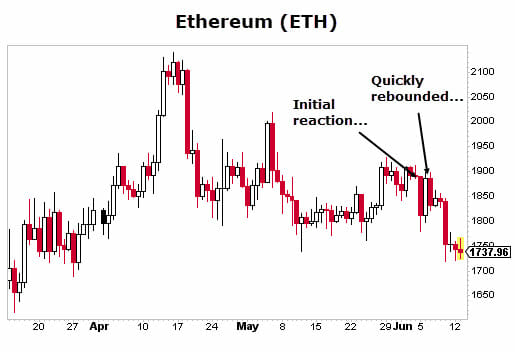

So, what does this mean for our crypto holdings, Bitcoin and Ethereum? Well, here’s how they reacted to the news…

Both Bitcoin and Ethereum initially fell on the news, then rallied. In the last week both cryptos have slid. But here’s the thing… crypto doesn’t need the U.S government’s approval to succeed. In fact, that’s the whole point of crypto.

It was built as an alternative financial system. One where a centralized government can’t control or censor it.

And that has regulators scared. Which is why they are doing everything they can to try and regulate cryptocurrencies. Right now, they can only go after centralized exchanges that make it easy to buy and sell crypto.

Closing Thoughts

As I’ve said before, Bitcoin (and cryptocurrency in general) may be the most fascinating and controversial development in money and finance in generations. And the underlying blockchain technology has the potential to revolutionize aspects of our economy, upending many established companies, and even entire industries.

The bottom line is that crypto isn’t going anywhere. Companies, governments (even our own U.S. government), and retail investors around the world hold digital assets.

Crypto has survived and will continue to survive.

The cryptocurrency world is constantly evolving. And the next big thing is right around the corner…

Over at Capital Wealth Letter, we plan to be there when it happens. Remember, cryptocurrencies are speculative at this point. The ride will be volatile, so don’t bet the farm on these plays. But you need to learn about this corner of the market — and even consider dipping your toe in the water as long as you feel comfortable. Because the potential upside here is just too good to ignore.

That’s why I just released a bombshell briefing about how you can profit. Go here to learn more now…

P.S. Subscribe to the Investing Daily video channel by clicking this icon: