The Solar Industry Is Down, But Not Out — Here’s How You Can Profit…

A few years ago, solar panels were an easy sell. Let’s say you pay, on average, $150 per month on your electric bill. Well, you could install solar panels, and instead of paying that $150 to the utility company, you would send it to the solar company to pay off the panels. Sometimes, you might even save money on your bill.

It was a no-brainer, and solar-powered homes exploded.

But that was a few years ago when interest rates were near zero. Today, thanks to the Fed’s rapid interest rate increases, money isn’t free. In fact, it is quite expensive.

Solar companies can no longer offer those sweet financing deals. And it’s crushed the solar industry.

As you can see, the Global X Solar ETF (Nasdaq: RAYS) has lost half its value over the last two years.

Does this mean the solar-powered homes were just a fad? I don’t think so…

But before we get into that, let’s talk a little bit about solar power itself.

The History Of Solar

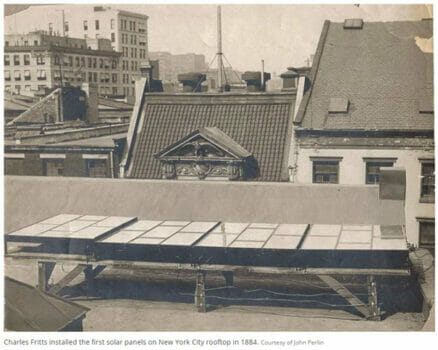

While solar-powered homes are still relatively new, the solar panel itself is not…

In fact, it was first discovered in the late 1860s. But it wasn’t until 1884 when Charles Fritts built the world’s first solar panel, on a rooftop in New York City.

As neat as it was to create energy from light, it was terribly inefficient. Fritts’ solar panels achieved an energy conversion rate of just 1% to 2%. For comparison, the world’s main source of power — coal — sports an efficiency of up to 40%.

Of course, times have now changed. Today’s solar panels are now 20 times more efficient than the ones created in the early 1900s — and much more practical. And with those advancements, interest in solar technology has soared again.

Solar 101

While we call them solar panels, most panels you see on the roofs of houses are photovoltaic (“PV”) panels, which turn light into electricity. (Solar panels turn sunlight into heat.)

Each PV panel is basically a sandwich made up of two slices of semiconducting material — usually silicon, the same stuff used in most chips that go into smartphones, televisions, and computers.

We spread phosphorous on one piece of this bread (peanut butter for those still following my silly analogy). Phosphorous contains extra electrons, giving that layer a negative charge. The other piece of bread gets jelly or boron — an element with fewer electrons and thus a positive charge.

This perfect combination creates an electric field. Then, when a photon of sunlight hits the panel, it knocks an electron free. This energy creates electrical charges, causing energy to flow. (That energy is captured by metal conductive plates and passed onto wires, which feed your home).

Why Now Is The Time To Invest…

I mentioned earlier that the share prices of solar stocks are in the dumpster right now. So, let’s talk about why now is a good time for investors to jump into the solar industry…

Catalyst No. 1: Increasing Adoption

First, the low-hanging fruit, and that’s the increasing adoption of solar.

Everyone, from individuals to municipalities to corporations to entire countries, are trying to “go green.” And thanks to major advancements, solar is one of the easiest ways to do it.

People aren’t nearly as weary about bolting down solar panels on their homes. In fact, until interest rates soared, solar installations were having a real renaissance. The residential solar market experienced its 6th consecutive record year in 2022, growing over 40% over 2021. The chart below shows the installation growth (and projected growth):

Despite that strong growth, just 3% of homes have solar. So, don’t think the market is saturated. In fact, it’s just getting warmed up. There’s a long runway of growth for solar. And that’s just the residential market… commercial and utility installations have also ramped up.

Catalyst No. 2: H.R. 5376

What the heck is H.R. 5376? Well, it’s a bill that passed in Congress last year. It’s better known as the Inflation Reduction Act (“IRA”).

Of course, the name of this bill is a little deceptive. At first glance, you might be wondering what it has to do with solar (then, after reading the bill, you might be wondering what it has to do with inflation).

But buried in this 274-page bill is a sweeping $700 billion climate, tax, and health care package, half of which is allocated to climate initiatives.

This legislation is the most significant investment addressing climate change in U.S. history. It includes provisions like a $7,500 tax credit for buying new electric vehicles (“EVs”) and $4,000 credits for used EVs. There are also incentives for electric appliances, heat pumps, and other technologies to increase home energy efficiency.

But the biggest takeaway is that the government wants to spur massive new investment and innovation in the green energy space. And the solar industry should benefit immensely from these subsidies and tax credits.

My Plan To Profit

One way to play this would be to buy the Global X Solar ETF — or pick and choose among individual solar companies.

Instead, over at Capital Wealth Letter, we’re targeting a company that makes a device that just about every solar power installation needs.

I’ll try to spare you the jargon, but every solar-powered home needs devices called inverters that convert the DC (direct current) electricity it produces to AC (alternating current) that your home uses.

Historically, solar-powered homes had a single inverter, which means the entire system goes down if the inverter fails. But our pick helps solve that problem with what’s called a “microinverter” — so if one inverter breaks, the entire system continues to function.

This company is a leader in this space, with nearly 50% market share. It’s also in a great position to benefit from the IRA bill. New tax credits could cut the cost of producing a microinverter domestically almost in half. And thanks to the recent weakness in the solar space, shares are trading at their cheapest valuation in over five years.

In the meantime my team and I think a select few cryptocurrencies are about to go on another MASSIVE run…

We believe NOW is the most important time to buy crypto… if you haven’t yet. So if you feel like you missed the boat, then you’re in luck. We just released a bombshell briefing about how you can profit. Go here for all the details.