Here’s an Investing Lesson From Another Buffett Family Member…

Warren Buffett may be an investing legend, but his sister Doris… not so much.

In 1987, Dorris got financially wiped out and went bankrupt. You see, she got talked into “selling” insurance on stocks to generate income by her brokerage firm.

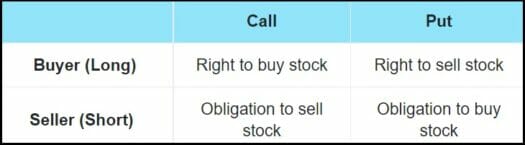

This is better known as selling naked puts. Here’s a quick rundown on the premise of this options strategy…

Naked Put Options 101

A naked option, or uncovered option, obligates you to buy a stock at a certain price, called the strike price. When selling puts, you have no intention of buying the stock. Instead, you want the put you sell to expire worthless.

Let’s run through a quick example…

Say a stock is trading at $50 per share, and you think that in one month, it will be worth more than $50. You’re very bullish and confident that this stock is going up.

So you decide to sell a put option to collect a little upfront income. Entering this contract means you must buy the stock if it falls to the strike price. In this example, let’s say you give yourself a little leeway and set the strike price at $47 per share.

In exchange for taking on this risk, you collect a premium. Let’s say your premium is $2 per contract.

Now, one options contract controls 100 shares of the underlying stock. So if you sell one put option, you would collect $200 in this case ($2 x 100 shares).

Here you can see where this strategy is enticing for many people. After all, if you sell 10 put option contracts, you would collect $2,000 in premiums. But that also means you are on the hook for 1,000 shares of the stock at $47 per share. That’s $47,000.

Of course, the goal is not to have to buy these shares… just keep the “income.”

If the option expires in one month and the stock is trading for more than $47, this worked out great. You keep $200 or $2,000 and can do it again.

However, let’s say the stock tumbles and is trading for only $40 per share. Now you have to buy the shares at $47, and you are immediately in the hole. Not to mention, you must fork over $4,700 or $47,000 to buy these shares (depending on how many contracts you sold).

This is where things can turn sour quickly.

How Black Monday Wiped Out Buffett’s Sister

In short, naked puts are essentially a promise to cover somebody else’s losses if a stock falls.

Doris’ broker may have failed to mention some of the risks involved in this options strategy. Instead, they emphasized that it would provide her with a steady stream of income, which she needed.

Doris liked this idea and wanted to do something on her own. So she never mentioned the investment strategy to her brother. Warren was famous for recommending “boring” investments. This other strategy seemed way more exciting.

Now, if you recall, the year was 1987, which is now famous for “Black Monday.”

As a quick refresher, Black Monday happened on October 19, 1987. That day, the Dow Jones Industrial Average crashed 22.6% — the largest one-day drop in its history. Between August and November, the Dow Jones crumbled roughly 31%.

As you can imagine, a tanking stock market is a terrible time to be selling put options. Not only that, but the leverage the options provide, coupled with margin, means you only have to put up a fraction of what you might need if you get assigned the stocks.

When the market collapsed, Doris was margin called… but she didn’t have the money. She defaulted on $2.6 million in obligations owed to the firm.

Because Doris and other clients in a similar situation couldn’t pay the brokerage firm, the firm went under.

Buffett didn’t bail his sister out. He said that if he gave her the money to pay her creditors, it would only help the businesses to whom she owed money — the counterparties she had insured. His logic was that they were speculators, and we shouldn’t bail them out.

The Bottom Line

The stock market attracts a lot of dreamers. Many people think it’s an easy way to make money. All they need is that “holy grail” investment scheme to nail every trade.

Of course, if you’ve been investing for any time, you know it’s far from easy and not a get-rich-quick scheme.

To make matters even more confusing, the investment world is littered with hundreds of different strategies. And all these strategies get dangled in front of us, luring us to believe that it’s the one strategy or system that will get every stock trade correct (and make you an instant success).

But the moral of the story is that chasing that next shiny object (strategy) won’t make you rich. There is risk involved in all aspects of investing. It’s crucial that you come to grips with this fact.

Remember, the number one rule in investing is to cut your losses short. Don’t let small losses swell into large losses. Because if you lose your money, it’s game over.

Editor’s Note: On Friday, February 2, Apple (NSDQ: AAPL) is scheduled to release its new Vision Pro device, a headset that promises to shake up the VR/AR market. The $3,500 device includes high-resolution displays and sensors that track eye movements and hand gestures. It’s one of Apple’s most ambitious products yet.

However, the tech analysts at Investing Daily have determined that the Vision Pro is dependent on mission-critical software made by a tiny, under-the-radar innovator. Without the software provided by this small company, Apple’s much-ballyhooed device would be a catastrophic failure.

Apple’s dependence on this software opens a huge investment opportunity. You won’t see this small-cap stock mentioned on CNBC, but it’s poised to explode on the upside.

I urge you to make your move before February 2. That’s the day Apple rolls out the new Vision Pro device, and if my colleagues are right, that’s when a profit surge could start for the company’s small software partner. Click here to learn more.