This May Be Your Best Investing Move Of 2013 (But You Have To Hurry)

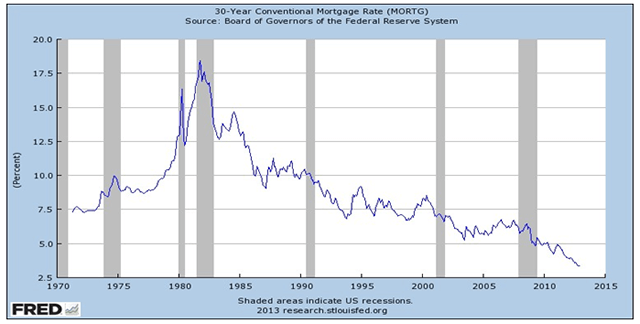

If you haven’t taken advantage of the lowest mortgage rates in history, then you probably don’t want to wait any longer.

According to two economists at the New York Federal Reserve, there’s no reason to expect that rates will go any lower under the current Federal Reserve policy.#-ad_banner-#

Furthermore, they say, even if the Federal Reserve were to implement significant changes in an attempt to drive rates lower, there’s no guarantee the rates would respond. For reasons they are unable to explain, the 30-year fixed mortgage rate has hit a floor near the 3.5% range we’ve seen for the past several months.

So what is your average homeowner to do?

In short, stop waiting for sub-3% rates and call your mortgage broker today. Refinancing your mortgage may be the one “no-brainer” investing move for 2013.

Even if you refinanced in the last few years, rates have fallen so far that it might be time to consider refinancing again.

I know it sounds crazy, but the numbers don’t lie.

Here are the facts:

1. Rates are still near their all-time lows. Period. Had I written this article a year ago, I would have said the same thing. Rates had just dipped below 4%, and it seemed insane to think they would go even lower. Yet here we are. That said, when the Federal Reserve publishes a report saying that rates have likely hit a floor, I certainly listen. So if you’ve been holding out for lower rates, then you may want to stop. Chances are very good that the time to act is now.

2. Every $1 you save on mortgage interest grows your total net worth. If you have a $300,000 mortgage, then you can save $62,248 in interest expense during the life of your loan by lowering your rate from 4.5% to 3.5%.

Provided you save that money and don’t spend it, then you increase your net worth by at least the same amount. You would have to earn almost 8.8% a year on a $5,000 investment to grow your wealth by the same amount over 30 years, requiring you to invest in some pretty risky assets.

3. This is an opportunity to diversify away from real estate. For most investors and myself included, the family home is our largest investment. And as we all learned five years ago, you probably don’t want all your eggs in one basket of real estate.

If you have a $300,000 mortgage, then you can save $172.93 a month on mortgage payments, improving your cash flow and increasing the amount of money you can invest in stocks, bonds or even cash.

4. Don’t forget that a mortgage is a tax shelter. Even though marginal rates didn’t go up for most people, those in the highest income bracket did get dinged. If you’re one of those high-income earners, then it makes more sense than ever to shelter some of that income with a mortgage.

5. Fixed-rate debt is one of the best hedges against inflation. Unlike commodities or precious metals, a house provides economic value. Either it gives you a place to live or it gives you a property to rent out to others.

Rents tend to keep up with inflation. If inflation goes up by 5% to 6% a year and your home is financed at a 3.5% fixed rate, then you should be able to collect increasingly higher rents even though your monthly mortgage payment stays the same. The rest goes in your pocket. The same cannot be said for gold, silver, corn or other commodities.

There are some costs to take into account when refinancing any mortgage. For example, closing costs are typically rolled into the principal amount and amortized during the life of the loan.

Action to Take –> Call a reputable mortgage broker and get a quote. Compare it to the quote offered by your local bank or credit union and then pick the lowest rate.

Regardless of which lender you use, you should be able to close your loan within a month or two and start seeing economic benefits almost immediately.

This article originally appeared on InvestingAnswers.com:

This May Be Your Best Investing Move Of 2013 (But You Have To Hurry)