Why Enbridge Belongs In Your Long-Term Portfolio

There are many investing strategies available to investors to build long-term wealth. And although out of fashion with Wall Street, a buy and hold strategy with stocks in the midst of a strong secular trend remains one of the best strategies for retail investors.

| —Recommended Link— |

| Is Your Portfolio Missing Something? Legendary investment analyst Jimmy Butts reveals the 10 stocks he believes will crush the market in 2019. Be one of the first to get your hands on this report to make sure you’re not missing out on a windfall stock pick. Click here to discover all 10 now. |

Better yet, when applying this strategy with undervalued blue-chip stocks with a solid history of growing dividends, the buy-and-hold strategy morphs into a powerful wealth building investment philosophy. It has made Warren Buffet a wealthy man, and it can grow your own portfolio beyond your wildest dreams, too.

Strong Secular Trend

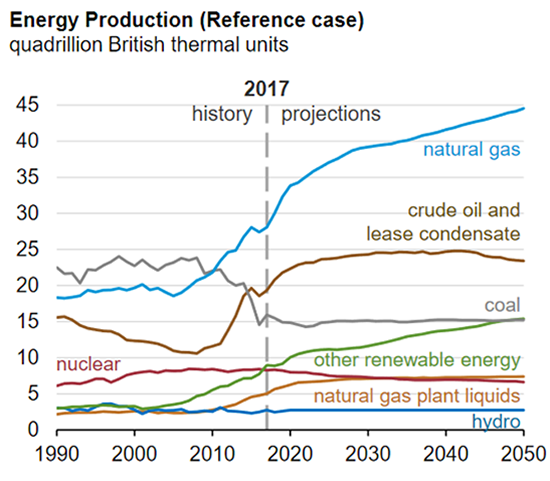

According to the U.S. Energy Information Administration (EIA), the U.S. will see strong tailwinds in the production of oil and gas for several decades. The following EIA chart shows oil production in the United States growing until about 2040 before stabilizing thereafter. But the outlook in the growth of natural gas shows no slow down through 2050.

More importantly, a report by OPEC suggests that shale oil production in the U.S. will climb to 16 million barrels per day (mb/d) by the late 2020s. If accurate, that would make up nearly 25% of non-OPEC supply and be twice the amount of U.S. shale production in 2017.

Neither Upstream Nor Downstream

#-ad_banner-#The upstream oil and gas industry locates and drills for crude oil and natural gas, while downstream companies refine and market oil and gas products to end-users. Of #course, both upstream and downstream companies will profit from the ongoing boom in the oil and gas industry. But the stocks of these companies are correlated to the actual price of oil and gas, and as such, they are much more volatile than other stocks.

On the other hand, midstream companies process, store, and transport oil and natural gas and natural gas liquids. Because their fortunes are not directly tied to the price of oil and gas, they make for less volatile stocks for retail investors.

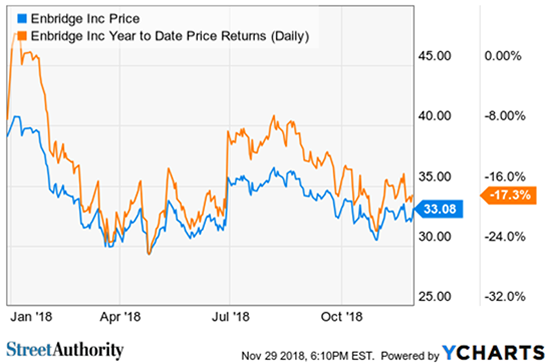

One of my favorites is the Canadian midstream company, Enbridge (NYSE: ENB). As you can see from the chart, Enbridge stock has been beaten down more than 17% from its 2018 highs.

Enbridge was founded in 1949. The company has a wide moat with more than 50,000 miles of oil and gas pipelines in North America. Enbridge’s midstream network serves nearly every major oil & gas producing region in the U.S. and Canada. Roughly 28% of North American oil and 20% of the continent’s gas flows through Enbridge assets.

But unlike upstream and downstream players, Enbridge makes its money from the toll-booth nature of its business — where 96% of its cash flow is under long-term contracts. Better yet, the company reports that less than 1% of its cash flow is directly subject to commodity price fluctuations — meaning the company is insulated from the volatility in spot oil and gas prices.

Nearly A Dividend Aristocrat

The company’s stable cash flow will help the company become a dividend aristocrat in another two years — meaning the company will have increased their dividend for the past 25 years. And that’s no small feat in the oil and gas industry, especially in light of more than two years of depressed oil prices.

Through the end of 2017, the company has raised its dividend at an 11% compound annual growth rate (CAGR). The company’s dividend is $2.04. At current prices, the stock yields an attractive 6.17%. Since 1997, ENB’s dividend helped push the total return for the stock to a CAGR of 17%.

| —Recommended Link— |

| New Medical Breakthrough Could Save More Lives Than Penicillin And End Disease As We Know It We’ve just uncovered a bombshell that you NEED to see… One company is taking strides to stomp out disease… even if you’re genetically predisposed to them by creating custom coded cures. Best of all, you could make millions by getting in early. Discover the shocking truth here… |

Undervalued, Too…

In 2018, Enbridge expects to generate roughly $3.33 per share in free cash flow — a 15% increase over last year’s results. At current prices, the company’s shares are trading at 10 times cash flow — a 20% discount to its midstream peers.

More importantly, Enbridge is currently priced just 9.6 times 2018’s guidance of distributable cash flow (DCF). If you are unfamiliar with DCF, the P/DCF ratio is to energy stocks what the price-to-earnings ratio (P/E) is to other stocks. And at this level, the multiple implies no growth for the company.

Of course, that’s patently false. Enbridge will deliver almost 20% DCF growth this year, as well as a 10% CAGR in earnings over the next decade. That translates to a significant multiple expansion in the future.

Lastly, the stock’s dividend yield tells a story, too. Because yields are inverse to prices, as the price of a stock declines, the dividend yield increases. Enbridge historically yields 3.6%, but yields 6.17% at today’s prices. Dividend yield theory indicates the stock is trading roughly 40% below its historic average — making Enbridge a must-own powerful wealth building investment suitable for value investors looking for income.

Risks To Consider: Enbridge pays its dividend in Canadian dollars. Thus, there is some exposure to foreign exchange risk. It’s also important to know that Canada imposes a 15% withholding tax if the stock is not held in a tax sheltered retirement account. A dollar-for-dollar tax credit is available to US investors subject to the tax. See your tax advisor for details.

Action To Take: Buy shares of ENB up to $36/share. Mitigate risk by applying no more than 2% of your portfolio into shares of ENB. Shares of ENB are for investors with a medium to long-term time horizon, so expect to hold shares for five (5) years or longer using a buy-and-hold strategy. Use a 25% trailing stop on your position.