Here’s How To Make Money When The Market Tanks…

The table is set. After hitting all-time highs this month, markets are poised for a pullback.

I’ll have more on that in a moment.

First, it’s important to remember that pullbacks, corrections — and yes, even recessions — are normal occurrences for healthy, functioning markets. Legendary investor Warren Buffett reminded us of this when, during the darkest days of the financial crisis in 2008, he wrote in an op-ed for the New York Times:

| “Over the long term, the stock market news will be good,” he said. “In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.” |

That long-term bullish sentiment is still as valid today as it was then. Few investors, if any, have made money betting against the United States over the long arc of time.

But that doesn’t mean we can’t protect ourselves — or even profit — during times of short-term weakness.

The ‘Perfect’ Set Up…

#-ad_banner-#A few weeks ago, I passed along details on how our colleague Jared Levy was able to steer his Profit Amplifier readers to an 18.5% gain in one day by making a calculated bet against the S&P 500 by using a simple options strategy. And just two weeks ago I wrote about Profitable Trading’s newest premium service, Trade of the Week, and how it will level the playing field for investors who are new to trading by offering a variety of trades from Profitable Trading’s premium offerings.

Simply put, each week Profitable Trading’s Publisher, Frank Bermea, will cherry pick the single best trading idea that comes across his desk each week, and explain in full detail how readers can profit.

For the inaugural issue of Trade of the Week, Frank showcased how Jared Levy is looking to replicate the success of his previous bearish bets against the S&P. As he puts it, we have the “perfect backdrop,” for a bearish trade.

| “What makes this week’s trade so compelling is not only the fact that we have a nearly perfect bearish backdrop… like I mentioned, Jared has already profited from similar setups a few times. Not to mention, he has an incredible track record of making money from falling stocks, which is what this trade does. In fact, since he started Profit Amplifier, his average bearish trade has made subscribers 7.4% in just 28 days — a 95.3% annualized return.” |

Reason No. 1 for Jared’s bearish short-term sentiment is declining earnings. Companies in the S&P 500 have so far reported an earnings drop of 10%, yet the index is still trading near the same level it was at last year.

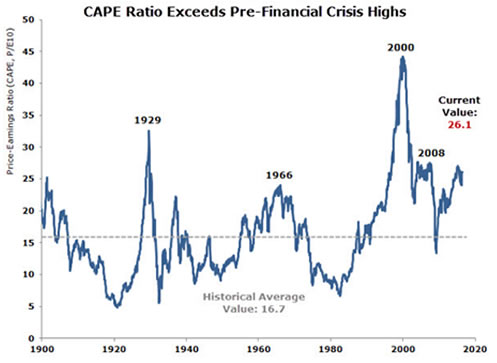

Company valuations tell a similar tale. But rather than simply look at price-to-earnings ratios, take a look at Nobel laureate Robert Shiller’s cyclically adjusted price-to-earnings ratio (or CAPE for short). This measure takes the price of the S&P and divides it by a 10-year moving average of earnings, adjusted for inflation.

The S&P’s CAPE ratio currently sits at 26.1, a peak not seen since May 2007 (when it was 27.5). And we all know what happened after that…

Next up is the Volatility Index (VIX). The “Fear Index,” as it is commonly known, tells us how much volatility is factored into the prices of options. When it’s low, it suggests investors believe stocks will gradually go up. When it’s high, then investors are nervous and see a bearish move on the horizon.

So it follows that if the VIX is low, then that’s a good thing, right? Not necessarily. Right now, the VIX is too low, suggesting that bullish investors are already in the market, meaning that there are few new “buyers” left to enter the market. Said another way, the “smart money” is not buying right now.

To summarize, Jared cites three major factors for believing the market will pull back: weak fundamentals, lofty valuations and investor complacency. It’s the perfect set up for a bearish trade.

Now, as I mentioned earlier, Jared and his readers have made money from this idea before. Last time around, Jared and his readers bought puts on the S&P 500 ETF (NYSE: SPY) and made out like bandits (an 18.5% gain in one day).

That’s the great thing about options… When done properly, they don’t have to be risky or complicated. You can trade options on specific stocks, sure, but you can also trade ideas — like the bearish set up we’re seeing in the S&P 500 today.

Specifically, Jared recommends buying (to open) SPY Jul 214 Puts for $6.50 or less. That’s a SPY put option with a strike price of $214 that expires on July 15. The goal here is for SPY to drop to $205, which is 2% below the current price, by expiration on July 15. If the option hits Jared’s price target, he’ll generate a 38.5% gain in 46 days. That’s an incredible 305% annualized gain.

If some of the terminology I used above sounds foreign to you, don’t worry. If you sign up for Trade of the Week (only $19 per month), not only will you get the trades I mentioned, but our friends at Profitable Trading will send you a handful of reports to get you up to speed with the strategies their premium services use.

For the simple options strategies Jared uses, three of the reports you’ll get will come in handy:

How to Set up Your Brokerage Account for Triple-Digit Trading

Profitable Trading’s Options 101

Turn a 5% Stock Move into an 80% Gain

Like I’ve mentioned before, Profitable Trading’s new Trade of the Week service is the single best value for anyone wanting to learn more about trading. I’d highly encourage you to give it a try if you’re even remotely curious. If you do, then the money you make on this trade alone will more than cover the cost of a subscription. To learn more about this service, go here.