5 Mid-Cap Stocks You Need To Know About Right Now

One of the goals I have in mind when screening for stocks is to find fresh investment ideas — ideas that have not been preconceived or predetermined by an analyst’s current thinking and market outlook. These screens also generate new and sometimes unexpected ideas for my Fast-Track Millionaire readers to consider.

Recently, I showed my subscribers the results of a screen I ran for financially healthy mid-cap companies (market capitalization between $2 billion and $10 billion) that have been outgrowing the rest of the pack.

And today, I’m going to share it with you…

| —Recommended Link— |

| What would YOU do with an extra $3,080 every month for the rest of your life? Never worry about cash again. Be free to live how YOU want… go on a lavish vacation… or build up a college fund for the grandkids–it’s up to you. Get your share here…. |

The Criteria

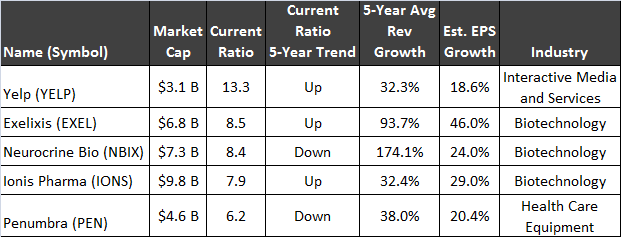

Screening for growth might seem easy, but there are many ways to go about it. For this screen, I’ve chosen a relatively straightforward way to measure growth, a method that would also allow us to include younger companies that could have been unprofitable over the past few years. Only companies with a five-year compound average rate of revenue growth of 20% and higher have made the cut.

Still, because the ultimate goal is making a profit, my next screening criterion was long-term profit expectations. Only companies where a long-term earnings growth of 18% or more is expected have made it through stage two.

Further, because I also wanted to choose financially healthy companies, I screened for companies sporting a current ratio of 3 and higher. Current ratio gives us a good estimate of financial quality.

The current ratio is a measure of a company’s liquidity. We find it by dividing a company’s current assets by current liabilities.

This shows how well a company’s assets (such as cash, inventory and accounts receivable) cover its liabilities (short-term debt and current portion of long-term debt, accounts payable, wages and current taxes). Anything over 1 means that a company has enough liquidity to cover all current liabilities — and high current ratios generally indicate strong liquidity and financial flexibility.

The Results

Taken together, the three screening factors I just described have returned just under 20 mid-cap companies. Here are the top five.

Not surprisingly for anyone who watches market trends, three companies on the list are biotechs.

With major strides being made in areas falling under the umbrella of “personalized medicine” — biotech stocks have been fertile ground for us over at Fast-Track Millionaire. In fact, I’ve gone as far as saying that it could be the most important (and profitable) trend of our lifetime.

A biotechnology company that survives into mid-cap territory is already a promising company, with at least some revenue sources and late-stage or marketed products. (For more biotech-related ideas, see this recent piece.)

Let’s take a look at the three mid-cap biotechs that combine fast growth, good liquidity and strong profit outlook.

3 Biotech Standouts

Founded in 1994 and a member of the S&P 400 Mid-Cap Index since last summer, Exelixis (Nasdaq: EXEL) has already brought three cancer therapies (Cabometyx and Cometriq for thyroid and kidney cancer, and Cotellic, approved for treating melanoma in combination with older drug vemurafenib) to the market.

#-ad_banner-#For these therapies, which are thought to work by helping to block some cancer-growth signals, EXEL has partnered with large pharmaceutical companies to make sure its products are properly marketed. It’s no wonder then, that EXEL has been growing revenues at nearly 100% per year for the last five years.

It’s also the strongest company on this list when it comes to expectations. It’s profitable and is expected to make $1.02 per share in 2019. With a better than 40% long-term future profit growth expected, this is definitely a stock to watch.

Neurocrine Biosciences (Nasdaq: NBIX) is also quite appealing. It, too, already has a few approved products on the market. Unlike EXEL, though, NBIX’s products are for treating neurological and endocrine-related disorders.

NBIX’s Ingrezza is the first FDA-approved product indicated for the treatment of adults with tardive dyskinesia, an involuntary movement disorder, and oral medication Orilissa (sold by AbbVie as part of a collaboration to develop and commercialize this product) is approved for the management of endometriosis with associated moderate to severe pain.

While NBIX is likely to lose money this year ($0.17 per share loss is anticipated), it is expected to jump to profitability by as much as $2.99 per share in 2020. This is another company that deserves to be on any biotech watch list.

Ionis (Nasdaq: IONS) is a biotech that has already turned profitable. In 2019, it is expected to earn $0.38 per share, and $1.40 a year after. This is all because IONS, just like the other two biotechs on this list, has already been successful in bringing its medicines to the market.

Formerly known as Isis Pharmaceuticals, Ionis specializes in researching so-called antisense medicines (antisense is a type of RNA) utilized for treatment of genetic disorders and infections. While it’s the slowest revenue-growth biotech among the three on today’s list, Ionis is also a stock to watch here.

Action To Take

We’ll save Yelp and Penumbra for another day, but they are certainly worthy of further research. In fact, all five companies on this list deserve further attention and more strenuous research before they can make it into the Fast-Track Millionaire portfolio.

But don’t be surprised if that happens to one or more of these in the near future.

P.S. A revolution is happening in the world of advanced medicine — and faster than you know. Genetic editing, along with a host of other exciting developments, could lead to a colossal jump in our lifespans, while survival rates soar for dozens of diseases. There are a few little-known companies working in this area that stand to deliver massive returns for investors. To learn more about them, go here now.