Strange Times… Inflation Bad News/Good News… And Our Expert Says Facebook Is A ‘Buy’

What strange times we live in…

My wife and I were in Destin, Florida this weekend. We met up with some friends, who were taking their first vacation away after having their first baby earlier this year.

On Saturday at the beach, I checked my phone and saw that a few flights were getting cancelled in Jacksonville. Thinking maybe we’d be fine, I looked up our flight for the next day and it said “on time”.

I should have known better.

As you probably know, Southwest Airlines cancelled thousands of flights over the weekend. The company blamed weather and staffing issues. And even though we were flying American Airlines, we got caught up in the mess, too.

Our flight was rebooked for Tuesday. “Unbelievable,” I thought. On Sunday, after spending four and a half hours on hold before speaking to someone, only to be told there was no chance of getting an earlier flight (Monday flights were unavailable), we decided to throw a Hail Mary… by trying to rent a car in the middle of a national rental car shortage and drive back.

After calling every company in town, we finally had some luck. One said they only had four cars available. I think those must have been the only four rental cars available in northern Florida.

After making the 13-hour drive back home on Monday, I thought about another incredible anecdote from our trip… Every restaurant we went to was short-staffed. One lady we talked to who was serving us pointed to a man working back in the kitchen. “That’s the owner,” she said.

Strange times, indeed.

I don’t bring this up to complain about our trip. We had a fantastic time. Instead, I simply want to highlight the real-world effects of this place we find ourselves in… Covid still lingering around, the economy fighting to recover, inflation, labor shortages, supply chain disruptions, etc.

I’m sure you’ve experienced your fair share of stories like this, too. If so, be sure to drop me a line and tell me about it.

Bad News/Good News: Prices Rise At A Record Pace, Retirees Get A Pay Raise

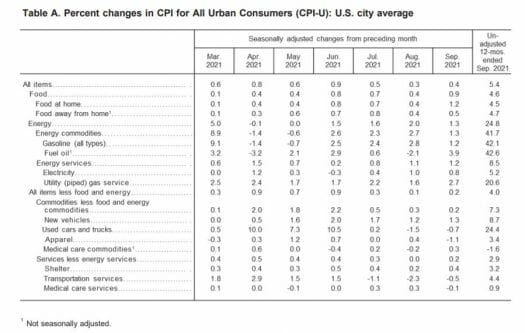

This morning, the Bureau of Labor Statistics reported that the Consumer Price Index (CPI) for all items rose by 0.4% in September, compared to the 0.3% expected.

Compared to a year ago, prices are 5.3% higher – the highest rate of increase since January 1991.

As you can probably guess, there are a few “problem” areas that are contributing to rising prices. I’m including a screenshot of the breakdown, so you can see the impact that things like food, energy, and used cars are having on the overall CPI:

Source: Bureau of Labor Statistics

Here’s more from CNBC:

Gasoline prices rose another 1.2% for the month, bringing the annual increase to 42.1%. Fuel oil shot up 3.9%, for a 42.6% year over year surge.

Food prices also showed notable gains for the month, with food at home rising 1.2%. Meat prices rose 3.3% just in September and increased 12.6% year over year.

“Food and energy are more variable, but that’s where the problem is,” said Bob Doll, chief investment officer at Crossmark Global Investments. “Hopefully, we start solving our supply shortage problem. But when the dust settles, inflation is not going back to zero to 2 [percent] where it was for the last decade.”

Used car prices, which have been at the center of much of the inflation pressures in recent months, fell 0.7% for the month, pulling the 12-month increase down to 24.4%. However, the continued rise in prices even with the drop in vehicle costs could lend credence to the notion that inflation is more persistent than policymakers think.

So no, you’re not imagining this. Inflation is here, and it’s bearing out in the numbers – even of those numbers are uneven. Experts and policymakers alike are beginning to acknowledge it.

Heck, even Uncle Sam is giving the biggest COLA adjustment to Social Security in 39 years to retirees.

As the Associated Press reports:

Millions of retirees on Social Security will get a 5.9% boost in benefits for 2022. The biggest cost-of-living adjustment in 39 years follows a burst in inflation as the economy struggles to shake off the drag of the coronavirus pandemic.

The COLA, as it’s commonly called, amounts to an added $92 a month for the average retired worker, according to estimates Wednesday from the Social Security Administration. It’s an abrupt break from a long lull in inflation that saw cost-of-living adjustments averaging just 1.65% a year over the past 10 years.

As I mentioned a couple of weeks ago, my colleague Nathan Slaughter called it. For months, he’s been saying that the inflationary signs we’ve been seeing are more than “transitory”. He also correctly forecasted that shipping companies would see record demand (and charter rates) once the world opened for business.

And as good of news as more money for retirees is, as Nathan always points out to his readers, you’re going to need more. With this latest increase, average Social Security payment for a retiree will be $1,657 a month, starting next year. For a couple, it’ll come out to about $2,753 per month.

For most of us, that’s not going to cut it. That’s why Nathan has put together a special report, full of “bulletproof” dividend payers that can be relied on in any market, year after year.

These securities have a well-documented history of rewarding investors with higher payouts every year. And thanks to that, you’ll worry less about inflation, Social Security, or the day-to-day volatility of the market. Go here now to learn more.

Editor’s Note: To close out today’s issue, you may remember recently when I discussed the latest controversy surrounding Facebook (Nasdaq: FB).

My take was simple… I said that despite any reservations you may have about the company, this is likely to be a good buying opportunity for investors. I also mentioned that my colleague Jimmy Butts was updating his Top Stock Advisor premium subscribers on the situation as we went to press.

So today, I thought it might be worthwhile to hear from the man himself. As a reminder, Jimmy and his premium readers have held FB through thick and thin since mid-2016. And as a result, they’ve crushed the market. Here’s Jimmy with more…

Facebook In The Spotlight Again: Is It A Buy?

Facebook (Nasdaq: FB) is back in the spotlight, and it isn’t pretty.

Facebook (Nasdaq: FB) is back in the spotlight, and it isn’t pretty.

An investigative piece by The Wall Street Journal dubbed The Facebook Files, revealed some deep flaws in the social-media giant and its subsidiaries, namely the photo-sharing app Instagram.

The Facebook whistle-blower who leaked the documents to the Wall Street Journal was revealed. Her name is Frances Haugen, and she was a product manager on Facebook’s Civic Integrity team, and her interview on 60 Minutes is worth the watch.

Oh, and to let’s not forget that Facebook management is once again being grilled by Congress.

Shares of Facebook have fallen double digits over the last month.

Despite all this terrible news and all the faults of Facebook’s business practices (which I don’t condone), I still rate the stock as a “Buy.”

Facebook is a bit of a contradictory investment for me personally…

You see, I don’t personally have a Facebook account, and quite honestly a lot of the stuff that has come out about the business isn’t surprising at all. Society would probably be better off, and healthier, if Facebook didn’t exist at all, in my opinion.

But it does exist. And it happens to be a wonderfully dominant business that makes a bundle of money and has been a great investment for us since I originally recommended it back in June 2016 — up 181% since then, compared with the S&P 500’s 107% return.

Action To Take

Facebook is an advertising juggernaut, with various other subsidiaries that could eventually develop into big money makers (like virtual reality).

Its platform is relied upon by businesses of all sizes, but is especially important to smaller businesses that don’t have large marketing budgets.

Legendary investor Bill Miller once said, “If it’s in the headlines, it’s in the stock price.” Regardless of the headlines, Facebook will continue to rake in advertising dollars and remains a “Buy” at these prices.

P.S. While Jimmy likes Facebook at these prices, he recently found a “game-changing” opportunity he likes even better…

If you haven’t heard of Starlink yet, get ready. It’s the latest brainchild of billionaire entrepreneur Elon Musk… And after extensive beta testing, it’s about to go “live” soon.

And even though Starlink is “off limits” to regular investors, we’ve uncovered a “silent partner” that gets you in on the ground floor… lightyears ahead of other investors. Go here now to see how you can get in on the action.