Omicron Fears (And The Fed) Weigh On Markets… Plus: The Easiest Way To Build Wealth Over Time

Well, the market didn’t give us too much time to digest our Thanksgiving turkey, did it?

On Friday, traders awoke to news that a new variant of Covid, dubbed Omicron, was detected in South Africa and had already spread to several other countries.

That was enough to spook traders, sending the major averages lower by roughly 2%. On Monday, it looked as if much of that lost ground would be recovered. But on Tuesday, those worries mounted as Omicron was detected in more countries. The S&P 500 closed down another 1.9% yesterday.

As a host of countries began to initiate new travel restrictions, we also heard a series of mixed messages around the nature of the variant. There are early indications that this variant may produce cases that are considered “mild to moderate,” but it’s still premature to say for certain.

Adding to the concerns, Fed Chair Jerome Powell spoke to Congress and gave some important cues to the central bank’s thinking on inflation and future interest rate hikes. In the biggest signal of all, Powell said that the Fed will no longer use that dreaded T-word that tends to make my eyes roll into the back of my head.

As Yahoo Finance reports:

“We tend to use [the word transitory] to mean that it won’t leave a permanent mark in the form of higher inflation,” Fed Chairman Jerome Powell told Congress on Tuesday. “I think it’s probably a good time to retire that word and try to explain more clearly what we mean.”

Translation: Okay guys, it looks like inflation might stick around longer than we thought. My bad.

Remember, the Consumer Price Index soared 6.2% year-over-year in October. That’s the highest rate we’ve seen since 1990.

As a result, the Fed may accelerate the pace of tapering, leading to the end of its asset purchases a few months earlier than anticipated.

Powell stated that inflation may last into mid-2022, but that his top priority is to “ensure higher inflation doesn’t become entrenched.”

Translation: While there was always the possibility of a rate hike sometime next year (likely late 2022), there is now an increased likelihood for two rate hikes next year.

Source: CME Group

We’ll keep an eye on Omicron as well as the inflation/Fed issue as they unfold. One interesting thing to note is that Oil prices have just taken a 20% haircut in just a few short days. If Omicron fears are overblown (as my colleague Nathan Slaughter and I both suspect), then it could prove to be a great entry point for investors who missed out on the incredible rally in energy stocks over the past year.

Coincidentally, Nathan has just released a brand new report, where he predicts a major wave of M&A deals in the energy sector, leading to a massive windfall for investors. You can get more details here.

In the meantime, it always helps to take a step back and focus on the big picture whenever a fresh wave of volatility hit the market. So for the remainder of today’s issue, I’m going to leave you with this excellent piece from Nathan, in which he explains the incredibly simple power of investing for income with a long-term mindset. Enjoy…

The Single Best (And Easiest) Way To Build Wealth Over Time

In all of my years in the market, it’s the most lucrative investing strategy I’ve ever found. It won’t make you rich overnight, but I’m convinced that anyone can earn a significant amount of money by investing this way.

In all of my years in the market, it’s the most lucrative investing strategy I’ve ever found. It won’t make you rich overnight, but I’m convinced that anyone can earn a significant amount of money by investing this way.

Today, investors have a ton of options when it comes to investing their hard-earned money. From high-growth tech names to sophisticated options strategies to algorithmically-designed funds, the choices are endless.

There’s nothing wrong with any of these, necessarily. It’s just that you just can’t beat the simplicity of owning a basket of high-quality dividend payers.

If you’re a regular reader, then you know I’ve shared the details behind the strategy we use over at High-Yield Investing before.

But allow me to explain just how powerful it can be…

Consider your typical income portfolio. It holds a position in a few dividend payers and maybe a fund or two. You get paid occasional dividends, that’s for sure. But because you only hold a few positions that pay quarterly dividends, the income you receive is inconsistent.

That’s where our High-Yield Investing strategy is a little different. The goal, for most of our subscribers, is to build a high and steady stream of income. And if you were so inclined, you could even build out a portfolio that pays a dividend for every month of the year.

Some of my subscribers do just that. And that total will grow with each passing year thanks to the power of reinvestment…

At the same time, I’m generating yields of 6%, 8%, and even 10%… at a time when interest rates — which fuel the yields on most “normal” income investments — are close to the lowest they’ve ever been in history.

There’s a major caveat, though. And it’s one that will cause most investors to never take the first step to start their own income-driven portfolio. Most investors don’t have the most important characteristic that allows you to earn the greatest amount of wealth with this strategy — patience.

Use Time And Patience To Grow Your Wealth

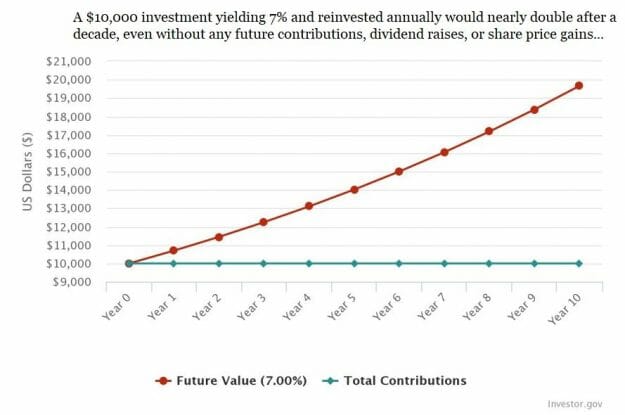

Take a $10,000 investment. In a portfolio that earns an average yield of 7%, that amount would earn $700 in dividend income during the year. I wouldn’t sneeze at $700, but it’s just a fraction of what you could earn if you simply let your portfolio pay you year after year.

The table below shows exactly what I mean. It shows how much you’d earn… if you have patience. As you can see, even modest amounts can generate substantial dividends over time.

Your $10,000 investment would earn a staggering $7,000 in dividends in a decade. And that amount is before any capital gains and ignores any dividend increases.

But it gets even better. Many of my subscribers use dividend reinvestment — a criminally underrated, yet powerful way to increase your long-term returns.

Just take a look at what dividend reinvestment can do to that $10,000 in just a decade.

Action To Take

I want to make something clear… this isn’t a “get-rich-quick” scheme. You aren’t going to invest a few thousand dollars and be buying expensive sports cars or going on exotic vacations. At least, not yet…

But I think that’s part of what makes this style of investing so powerful. It’s not overly complicated – anyone can do it.

Now, are you going to be able to find a 7% yield in this market? Well, it depends. Sure, the average S&P 500 stock yields less than 2% — but, trust me, the high yields are out there if you know where to look…

Besides, most of our readers have more than $10,000 to work with — and this example is purely hypothetical. It doesn’t take into account price gains, dividend raises, or any additional investment.

The point is, if you want to become wealthy in the stock market, it’s probably not going to happen overnight. The key is finding stocks that will pay you consistent dividends… and having the patience to let them grow your wealth over the long-term.

Truth be told, there’s a lot more to share about what we do over at High-Yield Investing. My team and I have built a solid portfolio full of market-beating yields that can be used for investors of all portfolio sizes and stages of life. But with a little patience (and dividend reinvestment), you could be on your way to earning tens of thousands in dividends a year.

Go here to learn more about our top picks and how to get started.