The Easy Way To Multiply Income That Most People Don’t Even Know About…

I can’t believe more people don’t take advantage of this…

For the past few years, my colleague Robert Rapier and his followers have been “multiplying” the dividends they earn from some of the most well-known stocks on Wall Street.

If you simply look these stocks up on Yahoo Finance or another website, you’re unlikely to see these dividends published on the main screen. But rest assured, it’s all perfectly legal. In fact, it’s one of the safest methods of earning extra income to be found in any market environment.

All you need to do is be willing to learn a new strategy. After that, it’s simply a matter of logging back in to your brokerage and repeating a similar trade every few months to earn this extra income.

When it comes to income, most investors think dividends are the only game in town. But you can routinely “multiply” those dividends and earn extra income from some of the most well-known companies on the planet. In fact, under the right conditions, it’s possible to earn five, 10, even 18x more income than dividends alone.

The best part thing about this is that there’s nothing complicated about it. To collect, you don’t have to monitor your brokerage statement daily. Nor do you need a million-dollar bank account and access to a high-powered money manager.

This Strategy “Multiplies” Dividends

I’m talking about selling covered calls.

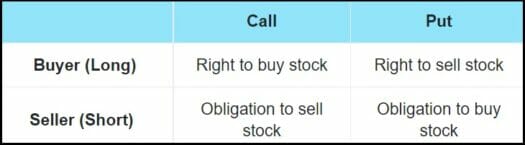

A covered call strategy involves selling call options on stocks that you already own. In exchange for selling the options, you receive upfront payments known as premiums. These premiums can range from a few hundred dollars to thousands of dollars, depending on the size of your investment.

In exchange for paying the premium, the buyer now has the option to buy that stock from you for a specific price, known as the strike price. If the stock is trading above the option’s strike price, you’ll be required to sell those shares to the option buyer. If the stock is trading below the option’s strike price, then the option expires worthless and you keep the premium with no further action required on your part.

Think about that for second… I don’t know anyone who buys a stock without wanting to sell it eventually. Even long-term growth investors usually have a price target for most of their underlying holdings.

So why not get paid while you wait for your stocks to get there?

That’s essentially what covered calls allow you to do. By selling covered calls, you’re generating a consistent income stream while waiting for your stock holdings to appreciate in value.

Since you already own the stock you’re writing the options on, and you’re willing to sell those stocks when they reach your target price, employing this strategy adds zero additional downside risk…

But at this point you’re probably wondering: What if the stock declines in value?

In that scenario, selling covered calls can only help you. Remember, to sell covered calls, you have to actually own the stock you’re writing the option on. So regardless of whether you use this strategy, your portfolio is still going to take a hit from the declining share price. But the beauty of covered calls is that they let you offset some of the damage. That’s because for every premium you receive, you essentially lower your cost basis in that investment.

To see how it works, consider how this could work with International Business Machines (NYSE: IBM).

Scenario 1: Earn 9.8% From IBM In A Year

Remember, there’s nothing particularly special about IBM in this case. In fact, you could say that “big blue” has become a bit boring these days. But that can be a good thing. If you’re already an owner of the stock, you can use that to your advantage by selling covered calls on the stock.

Just how much you receive depends on both the length of the contract (how long until the option expires) and the value of the strike price.

For example, right now, IBM is trading at about $138. You could sell the August $145 calls on IBM for about $1.75 a share. Since each contract controls 100 shares, one contract would generate a premium of $175. This is income paid upfront, and it is yours to keep no matter what.

As long as IBM doesn’t trade above $145 by August 18th (the day the option expires), you can keep your shares and the premium you collected as pure profit.

| Cost: | $138 ($13,800 per 100 shares) |

| Premium: | $1.75 ($175 per contract) |

| Return On Investment: | 1.2% |

| Expiration Date: | August 18, 2023 |

| Days In Trade: | 64 |

Now a little over 1% may not sound like much, but here’s where things get really interesting… Since this trade lasts roughly two months, you could repeat this process up to six times over the course of a single year. But let’s say you did it four times to be conservative. Assuming you are able to get that same $1.75 premium every time you sell a call, you would essentially lower your cost basis by $7 ($1.75 x 4) for each share of IBM you own.

Said another way, you’re collecting about 5% in annual income from IBM. And that’s before even considering IBM’s dividend, which is about 4.8%.

Can you see the math playing out here?

By just selling six contracts a year on IBM, you could end up earning 9.8% — from a stock that only pays 4.8%.

Granted, you may not end up making that many trades throughout the course of a year. And the premiums may end up being more or less, depending on market conditions. But it’s entirely achievable.

Scenario 2: Earn 7% In 64 Days (Or Less…)

On the other hand, let’s say shares hit $145 by the time August 18th rolls around In that scenario, all you have to do is sell your shares for a profit. The $1.75 premium is still yours to keep. As a bonus, the stock should pay a dividend during this time frame — meaning you will be entitled the $1.65 quarterly dividend, assuming the stock stays below $145 before the ex-dividend date.

A little napkin math tells us that’s $3.40 per share in income (or $340 total for 100 shares). Depending on where you get in, that should lower your cost basis to $134.60 ($138-$3.40). That means if the stock hits $145 and we are forced to sell, we will make a 7% profit in 64 days. That’s a great return in any market — especially this one.

| Strike Price: | $145 |

| Cost Basis (Entry): | $134.60 ($138 – $1.75 premium – $1.65 dividend payment) |

| Return On Cost Basis: | 7% |

| Days In Trade: | 54 |

Bringing It All Together

In either scenario, you come out on top.

It’s easy to see how you can dramatically multiply your income with this strategy. All you need is at least one stock you’re willing to potentially sell at a profit if it jumps higher.

That’s why we think more investors need to know about this strategy. And that’s where my colleague Robert Rapier comes in…

Robert has been using simple strategies like this for years to generate reliable income in any market. And his latest report shows how you can squeeze up to 18x more income out of dividend stocks… with just a few minutes of “work” each week.