Weighing In On Student Loans… Advice For Beginning Investors… Why You Should Care About Dividends (And More)

I recently opened a 529 account for our newborn daughter. Having attended a private university, I’m all too aware that it can be expensive to get a diploma – even if it was 15 years ago. So we better get started now…

When I looked up the sticker price for my alma mater out of curiosity, I couldn’t help by shake my head in disbelief. It’s now about $49,000 a year. Incredible.

Last Wednesday, President Joe Biden announced plans to forgive up to $10,000 in federal student loan debt for most borrowers. Low-income Americans may be eligible for an additional $10,000 in loan forgiveness.

It is estimated that about 43 million Americans carry student loan debt, though the majority owe less than $25,000. Eligibility will be limited to borrowers earning less than $125,000 a year (or $250,000 for couples).

According to an analysis from the Penn Wharton School of Business, the controversial plan is expected to cost at least $500 billion in year one.

I was fortunate to graduate with a relatively small debt burden. And you can be sure I’ll be doing everything in my power to ensure the same, or better, for my kid when the time comes to go off to college.

I bring this up because my colleague Nathan Slaughter recently weighed in on this issue, which led to a discussion about advice for investors who are just starting out. Our exchange is below, and my questions are in bold.

Nathan, I mentioned in my intro the big news about President Biden’s student loan forgiveness plan. What do you make of it?

Yeah, as the parent of a college sophomore, I’m keenly aware of the situation with college tuition costs.

Yeah, as the parent of a college sophomore, I’m keenly aware of the situation with college tuition costs.

Unfortunately, we aren’t eligible for much in the way of federal aid. Uncle Sam barely lets us borrow enough for textbooks. So the only resort to bridge the gap is private loans from an outfit like Ascent or College Ave.

There are currently about $140 billion in private student loans outstanding. While nowhere near the scale of $1.6 trillion in federal loans, this is still a colossal amount of money. And it’s growing faster than the U.S. auto loan or credit card markets.

And here’s the thing: it doesn’t apply to private student loans. They are excluded. So private borrowers are understandably feeling a little miffed, particularly anyone who recently refinanced from a public loan. They are now on the hook for $10,000 that could have just been canceled.

The average borrower has racked up $37,000 in student loan debt. Many owe $50,000 or more. And this is the final time the pause button will be hit. The moratorium will be lifted in a few months and will be business as usual.

I don’t want to wade into a political discussion other than to say that this $500 billion handout won’t address the root problem, regardless of your stance on loan forgiveness. It may make it worse. College tuition has been spiraling at more than four times the pace of inflation for the past fifty years.

What would be your advice to someone, whether they’re a recent graduate or someone just getting a late start?

Do your own due diligence. Don’t buy any company you don’t thoroughly understand. In the course of your research, make sure you clearly understand how a company makes money and whether the economic environment seems favorable for the stock to perform well. This may sound obvious, but you’d be surprised how many people don’t even check a security’s home page or read through the latest press releases and earnings reports.

Next, go slowly. Experiment with small amounts of capital first, and be prepared to learn by trial and error. Investing is a life-long learning process — sometimes you’ll be successful; sometimes, your investments may not work out as expected.

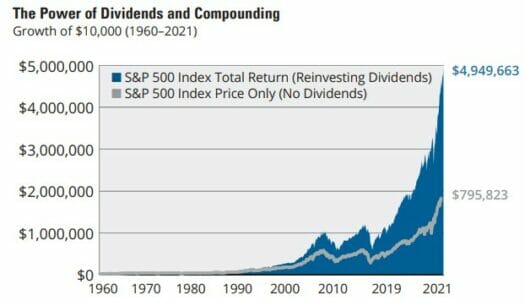

Take advantage of the magic of compounding by enrolling your investments into Dividend Reinvestment Plans (DRIPs). There’s no sounder way to grow wealth over the long term than to systematically invest in high-quality stocks and funds, hold on for the long haul, and reinvest your dividends. By plowing your dividends back into more shares, you harness the miraculous power of compounding. The beauty of compounding is that any little smidgen of money you can put to work now — no matter how small — can have an extraordinary effect on your wealth down the road.

Why don’t individual investors seem to care as much about income payers as so-called “growth” stocks?

Maybe it’s because the growth stories get the front page — not the stodgy dividend payers. But what’s lost in the shuffle is that dividends are a sign of financial strength, of a real business making real profits.

Conventional wisdom says that if you take on more risk, you’re repaid with more reward. Yet that’s not always true.

In fact, according to S&P Global Research, dividends have been responsible for 32% of the total return of the S&P 500 Since 1926. And according to Hartford Funds, 84% of the total return going back to 1960 came from reinvested dividends and the power of compounding.

Source: Hartford Funds

The odds are so kind that it’s hard not to come out ahead when you invest this way. I am constantly amazed that more investors don’t help themselves to this delicious free lunch.

One of the most common questions we get is about calculating dividend yields. Why is this sometimes trickier than it seems?

Dividend yields can be calculated in a number of different ways. Depending on how they are calculated, various websites may show different yields for the exact same security.

When payments vary greatly, the most reasonable calculation involves taking the last 12 months of dividend payouts (trailing twelve months or TTM) and dividing that figure by the firm’s current share price. This is called a trailing yield.

For example, let’s assume Company XYZ’s current share price is $50. Let’s also assume the firm has made the following dividend payments over the past year:

March — $0.50 per share

June — $0.50 per share

September — $0.50 per share

December — $1.00 per share

As you can see, Company XYZ has paid $2.50 per share in total dividends over the past twelve months. So in this example, XYZ sports a trailing dividend yield of 5% (calculated by taking the $2.50 in actual trailing dividend payments and dividing that figure by a $50 share price).

But it’s important to remember that this is just one way of calculating yields.

Unlike a trailing yield, a forward yield projects dividend payments over the next 12 months and is best used when these payments can be predicted with reasonable accuracy. The forward yield takes the stock’s latest declared dividend payment and annualizes it over the next 12 months.

In our example, Company XYZ’s most recent dividend payment was $1.00 per share. Assuming the firm’s quarterly dividend payout remains at this new level, the firm will deliver total dividend payments of $4.00 per share in the coming year. Therefore, Company XYZ’s forward yield is 8% (calculated by taking the $4.00 in projected future dividend payments and dividing that figure by a $50 share price).

This forward yield of 8% is very different from the trailing yield of 5% shown above. Both are correct, but they’re simply calculated differently.

In High-Yield Investing, we generally use trailing yields when possible. They represent concrete dividend payments that a firm has already made. But to make matters even more complex, if a company makes a “special” one-time dividend payment, this may or may not be reflected in the yield you see on a financial website.

When possible, it’s best to go directly to the source. Most companies list their historical distributions on their website, and declared distributions can usually be found in their press releases. We generally use this data, which comes directly from each respective company, to calculate the yields we present.

P.S. Want to know the only thing better than a dividend payout hitting your account every quarter? How about a dividend every month…

If you’re tired of waiting around for your income, I encourage you to check out my latest report. It reveals 12 simple stocks that pay out every month. There’s no day trading involved, no crypto, no fancy options plays… Just simply put these 12 securities in your portfolio and watch the money roll in. Go here now to learn more.