In A Gloomy Market, Here’s A Reminder That Big Gains Are Possible…

Last month, the Fed continued to crank up interest rates another 75 basis points. The fed funds rate now sits in a range of 3% to 3.25%. And with inflation not abating as quickly as they’d like, we should expect more rate increases at their November and December meetings. Fed officials project short-term rates will rise to 4.25% by year-end.

Last month, the Fed continued to crank up interest rates another 75 basis points. The fed funds rate now sits in a range of 3% to 3.25%. And with inflation not abating as quickly as they’d like, we should expect more rate increases at their November and December meetings. Fed officials project short-term rates will rise to 4.25% by year-end.

In September, the Fed also doubled its quantitative tightening (QT) balance sheet reduction program to $95 billion a month ($60 billion of Treasuries and $35 billion of mortgage-backed securities).

As I’ve repeatedly warned, the Fed’s QT would impact markets more than interest rates. Although interest rates will steal all the headlines.

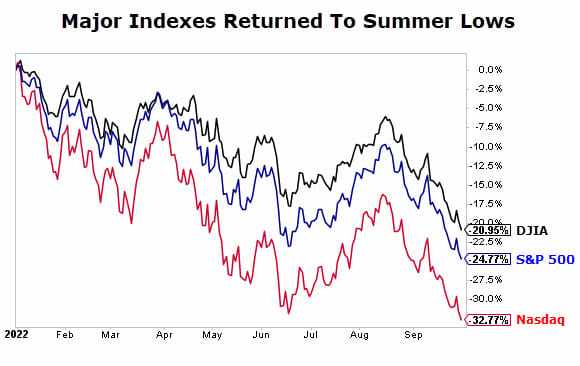

Sure enough, the major indexes all revisited their June lows last month. At the end of the third quarter, the S&P 500 index was down 25% year-to-date, the Dow Jones Industrial Average had lost 21%, and the tech-heavy Nasdaq had lost nearly one-third (32%) of its value.

The CPI print in August was up 8.3% year-over-year, with some areas such as “Food at Home” still accelerating (up 13.5% year-over-year — the fastest pace since March 1979). In August, the Fed’s preferred inflation gauge, the PCE index (which excludes food and energy prices), rose to 4.9% from 4.7% in July.

Clearly, the Fed still has a long and hard battle to fight inflation. Consumers are definitely feeling the pinch. Paychecks aren’t keeping up with higher prices. More and more people are putting everyday purchases on credit cards. Many folks are taking on part-time work just to make ends meet. The personal savings rate has fallen to a low last seen in August 2008…

I’ve already touched on some of these things recently. And I hate to paint such a daunting picture of the economy. And the markets aren’t making it any easier on the psyche, as people have seen their retirement accounts and brokerage accounts shrivel.

Bottom line, it isn’t pretty out there. There’s no denying it. But the good news is it won’t always be like this. We just have to keep our heads down and push through the storm. There will be some incredible opportunities on the other side of this.

All It Takes Is One Game-Changer…

Sometimes, all it takes is one big deal to change everything.

When I was managing money, I vividly remember when I won my first big account. (Big to me, anyway.) The account had just north of $750,000 in it. But that was just the “trial” amount. The client had millions more waiting to be deployed if I did well.

That first three-quarters of a million dollars allowed me to get my foot in the door. Having someone trust me with nearly a million (and then, more) of their capital also made it easier to accumulate more assets under management. People are more willing to trust you if others trust you with their money.

It was a game-changer.

If you work in sales or know anyone that does, I’m sure you’ve heard similar stories. That first big account can make or break your year or career. The same thing rings true for companies. Especially small ones looking to get their product out there. After all, it’s a big risk for a large corporation to decide to roll with a new smaller supplier (even if the product is superior).

There are a lot of questions that need to be answered. Does their product provide such a drastic improvement over what we currently use that it’s worth taking the risk? Can this new unknown company keep up with demand?

Overcoming these roadblocks is not easy. It requires a ton of work, patience, perseverance, and of course, luck.

But if it happens, a company can go from zero to hero seemingly overnight.

How This Creates Game-Changers In The Market

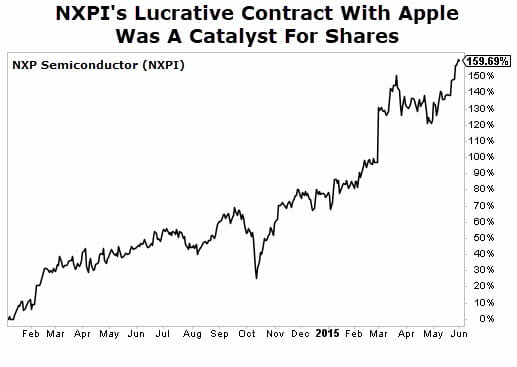

To show you the kind of effect this can have on stocks, let’s take a look at NXP Semiconductor (Nasdaq: NXPI).

About eight years ago, our team here at StreetAuthority identified this little-known semiconductor company as a potential winner to supply chips for Apple’s iPhones. This was when contactless payments were just entering the market, and NXPI had the near-field communication chips to make this a reality.

But again, the company was relatively unknown. Based out of the Netherlands, it had a market capitalization of less than $10 billion.

NXPI was fortunate enough to become one of Apple’s key suppliers, and boy did it make a difference for this little-known company. One year after we released our research report, shares soared over 160% the following year. It is now a $40-billion-plus company.

Not only was landing a big account (Apple) an immediate boost in sales, it also paved the way for NXPI to quickly add other large companies as customers. After all, if Apple was willing to trust NXPI, then why shouldn’t others?

Of course, the caveat is that it’s hard to pinpoint exactly which small company will turn into the next NXPI, the next Apple, or the next Amazon. But that’s exactly what we do over at Capital Wealth Letter with our “Game-Changer” picks.

This month, I’ve found a Game-Changer that shows a lot of promise (and similarities to NXPI). It operates in the booming lithium-ion battery space, a market that is on a tear thanks to a confluence of technologies that require not only smaller batteries that last longer, but also large ones that can power vehicles.

According to Grandview Research, the global lithium-ion battery market was valued at roughly $42 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 18.1% from 2022 to 2030, reaching more than $182 billion.

Longtime readers might recall that we’ve invested in this space previously through lithium miner Albermarle (NYSE: ALB). I recommended that stock in my November 2019 issue. We ended up booking a triple-digit gain on that investment in just one year.

Closing Thoughts

I bring all of this up for a few reasons. First, I want to acknowledge that I know it’s tough out there. Second, amid all of the gloominess in the market right now, I want to hopefully offer you a glimpse at what is possible when you take a shot and invest in “Game-Changers” like the ones I described above.

While there are no guarantees, I believe our most recent lithium recommendation could easily match the gain we made on Albemarle. And when the time is right, there will be plenty more opportunities to make gains like this (and more) in the future.

So stash away that cash and get ready.

In the meantime, over at Capital Wealth Letter, I’m relatively satisfied with where we are at. Of course, there is always room for improvement, but our overall portfolio boasts some of the best companies out there. It should continue to outperform the broader market in the years to come.

By holding a group of quality long-term winners in our portfolio, we can afford to wait out the storm. And because of that, we can also afford to occasionally take a shot on a riskier, high-upside stock… like our new lithium play.

It won’t be the last time we do this, either. For example, last week I mentioned that my team and I are hard at work on our annual predictions report. As I said then, this is easily one of the most popular things we do — and more than a few of the picks should prove to be big-time, game-changing winners.

In the meantime, I’ve also been telling readers about my plan to profit from the new “billionaire space race”…

The commercialization of space is one of the biggest investment trends we’re likely to ever see in our lifetime… Musk… Bezos… Branson… each one of these billionaires plan to dominate the $2.5 trillion space industry. But according to our research, ONE may have already won the race, thanks to a new technology that’s hovering above the earth as we speak.

And the good news is that you and I can profit from it. Learn more about this incredible opportunity right now.