An Income Strategy To Try In 2023… Forget What You “Think” You Know… Covered Calls 101

We all know that income is hard to come by. Until five minutes ago, interest rates had been low for years, leaving investors with few options.

Thankfully, things have gotten better recently. (For example, I am getting offers for a high-yield savings account that pays 3.5% – not bad.) But if you really want to take your income-earning potential to the next level without taking on unnecessary risk, you’ve got to look beyond the usual suspects.

Luckily, there are several ways you can do this — if you’re willing to try.

Today, I’m going to tell you about one of the simplest and safest ways to earn more income from the market. All you have to do is be willing to learn something new. If this is new to you, then consider making it a personal resolution for the New Year to give it a shot.

Let’s dig in…

Forget What You Think You Know…

Most income-minded investors take a passive approach to their portfolios. They find a solid stock that pays a good dividend, buy it, and then wait for those dividends to roll in.

Nothing wrong with that. But if you want to take the reins and earn even more — we’re talking anywhere from three to 20 times more — then you need to consider covered calls.

Covered calls are one of the simplest options strategies out there. So don’t let the fact that we’re talking about options intimidate you. What you may have heard about options and what they actually are might be completely different.

Yes, there are a lot of aggressive strategies out there using options. But some options strategies aren’t anything close to what the average investor thinks. Some are geared more toward hedging and income generation. And the covered call strategy is one of them.

Covered Calls 101

Covered calls allow you to increase your income from a stock while protecting you on the downside. You still enjoy some upside in the stock, but the only catch is that your gains may be capped.

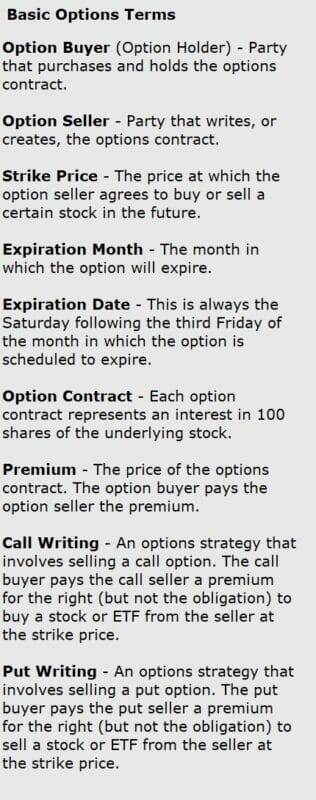

When you write a call option, you enter into a contract to sell the underlying shares to the option owner at the specified price (called the “strike price”) if the stock reaches this price. In return, you get a cash payment upfront from the option buyer (known as a “premium”). Depending on how many of these contracts you sell, the payments can easily be anywhere from a few hundred dollars to thousands of dollars.

A “covered” call is when you already own the underlying shares. This is much safer than what’s known as “naked” call writing — meaning you don’t own the underlying stock at the time.

For example, let’s say you own 100 shares of XYZ stock. It’s currently trading at $50 per share. You don’t think the stock price will rise significantly in the near future and want to generate some income from your position.

You could sell one call option at a strike price of $55 that expires in one month. By selling this option, you will receive a premium (the price of the option) from the buyer.

If the stock price remains at or below $55 at expiration, the option will expire worthless. This is a good thing because you will keep the premium as profit. This is why covered calls are regularly used as a hedging tool — it protects your position.

If the stock price rises above $55, the option will be exercised, and you will be required to sell your shares at $55. That can be a good thing, too, since it is higher than the current market price.

The only potential downside is that your gains could be limited. So if the stock soars to $65, you’re out of luck. You are only entitled to the difference between the strike price and the sale price (in this case, $5).

Closing Thoughts

As we always say, there are no free lunches when it comes to investing. But this is pretty close. With the sole exception scenario of a stock soaring, you’re better off with covered calls in every possible outcome. It’s as close as you’re going to get to a “win-win.”

Don’t be fooled by what you may have heard about options. A lot of people use options like a casino. But most of those people are buying options, not selling them.

And as my colleague Robert Rapier says, don’t gamble at the casino, be the casino.

This is just the beginning of what covered calls can do for you. And once you understand the power of this strategy, you may never go back to the same old “buy & hold” approach to dividends ever again. To learn more, I recommend you learn more from Robert right now.