12 Traits Of The World’s Greatest Businesses… (Before You Buy A Stock, Use This List…)

The importance of buying great businesses is something everyone knows. But few people actually execute on it…

The importance of buying great businesses is something everyone knows. But few people actually execute on it…

The truth is that, over time, you make the most money in the stock market by investing in the world’s greatest businesses. I know this sounds simple. But you’d be surprised at how many investors don’t follow this advice. And here’s why they don’t…

Investing in great businesses isn’t glamorous. It won’t make you an overnight millionaire. And it’s highly unlikely that you’ll wake up to see that one of your holdings leaped 20% overnight.

Great businesses often take time to play out. The key is letting their returns compound year after year, building wealth over a period of years or even decades. But most investors aren’t interested in that.

In today’s society, where folks are looking for instant gratification, they are more interested in gambling and making money as quickly as possible. Don’t get me wrong — I’m just as interested in making money as quickly as possible… but I also like stacking the odds in my favor.

Of course, you can’t just buy any stock, hold it for years or decades, and expect to come out ahead. You want to own quality businesses that reward shareholders year after year. You have to find the sort of companies that can be considered “the world’s greatest businesses.”

12 Traits Of The World’s Greatest Businesses

These traits should be familiar to longtime readers of my Capital Wealth Letter premium newsletter. But they’re so vital that I believe it’s worth taking a look at them again.

While I always point out that we don’t have a crystal ball, we can reasonably expect success with our investments by looking for these 12 characteristics — markers of the world’s greatest businesses.

1) The world’s greatest businesses sell their products at premium prices. This all comes down to brand loyalty. Apple (Nasdaq: AAPL) is a great example. Although cheaper alternatives exist, more people will pay a premium for one of Apple’s products. Thanks to the power of its brands, Apple has generated some of the greatest returns in stock market history. By contrast, companies that compete solely on price are constantly under pressure to keep prices (and profit margins) low; otherwise, they risk losing customers.

2) The world’s greatest businesses sell products used in day-to-day life. Products used in daily life — like toothpaste, food, and laundry detergent — are in constant demand. These daily purchases are also harder for a consumer to put off during bad times. This is why Proctor & Gamble (NYSE: PG) is a mainstay in many portfolios.

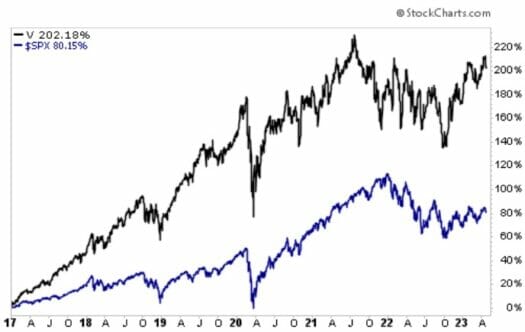

But this also can extend beyond consumer staples. For example, millions of consumers use credit or debit cards multiple times a day, leading to steady cash flow for companies such as Visa (NYSE: V). It’s no wonder then, that the stock has delivered returns of more than 200% for Capital Wealth Letter subscribers. Not only that, but it’s absolutely destroyed the broader market since adding it to the portfolio at the end of 2016.

3) The world’s greatest businesses have a global reach and appeal for their product. A product that only has appeal in a certain region or country doesn’t have the same type of long-term growth potential as a truly global product. The world’s greatest businesses sell products that consumers love universally across the globe. Think about Starbucks (Nasdaq: SBUX) and Nike (Nasdaq: NKE), for example. Both sell a product that’s loved not only in the United States but in countries around the world, including China, Japan, Germany, England, and more…

4) The world’s greatest businesses are highly scalable. A business should be able to quickly and easily grow. This means having low expansion costs and limited need for specialized or highly trained labor. This is why McDonald’s (NYSE: MCD) is so successful. It can staff a new restaurant and deliver the same consistency without specialized, highly-skilled cooks and servers.

The same goes for Starbucks, for that matter. In fact, you’ll notice that many of these stocks mentioned here have more than one of these traits.

5) The world’s greatest businesses sell things that consumers can’t live without. Basic necessities such as food, water, and utilities will always be in high demand. The same goes for many basic healthcare products and infrastructure assets like roads, bridges, railroads, and ports. And don’t forget, there’s another category of products that many consumers can’t live without — addictive substances like cigarettes, caffeine, or alcohol.

6) The world’s greatest businesses face little or no regulation. Government regulation increases costs and creates headaches for companies. Regulatory challenges take the focus away from a business’s day-to-day operations.

7) The world’s greatest businesses have unlimited growth potential. Great businesses have a well-defined path that will help them grow revenue and earnings for decades to come. Again, companies like Starbucks and Apple are great examples of this — even if the “best” days of growth are already behind them.

8) The world’s greatest businesses dominate their competition. This is one of the most important aspects of a great business. Unless a company dominates its niche or industry, I usually want nothing to do with it. A great example of this is search engine and advertising giant Google (Nasdaq: GOOGL). It more or less has a stranglehold in the online search market. You know you’re a dominant player when your company name becomes a verb, i.e. “just Google it.”

You can see how that’s worked out for us over at Capital Wealth Letter. Our position in GOOGL has more than doubled the S&P 500…

9) The world’s greatest businesses have clear competitive advantages that keep rivals at bay. Competitive advantages — or “economic moats” — come in a variety of forms, but it’s important that a great business have one or more major moats that keep competitors at bay.

That’s why I’m a big fan of master limited partnerships (MLPs). Another company can’t simply come along and build a pipeline next to another one. That means MLPs like Enterprise Products Partners (NYSE: EPD) don’t have to worry much about rivals eating into their business.

10) The world’s greatest businesses generate enormous cash flow with low capital spending requirements. Again, Visa is a prime example of a company that generates loads of free cash flow while spending relatively little on capital expenditures. It has historically only spent about 10% of its cash flow on capital expenditures, so nearly 90% of its cash flow can be delivered to shareholders.

11) The world’s greatest businesses return billions of dollars to investors in the form of dividends and buybacks. Dividends and share buybacks prove that a company places great importance on generating high returns for its investors. Not only do these actions help put money in your pocket, they also help to smooth out a stock’s volatility.

12) The world’s greatest businesses have extremely high profit margins, or at least margins that outpace their broader industries. The goal of any business is to generate a profit… but some companies do that better than others. The world’s greatest businesses are those that turn the greatest amount of their revenue into profit, which drives dividends, buybacks, and expansion opportunities — not to mention share prices.

Action To Take

I urge you to print this list. Put it next to your computer and refer to it before you buy any stock. There’s little doubt it will make you a better investor.

Granted, you won’t find a stock that meets all of these criteria. But any good long-term winner will likely have a few of these characteristics.

If you boil it all down, our ideal stock is a company that dominates its market, provides a product or service that is essential to daily life, and returns the bulk of its cash to shareholders in the form of dividends and share buybacks. When you can pick up these types of stocks at fair prices, you’re sure to reap the rewards over the long haul.

P.S. If you’re looking for a new pick that fits these traits, then I have good news for you…

I’ve been closely following a little-known satellite company that just paid a measly $26 million for a tech startup. And this tiny company was sitting on an absolute gold mine…

As it turns out, this startup owned exclusive global rights to a huge slice of satellite communication frequency channels. And this hidden asset could be worth up to $10 billion in the future.

To get a full briefing on this fascinating opportunity, go here now.