7 Do’s And Dont’s Of Successful Investing

There may never be a time like WWII again in modern history. You could spend a lifetime learning about the causes of the war, the grand tactics of generals, the exploits of individuals, and more. And even then, you’re liable to come across something new.

For example, I just recently learned about Major General Clarence L. Tinker. Born in 1887, in the Osage Nation, Oklahoma, Tinker was a child of mixed European and Osage heritage. He joined the U.S. Army in 1912, steadily rising through the ranks during WWI and the peacetime interlude. He began taking flying lessons and transferred to the new Army Air Service in 1922. Eventually, he was promoted to Brigadier General, and after Pearl Harbor, he was promoted to Major General. That made him the highest-ranking Native American officer in the U.S. Army at the time.

As Commander of the 7th Air Force, Tinker was responsible for defending the Hawaiian Islands. During the Battle of Midway on June 7, 1942, Tinker personally commanded a squadron of Liberator bombers when his plane lost control and plunged into the sea. His remains were never recovered. (Tragically, Tinker would posthumously lose a son over Europe in 1944.)

Tinker was the first Army general (and only the second U.S. flag officer) to be killed in battle at that point in the war. The Tinker Air Force Base in Oklahoma City, is named in his honor. And when the Osage community gathers for the annual I-Lon-schka, where songs and dances take place to honor ancestors and celebrate the tribe’s culture, it is said that the song for Tinker is the only one in which all Osage are required to stand.

With that, I’ll leave you with some light reading as we head into Memorial Day weekend.

Good Investing,

Brad Briggs

StreetAuthority Insider

7 Do’s And Dont’s Of Successful Investing

The world is full of dividend investors. And for good reason… Aside from putting cash in your pocket, countless academic studies have shown that dividend-paying stocks typically outperform non-payers over the long haul.

But that doesn’t mean you can invest in 10 or 20 of the highest yielders, sit back, and wait for the riches to roll in. If only it were that easy.

Sadly, many income investors struggle to preserve and build their portfolios, lagging behind the market and sometimes even absorbing costly losses that can delay retirement. Yet others are wildly successful.

How can similar assets lead to such divergent levels of success? Well, the answer isn’t necessarily where you invest, but how…

The most successful investors have made a habit out of practicing certain behaviors, while avoiding others. Over the years I, along with my research staff over at High-Yield Investing, have identified seven of these do’s and don’ts that have the most influence on long-term returns.

7 Do’s And Dont’s Of Successful Investing

1. Do Think Outside The Box

It’s not hard to stumble on to widely-held stocks like Wal-Mart (NYSE: WMT) or Exxon-Mobil (NYSE: XOM). They’re solid companies, no doubt, with decent dividend yields. But if you want to capture much bigger payouts, then you have to break away from the crowd.

Exxon-Mobil is a cornerstone of many income portfolios. But if you look a little deeper, you’ll find relatively unknown companies like Magellan Midstream Partners (NYSE: MMP).

MMP is a fraction of the size of Exxon-Mobil. Yet, the firm packs quite a punch in the yield department. It owns a network of energy pipelines and storage facilities that is absolutely essential to the nation’s energy infrastructure. The master-limited partnership’s fee-based income supports a 7.9% payout, five times the market average.

Oh, and over the haul it has absolutely trounced the sector (and the overall market). (We’re currently sitting on a 556% total return since adding it to our portfolio in 2005.)

The point is, if you limit your universe exclusively to popular blue-chip dividend payers, then you’re missing out. That’s why our High-Yield Investing portfolio is filled with income-producing master limited partnerships (MLPs), real estate investment trusts (REITs), and business development companies (BDCs).

These companies may not be household names, but they are solid businesses with far more generous payouts.

2. Don’t Get Blinded By Yield

If a yield seems too good to be true, then it probably is. More often than not, the high payout didn’t result from rising dividends, but because of a falling share price. And plunging stock prices usually indicate trouble. The company could be losing customers; it could be facing an industry slowdown; or it could be loaded down with crippling debt.

If a yield seems too good to be true, then it probably is. More often than not, the high payout didn’t result from rising dividends, but because of a falling share price. And plunging stock prices usually indicate trouble. The company could be losing customers; it could be facing an industry slowdown; or it could be loaded down with crippling debt.

On the bright side, the market could simply be overreacting to temporary issues that will resolve in time. Contrarian investors love these situations. But you can’t tell the difference without popping the hood and doing a more thorough inspection.

Successful investors don’t get lured by the headline yield without first evaluating cash flows, payout ratios, debt levels and other factors to determine sustainability of the distributions. Remember, dividends are never guaranteed — they can be cut or discontinued without a moment’s notice.

Bottom line: Better to invest in a stable business with a sustainable 6% yield than a cash-strapped one offering a dubious 12% that might be eliminated.

However, a safe dividend doesn’t mean the share price can’t tumble. A double-digit yield is of little consolation if the stock declines 30% or 40%. Total returns (dividends plus share price performance) are what matter most.

3. Don’t Overlook Dividend Growth Potential

Successful investors don’t just look at the dividends paid out last quarter, but rather at what they might receive over the next 10 or 20 quarters.

When choosing between portfolio candidates, you might run across two $20 stocks, one with a $0.50 per share annual dividend and the other paying $0.70, providing yields of 2.5% and 3.5%, respectively.

The first impulse is to automatically pick the higher upfront yield. But don’t be too hasty. The lower dividend might be growing far more rapidly. At a 10% annual growth rate, a dividend will double in just 7 years. So that $0.50 payout might easily grow to become $1.00 or more in the future.

Even better, that type of growth is usually accompanied by a rising share price as well.

4. Do Invest During Market Downturns

A wise man once observed that you make most of your money in bear markets — you just don’t realize it until later. When panic sets in, investors sell indiscriminately, even dumping the shares of unaffected companies that are still posting record profits.

We saw that happen with the Covid-19 selloff. When other investors panicked, we went on a shopping spree over at High-Yield Investing. And it paid off handsomely. When this happens, it can be a great opportunity to pick up undamaged merchandise at discounts of 20%, 30% or more. Quite often, these undervalued stocks are among the first to bounce when sentiment improves.

Until then, you can thank the market for these erratic mood swings. A widespread 20% decline means that stocks that used to yield 4% now pay 5%. On a $200,000 investment, that’s an extra $2,000 in your pocket over the next 12 months — and $10,000 over the next five years.

5. Do Reinvest Dividends

Unless you’re living off your dividend payments, you need to reinvest them.

By reinvesting, you purchase more shares, which throw off more dividends, which then buy more shares, which in turn generate more income… and so on. This is a great way to harness the miraculous power of compound interest to dramatic effect.

Let me give you a quick example using one of the world’s most iconic companies, Coca-Cola (NYSE: KO).

An investor who bought $10,000 worth of KO in 1962 would have received a total of $136,000 in dividend payments over the next 50 years. By that point, through stock splits and appreciation, the original stake of 131 shares would have grown to 6,288 shares worth $503,000 — for a total of $639,000.

You could certainly do worse than turning $10,000 into more than half a million.

But if all those quarterly dividends were reinvested, the original 131 shares would have grown to 21,858 shares worth a cool $1.75 million. That’s an extra $1 million in your pocket — not by investing in better stocks, but simply from putting your dividends back to work and harvesting the power of compound interest.

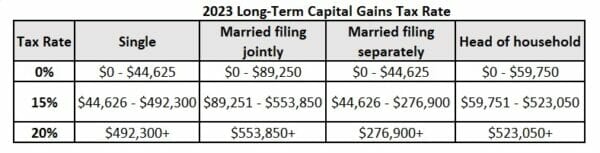

6. Don’t Forget About The Impact Of Taxes

It’s not what you make that counts, but what you keep. That’s an old saying, but it’s never been more true.

It’s not what you make that counts, but what you keep. That’s an old saying, but it’s never been more true.

While dividends can receive preferential treatment, interest income is taxed just like ordinary wages. In the eyes of the IRS, a taxpayer with a salary of $100,000 who collects $10,000 in interest owes the same as a worker that takes home $110,000.

Virtually every income investor must hand over a portion of their earnings each year — even those with just a simple interest-bearing bank savings account. Growth investors aren’t exempt and get hit whenever their funds make a capital gains distribution.

Fortunately, fund companies like Eaton Vance have developed a full line of funds designed to optimize tax efficiency. Tax-free municipal bonds can also be an ideal solution.

Successful investors know how to calculate tax-equivalent yields and build portfolios that minimize how deeply the taxman can reach into their pocket. Cutting the IRS out of the loop can make a big impact over time. We won’t get bogged down in the math right now, but suffice it to say, we’re constantly looking for tax-efficient income investments for our readers at High-Yield Investing.

7. Do Have An Exit Plan

While there are countless articles and other resources that help teach you which stocks, bonds and funds to buy, information regarding when to sell is sparse.

Yet, these decisions can be just as important. (My colleague Jimmy Butts does a fantastic job of reiterating this with his subscribers.)

Many investors sitting on big gains have watched helplessly as those unrealized profits evaporate, until finally the position is underwater. There are few things more frustrating than taking a loss on a stock that had been a big winner just a few weeks or months earlier. But it’s a common tale.

That’s why it often pays to protect gains with stop-loss orders, particularly on overheated stocks that might be due for a pullback.

And don’t be too quick to cut losses on stocks that drop right after you buy them. If the company is operating the same as before and the shares are simply sliding in a weak market, then there is no need to panic.

But if the stock is falling because of deteriorating earnings caused by company or industry-specific reasons, then it’s time to reevaluate. Up or down, successful income investors don’t succumb to emotion and base their sell decisions on valuation.

Conclusion

The seven habits described here are only a starting point for successful investing. You should always do your own research as there’s no substitute for proper due diligence. But if you develop the habits we’ve discussed today and make them part of your regular routine, you should be well on your way to becoming a much better income investor.

If you love learning about under-the-radar dividend stocks, then I encourage you to check out my premium advisory, High-Yield Investing. Each month, I scour every corner of the market to deliver safe, high-performing picks to subscribers who are looking for more income.

In fact, I just put together a special report where I reveal 12 companies with long histories of paying monster dividends each and every month. Go here now to learn more.