The Tech-Fueled Rally, Why Homebuilders Are Hot, And How To Store Your Crypto…

Before we get to the main thrust of today’s issue… Do you remember last week, when I showed you something we’ve never done before?

Our boss, Phil Ash, President of Investing Daily and StreetAuthority, gave an inside look at how he uses one of our strategies to trade in his own real-money portfolio.

And this week, he’s keeping the ball rolling. In his latest video, he closed a trade from Jim Fink’s brand-new Seasonal Stock Alert service for a fast 24% gain in 2.5 months! You can head over to this link to watch the full video or read the transcript.

Also, be sure to subscribe to our YouTube channel for some more market analysis and trading action. You can also try Jim’s new trading service for as little as $39. Learn more about this special offer here.

Switching gears, I recently had a discussion with my colleague Jimmy Butts, Chief Investment Strategist of Capital Wealth Letter.

As some of you know, Jimmy and I have worked together for years. And because he makes it his mission to deliver insightful analysis and picks with huge upside potential every month, he’s one of the first people I turn to when I want to bounce around ideas.

Our wide-ranging chat covered everything from the recent tech-fueled market rally to why the homebuilders are red-hot to the best ways to store your cryptocurrency. My questions are in bold…

Enjoy,

Brad Briggs

StreetAuthority Insider

What do you make of the recent rally, led by tech stocks? Are we out of the woods yet?

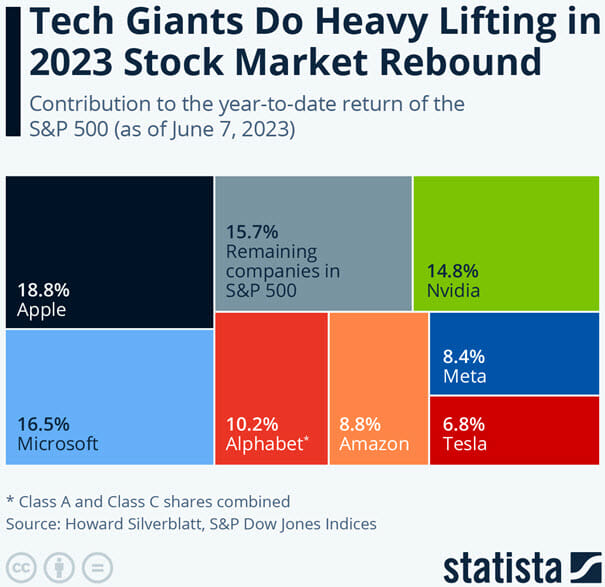

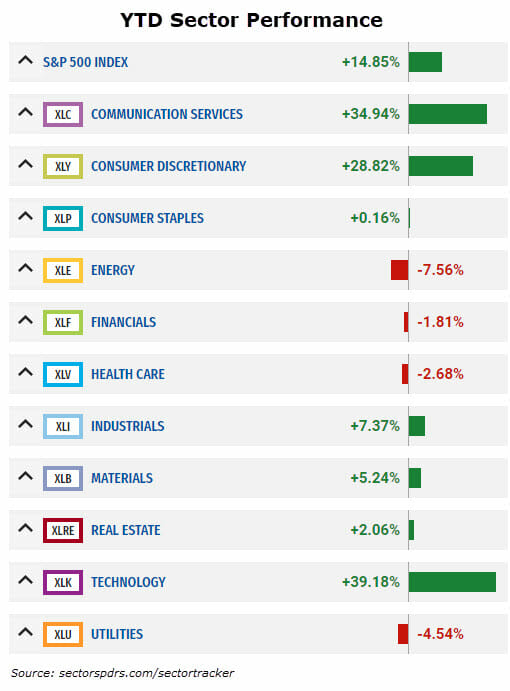

Tech stocks are back in vogue. After a tough year or so, they are once again leading markets higher. The technology sector is up 39% this year, followed closely by communication services. Last year’s big winner — Energy — is the worst-performing sector. And believe it or not, the S&P 500 is up nearly 15% on the year.

Tech stocks are back in vogue. After a tough year or so, they are once again leading markets higher. The technology sector is up 39% this year, followed closely by communication services. Last year’s big winner — Energy — is the worst-performing sector. And believe it or not, the S&P 500 is up nearly 15% on the year.

The top-performing stock in the S&P 500 is graphics-card maker Nvidia (Nasdaq: NVDA), up a staggering 192%. But number two on the list is our Capital Wealth Letter holding, Meta Platforms (Nasdaq: META). The social media giant is up over 133% on the year.

Another portfolio holding, Alphabet (Nasdaq: GOOGL), makes a strong showing with a 40% rise. That’s followed closely by our homebuilder (which I won’t name out of fairness to our premium readers), up 33% on the year.

But here’s a crazy stat for ya… even though the S&P 500 is up double-digits year-to-date if you took away the seven mega-cap tech stocks, the S&P 500 would be barely above even on the year.

The market is clearly being led by a handful of stocks.

What does this mean for investors? Well, a healthy market is one where nearly all stocks are doing well. I mean, these seven stocks can only carry the weight for so long. If they trip up, the S&P 500 will quickly fall.

So be weary out there.

With interest rates so high, why are the homebuilders doing so well?

Yeah, it might seem odd at first. I mean, homebuilders are doing so well. Over at Maximum Profit, we’re already up 16% on one homebuilder in less than two months. And our longtime homebuilder holding at Capital Wealth Letter has rebounded by more than 70% in the past year (bringing our total return to 129%).

Considering mortgage rates are near their highest levels since 2007 (average 30-year fixed rate mortgage is 6.73%), causing buyer sentiment to plummet.

But the fact remains that there just aren’t many homes for sale. Housing inventory is still near its lowest level in history. And folks who locked in super low mortgage rates aren’t interested in selling their home as they can’t fathom getting a rate near 7%.

These supply and demand dynamics are a strong tailwind for the homebuilding industry. Plus, homebuilders remain at ridiculously cheap valuations despite these tailwinds.

One favorite I’m looking at right now trades at a P/E multiple of about 6. That’s below its five-year average of 7.7 and is a fraction of the S&P 500’s multiple of 24. Its enterprise value (“EV”) to earnings before interest, taxes, depreciation, and amortization (“EBITDA”) sits at just 4.6. That’s a 46% discount to its historical average.

This isn’t the only one, either. Practically the whole sector is trading at single-digit multiples.

The bottom line is that strong industry dynamics, cheap valuations, and strong financials are helping the shares of many homebuilders reach new highs.

We’ve been talking about cryptocurrencies a lot lately, and this is something a lot of newer folks don’t think about… How should investors store their crypto?

I’m glad you asked. We talk about this in one of my premium reports. But I’ll give you the highlights.

First, it’s important to understand the types of storage and how best to use each.

The most basic storage route is an exchange. This is where you buy and sell cryptocurrencies; and any cryptocurrency that you buy is stored on that exchange’s server.

Coinbase is an example of an exchange. The nice thing about these exchanges is that converting your local currency (dollars, euros, yens, etc.) into cryptocurrency is easy.

The downfall is that these exchanges are not great places for the long-term storage of your cryptocurrencies. That’s because you are trusting the exchange to protect your cryptocurrency, which makes them giant targets for hackers. If the exchange gets hacked and steals all the cryptocurrency, then there’s not much you can do… you essentially got robbed, and it’s a very slim chance you’ll see any of your cryptocurrency again.

Then there’s digital wallets. These are sometimes called “hot wallets,” meaning they are connected to the internet. But these cryptocurrency wallets provide a safe place to store your proof of ownership of the cryptocurrency you’ve bought.

One of the top wallets for beginners is the Coinbase Wallet. It can be downloaded as an app for Apple or Android. It has an intuitive interface, and the wallet is fully integrated with the company’s exchange, making it easy to conduct transactions.

Source: Coinbase

Unlike the company’s exchange, the Coinbase Wallet is noncustodial. That means that only you have access to your wallet’s private key, which is generated with a 12-word recovery phrase when you sign up – if you lose this recovery phrase, you will be locked out of your account.

Then, finally, we got to the hardware wallet. This is a physical device you can hold in your hands (think thumb drive). It’s a special type of wallet that stores the user’s keys in a secure hardware device.

Hardware wallets are not connected to the internet, so they are known as “cold wallets.” The beauty of hardware wallets is that this is the safest form of cryptocurrency storage as they are immune from computer viruses, hackers, and even overbearing government officials.

Editor’s Note: Remember the last crypto boom? Jimmy and his team think cryptocurrencies are about to go on another major run…

That’s because three “blue chip” cryptocurrencies are getting major upgrades this year, and they could unleash a massive crypto boom. This could easily be a once-in-a-lifetime chance to take a small amount and turn it into a life-changing gain.

That’s why he just released a bombshell briefing about how you can profit. Get the details here…