Why Investors Need To Learn To Spot Changing Market Trends — Or Else…

It might be the most important (and profitable) investment approach that most investors miss. In fact, for years, I missed it myself. Even though it was staring me right in the face every day.

It might be the most important (and profitable) investment approach that most investors miss. In fact, for years, I missed it myself. Even though it was staring me right in the face every day.

Fortunately, one day, it finally struck me.

It’s a phenomenon that consistently happens in the stock market.

I’m talking about changing stock market trends or the reshuffling of market leaders. The booms and busts that are constantly happening within the stock market.

Investors who don’t understand this little phenomenon earn mediocre returns.

Let me explain.

The King Doesn’t Always Stay On Top

You see, there are always market leaders and laggards. This is no secret. But most investors fail to realize that the biggest stocks today won’t always be the biggest stocks in the years to come.

Your typical investor buys these big-name stocks, assuming they’ll stay on top for years and that everything will work out. And it might look like a great move initially as the stock moves higher. But just like Rome, eventually, that big-name company falls. And your typical investor never sells. They ride it all the way down.

Think about Cisco Systems (Nasdaq: CSCO) at the turn of the century. At the height of the dot-com craze, Cisco was leading the “Internet Revolution.” The company was crushing it. The company’s revenue grew from $2 billion to $12 billion in five short years. That’s an annual growth of more than 40%.

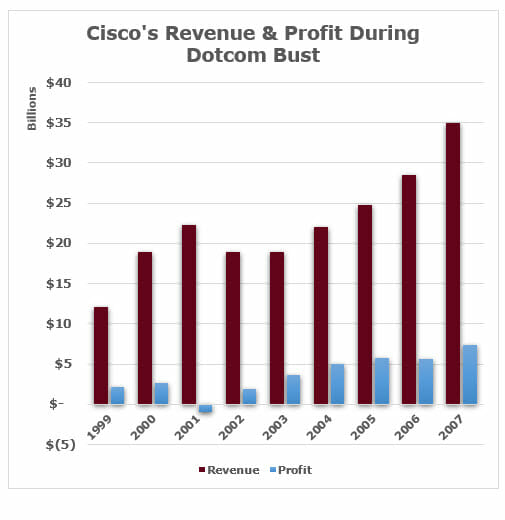

To be sure, this wasn’t like every other internet company at the time. Because most of those companies didn’t actually make any money. Cisco did. In 1999, it earned more than $12 billion in revenue and topped $2 billion in profit.

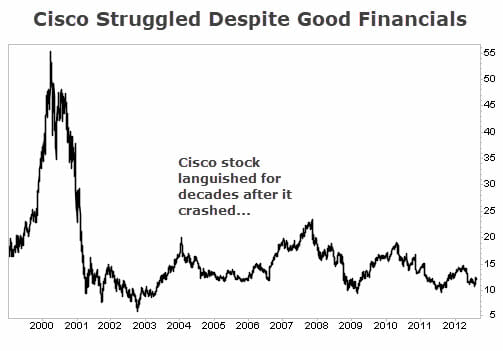

It was the obvious investment choice for investors. The top dog. The biggest company and the leader of the pack by a mile. Of course, we know now that when the dot-com bubble burst, it took everything down with it, including Cisco.

But your average investor would come back to Cisco. And why not? The stock lost 90% of its value during the dot-com bust. But the business itself was doing fine.

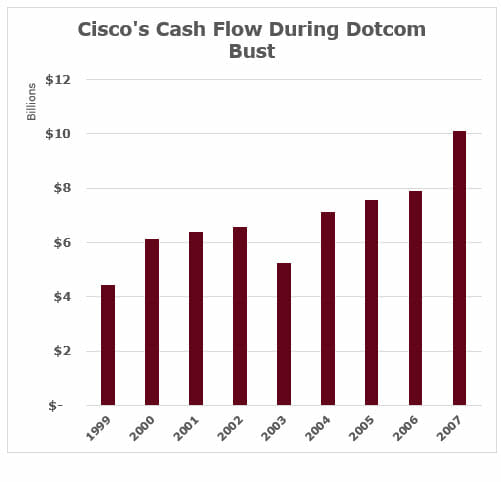

Sure, the company had a couple of down years in terms of revenue growth in 2002 and 2003. But outside of 2001, the company remained profitable. Plus, as I’ve pointed out before, net income is fickle. Instead, I rely on cash flow.

Cash flow is the actual cash the business generates. It’s the lifeblood of any business. And if we take a look at the company’s cash flow during this period, it grows every year except 2003.

Now, think to yourself. Here’s a stock that skyrocketed 131% in 1999 alone. Its business is solid, consistently growing revenue, profits, and cash flow.

The stock has now crashed roughly 90%, meaning you can now buy this same business (generating even more revenue and profit) for even less than it was trading for before 1999.

Seems like a no-brainer, right? Wrong.

Learn To Spot These Changing Trends

And that’s exactly what I’m talking about when I say that most investors miss the market phenomenon of reshuffling market leaders. They miss the larger trends happening within the market.

If you don’t understand this little market phenomenon, you will consistently struggle to generate decent returns, let alone market-beating returns.

It doesn’t matter if you buy the “right” stock if you’re in the wrong industry. Make the wrong decision, and you’ll end up with mediocre returns even as the market soars.

My advice: Learn to consistently spot these trends. Once I stopped fighting the trend, exceptional returns followed.

Over at my premium service, Maximum Profit, we fought this market phenomenon a decade ago. Not that we ignored what the system recommended. We just didn’t lean into the bigger trends that our system was identifying.

For example, oil stocks were the market leaders in the early days. And we made good money on many trades from that industry. But we also tiptoed around it because, well, diversification. We didn’t want to put all our eggs in one basket. Plus, diversification is like investing 101. But diversification is also a bit of a myth. Especially when it comes to trading.

Over the years, we really leaned into the broader market trends the system pinpointed. Diversification was tossed out the window. And more importantly, just because something worked well last year didn’t mean we would jump all over it again.

Even more importantly, we didn’t ride our favorite trades all the way down. When the momentum stopped, we exited and moved on. I can’t tell you how much money we’ve saved by having an exit plan in place.

Closing Thoughts

The bottom line is this… times change. Market leaders change. And if you don’t follow the change, then it doesn’t matter how good a company’s financials are… you’re not going to make great returns.

The exciting thing is once you recognize this market phenomenon, you’ll be prepared and ready, while many investors will be caught off guard when the tide turns.

Just follow the big trends in the market, and when you identify them, don’t be afraid to go in heavy. Just remember to have an exit plan, so your profit doesn’t evaporate in thin air.

P.S. Wish you could turn back time and buy crypto?

We believe NOW is the most important time to buy crypto… if you haven’t yet. That’s because our team thinks a select few cryptos are about to go on another monster run — and we just released a bombshell briefing about how you can profit.