How To Boost Your Income, “Insure” Your Portfolio Against A Downturn, And More…

Many investors own stocks and simply hope that dividends and capital gains will be enough. The problem, though, is hope isn’t a strategy.

Studies show that most individual investors underestimate how much money they’ll actually need during retirement. And I’m willing to bet, if you’re being honest with yourself, you may be a little worried yourself.

But in just a second, I’m going to show you a strategy that can help you get to where you want to be.

Think of it as writing “insurance” policies for the stocks you own. In this case, you get to act as the insurance company — writing “just in case” policies for the stocks in your portfolio, and earning a hefty premium payment for your trouble — immediately.

“Heads, I Win. Tails, You Lose.”

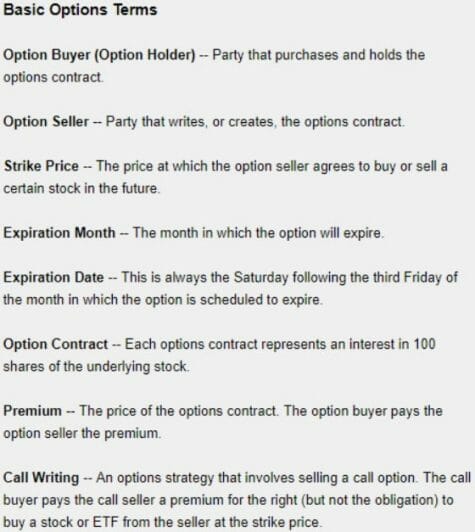

For those who haven’t guessed yet, I’m talking about covered call options. And before we go any further, let me just clear the air about one thing really quick.

Whenever we talk about options, there will always be a subset of our readers who instinctively push back.

“Oh, options? They’re too risky.”

While it’s true that some options strategies can be risky (for those who don’t know what they’re doing), the reality is that selling covered calls is one of the most conservative options strategies around. And what’s more, it’s not as complicated as you may think.

Think of it like this… Covered calls let you make a deal with other traders who want to pay you cash upfront for the opportunity to buy a stock you already own at a higher price. That money goes straight into your brokerage account. You collect the cash they pay to make the deal immediately. (We like to think of this as an “insurance policy” — I’ll explain why in a minute.) And you still get the opportunity to sell your shares for a profit down the road.

Sounds pretty good, right? Of course, there are some things you need to understand about this strategy first. But the nice thing about covered calls is that it’s easy to grasp and can be a reliable income strategy for everyday investors. However often you do it and however you use the income — the power is in your hands.

An Example Of A Covered Call Trade

The covered call strategy is incredibly simple to learn. For every 100 shares of a stock you own, you can sell one call option against it. That’s the “covered” part. By selling calls, you generate upfront income, also known as a “premium”.

Let me give you an example… (Keep in mind, this is not one an official recommendation. This is for illustrative purposes only.)

Let’s say you want to use this on shares of the energy refiner Phillips 66 (NYSE: PSX). As I’m writing this, shares are trading for about $116. Let’s say you own 100 shares.

You could sell a call option on Phillips 66 that expires on January 19th with a strike price of $125 for about $3.40.

This means if you execute this trade, you’ll earn a premium of $340 ($3.40 x 100 shares). That’s a return of about 2.9% ($210/$11,600).

Keep in mind, shares of PSX pay a yearly dividend payment $4.20. That’s a yield of about 3.7% at current prices. So you’ve essentially earned 80% of what other buy-and-hold investors would have earned all year, all at once.

What’s more, this trade expires on January 19th, which is about three months from now. As long as the stock price stays below $125 by the time the trade expires, you could turn around and make a similar trade all over again. As an added bonus, you can keep collecting the regular dividend payments, too.

On the flip side, if the share price rises to $125 or above, you’ll sell the shares at $125. If you bought those shares at $116, that would give you a net profit of about 11% in three months. (The $2.70 premium reduces your cost basis to $112.60.) That’s not bad for what would amount to a short-term trade. (And if you were fortunate enough to own PSX already at a lower price, then the math gets even better…)

How To Win With Covered Calls… Even When You’re Wrong

Since you earn this income upfront, this offsets some of the downside risk in the stock. The premiums you earn effectively reduce your cost basis, as shown in the example above. And because you own the shares, you still get to participate in some of the upside.

That’s why we like to say that covered calls are like insurance policies on your portfolio. You hope you don’t need them, but you’re glad you have them when the market takes a turn. Here’s what I mean…

Let’s say you bought 100 shares of Phillips 66 thinking the shares would rise. But something happens that you didn’t anticipate (like a dip in energy prices, or a broad selloff in the market) and the stock plunges by 5% (to $110).

If the stock remains below $125 by Jan 19, you’ll still keep the $340 per contract and continue to own the stock. But remember, that premium reduces your cost basis to $112.60. ($116 per share, minus the $3.40 premium.)

So what would have been a 5% loss is now only a 2% loss. That helps soften the blow. And since you had enough faith in the company to buy shares in the first place, you can sleep a little better at night. Regardless of whether the stock rebounds quickly or not, you can keep selling covered calls on the position to earn income and lower your cost basis further. (Again, let’s not forget those regular dividends, either, which can help soften the blow until the price rebounds.)

How To Start Using Covered Calls

In this market, safe (and high) income is tough to find. Selling covered calls on high-quality stocks is one of the best — and easiest — strategies available to regular, everyday investors. Even better, it’s perfectly scalable. So in our example, if you bought 200 shares and sold 2 calls, you’d earn $680 upfront — and so on…

And remember, you can repeat trades like this again and again. So it’s not that difficult to essentially double (or triple) the annual income you’d normally earn by simply buying and holding a stock.

That’s not to say covered calls are risk-free, of course. No investment is. But there’s a reason high-tech hedge funds and old-school value managers alike use covered calls… they can help you reduce risk and pay you to wait. It’s a no-brainer in more ways than one.

Just ask my colleague Robert Rapier, head of Investing Daily’s Rapier’s Income Accelerator service. Robert and his premium readers use strategies like this to earn hundreds of dollars — sometimes even thousands — in extra income with each and every trade.

If you’d like to learn more, including how to get his latest set of trades delivered straight to your inbox, you can go here to learn more.