Defense Stocks, Macro Worries, And Where To Find High Yields Right Now

Last week, I handed over the tail end of Friday’s issue to let my colleague Nathan Slaughter tell you about his latest big win.

This week, I thought I’d pick his brains for some insight on a few topics.

As Chief Strategist of High-Yield Investing, it’s Nathan’s job to find solid income securities for investors in any market. His track record of doing that speaks for itself (we’ll prove it in just a second).

In addition, Nathan and I discussed some of his macro worries and the situation in Israel.

My questions are in bold…

Enjoy,

Brad Briggs

StreetAuthority Insider

Nathan, I hate to even bring this up, but defense stocks have rallied in the wake of the horrific terrorist attacks in Israel. Should investors be looking at this sector?

Nobody hopes for armed conflict. But it’s understandable why defense stocks would gain favor in times of war. After a surprise attack on Israel by Hamas terrorists and a decisive counterstrike in Gaza shortly after, death tolls are rising, and the entire Middle East is suddenly destabilized.

Nobody hopes for armed conflict. But it’s understandable why defense stocks would gain favor in times of war. After a surprise attack on Israel by Hamas terrorists and a decisive counterstrike in Gaza shortly after, death tolls are rising, and the entire Middle East is suddenly destabilized.

As footage of the atrocities (which also involve dozens of Americans) is broadcast worldwide, the conflict has continued to escalate. A hostage crisis is unfolding, and news outlets report that a full-scale Israeli ground invasion is imminent.

It seems crass to discuss stock prices amid such suffering. As a father, the barbaric treatment of women and children sickens me.

But the investor in me can’t help but notice the swift rally in stocks like Northrop Grumman (NYSE: NOC) over the past ten days. The stock surged from $420 to a recent close of $490 on heavy trading volume. Peers like Lockheed Martin (NYSE: LMT) have also gained ground since the attacks.

Even before, these companies had plenty of business on their plate.

For Northrop’s part, the company reported nearly $10 billion in revenue last quarter, with gains across all four business segments (aeronautics, defense, mission systems, and space systems). And for every dollar of sales going out the door, it took in $1.14 in new orders.

Northrop Grumman received $10.9 billion in new awards for the period, bringing the year-to-date total to $18.9 billion. In turn, the backlog has risen to $78.8 billion – equivalent to nearly two years of future revenues on the books.

The bottom line is that advanced radar systems and hypersonic attack cruise missiles aren’t cheap. I’m partial to Northrop, but the sector as a whole is worth a look.

You recently cited a recent poll conducted by Fannie Mae, which found that 84% of respondents believe now is the wrong time to buy a home (the highest on record). Why should we be concerned about this?

Imagine how McDonald’s (NYSE: MCD) might react to a new survey showing that 84% of consumers believe this is a terrible time to eat hamburgers. Or the reaction from American Airlines (NYSE: AAL) upon hearing that four out of five people think now is a bad time to travel.

This is not good news because housing is about 15% of the economy (not to mention the ripple effects).

So why are people so sour on housing? It could be that median home prices have skyrocketed from $329,000 to $416,000 over the past 36 months.

Others might be deterred by unaffordable mortgage rates, which just touched 7.63% last week – the highest level since December 2000.

Or maybe it’s just the lack of selection. According to the National Association of Realtors, only 1.1 million units are listed for sale nationwide, exactly half of the normal inventory of 2.2 million.

Many homeowners feel trapped and don’t want to sell right now. That’s understandable – doing so might mean trading in a 3% mortgage for a 7% mortgage.

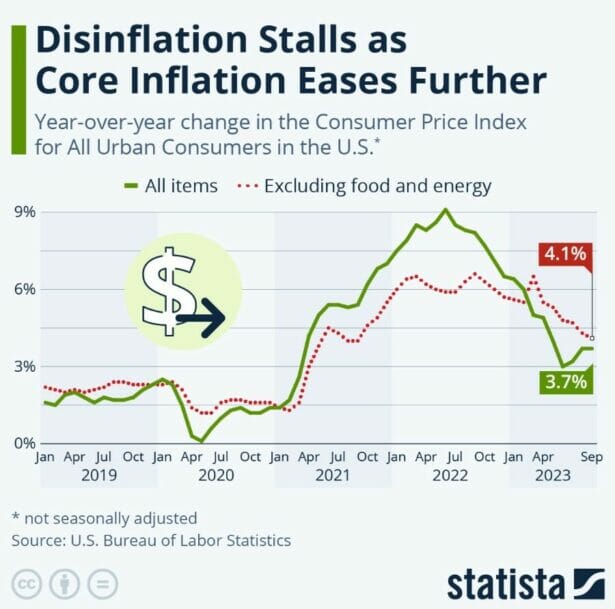

Also, you may have seen the September Consumer Price Index (CPI) report, which showed inflation remaining at 3.7% – double the Fed’s comfort zone. What the headline didn’t reveal was that shelter costs were the single biggest contributor.

What do you make of spiking yields in the Treasury market?

The last few Treasury Bond auctions have been met with lukewarm demand. Despite long-term yields soaring to the highest levels in 16 years, there aren’t many takers. To make matters worse, the most voracious buyer in recent years (the central bank itself) has stepped away from its bond purchases amid quantitative tightening.

Simply put, weakened demand for Treasuries equals higher yields. That equals more expensive borrowing costs for consumers and corporations.

Access to capital is a make-or-break proposition for some businesses right now. In this environment, we’ll scrutinize balance sheets and capital structures even more closely – cash is king.

But there is an upside to this… Growth is getting harder and harder to finance. So, companies that are flush with cash may just decide to buy their way into growth.

As you know, the average stock in S&P 500 yields about 1.6%. How can investors find the income they need in an environment like this?

I get it. It’s not easy. But if you truly want to build long-term wealth, then the core of your portfolio MUST have a yield attached to it.

Dividends make up for over half of the market’s total return over the long haul. Other investing fads may come and go, but it’s the single easiest way to create wealth in the market.

There are plenty of high yields out there. You just have to know where to look…

I say that all the time within the pages of High-Yield Investing. So, as proof, I’ve compiled the table below, which shows our current holdings that yield above 6% right now. The grand total is 32. That’s nearly three dozen holdings paying anywhere from 6% to double-digits.

Of course, those are the yields you’d earn if you buy today. But some of our holdings have been around so long — and have raised their payouts so much — that we’re earning a yield-on-cost that’s even higher.

And the great thing is that more than a few of these holdings have delivered triple-digit gains, too.

The point is that plenty of high-quality picks out there yield more than 6%. And we find them by looking beyond just stocks – we touch on everything from equities to REITs to MLPs to funds that sell covered calls and more.