Disney’s Entertainment Streamers Turn 1st Profit, Advice for Starbucks, and More

Editor’s Note: Happy Wednesday, dear reader! I hope you are enjoying the spring so far. This week, it’s been a bit like this around these parts:

Let’s get to it!

Disney’s Entertainment Streamers Finally Turn a Profit

Shares of Walt Disney (NYSE: DIS) turned volatile yesterday after the company reported second-quarter earnings that beat Wall Street’s expectations.

The good news: Two of the company’s streaming services — Disney+ and Hulu — reported their first-ever profit.

Disney categorizes Disney+ and Hulu as its “entertainment streaming services,” as opposed to sports-based ESPN+. The two streaming services saw a 13% quarterly revenue boost, to $5.64 billion. Their combined operating income was $47 million — versus a $587 million loss in the year-ago quarter.

However, when ESPN+ is added back to the mix, the streaming services lost $18 million in the second quarter. Still, that’s better than the $659 million loss reported a year ago.

Disney credits its entertainment streaming profits to a combination of added subscribers and higher average revenue per subscriber.

In the second quarter, Disney+ picked up more than 6 million Core subscribers, bringing the total to 117.6 million worldwide. Hulu saw 1% subscriber growth, to 50.2 million.

Meanwhile, ESPN+ lost 2% of its subscribers, ending the quarter at 24.8 million.

For the quarter, Disney reported a net loss of $20 million, or 1 cent per share. That’s a big departure from the $1.3 billion, or 70 cents per share, gain that the company reported in the year-ago quarter.

Still, Disney’s adjusted earnings per share came in at $1.21 versus expectations of $1.10.

The House of Mouse also reported revenue that slightly missed estimates, at $22.08 billion versus the expected $22.11 billion.

Revenue from Disney’s U.S. parks, cruises, and other “experiences” rose 7%, to $5.96 billion. Meanwhile, revenue from international resorts and cruises rose 29%, to $1.52 billion — thanks in large part to higher prices and attendance at Hong Kong Disneyland.

“Our results were driven in large part by our Experiences segment as well as our streaming business,” CEO Bob Iger said in a statement. “Importantly, entertainment streaming was profitable for the quarter, and we remain on track to achieve profitability in our combined streaming businesses in Q4.”

Disney’s cable TV business continues to be a drag on the company’s bottom line. That included a 9% plunge in ESPN’s operating income, to $799 million. Disney noted that lower advertising revenue and a drop in subscriptions as consumers continue to abandon cable TV were in part responsible for the dropoff.

Similarly, operating income from Disney’s TV networks (minus ESPN) decreased by 22%, to $752 million.

In addition, thanks to a dearth of blockbuster films, Disney’s revenue from box-office sales, licensing, and related businesses plunged by 40%, to $1.39 billion.

Former Starbucks CEO Chimes In on Disappointing Q2

Last week, Starbucks (NSDQ: SBUX) reported fiscal second-quarter earnings… and the results weren’t good.

The coffee giant missed on several accounts, including lower-than-expected revenue, same-store sales growth, and earnings.

Over the weekend, former Starbucks CEO Howard Schultz took to social media site LinkedIn to weigh in on the company’s current problems.

Schultz, who no longer plays an official role at Starbucks, wrote that the company needs to improve the customer experience at its U.S. stores.

“Over the past five days, I have been asked by people inside and outside the company for my thoughts on what should be done,” Schultz wrote Monday night. “I have emphasized that the company’s fix needs to begin at home: U.S. operations are the primary reason for the company’s fall from grace.

“The stores require a maniacal focus on the customer experience, through the eyes of a merchant. The answer does not lie in data, but in stores.”

Schultz went on to say that improving the company’s mobile app should be a priority.

“One of [senior leaders’] first actions should be to reinvent the mobile ordering and payment platform — which Starbucks pioneered — to once again make it the uplifting experience it was designed to be.”

However, Schultz remarked that the overhaul shouldn’t end with the app.

“The go-to-market strategy needs to be overhauled and elevated with coffee-forward innovation that inspires partners and creates differentiation in the marketplace, reinforcing the company’s premium position.

“Through it all, focus on being experiential, not transactional.”

Kind of like Walt Disney’s (NYSE: DIS) Bob Iger, Schultz has been off-again-on-again at the Starbucks top spot. However, he reportedly retired as Starbucks CEO for good last year.

Of course, we’ve heard that story before…

Currently, Laxman Narasimhan — former CEO of Reckitt Benckiser (OTMKTS: RBGLY) — is in the captain’s chair.

The market was surprised by the coffee giant’s underperformance last quarter. Since the earnings report was released, shares of Starbucks have fallen by more than 16%.

AWS Invests Billions in Singapore Infrastructure

Amazon (NSDQ: AMZN) announced yesterday that its cloud-computing unit, Amazon Web Services (AWS) will double down on its investments in Singapore. The company now plans to spend an additional 12 billion Singapore dollars (roughly $8.88 billion) over the next five years to expand its cloud operations in the Southeast Asia country.

“The investment will go into the construction and build-up of the [data center] capabilities, all associating with the Asia-Pacific Singapore region,” Priscilla Chong of AWS Singapore told CNBC on Tuesday.

“Starting with our investment in Singapore in 2010, AWS has continued to strengthen their commitment to the ASEAN region, sharing the uplift [in] digital skills across the nations, providing secure and resilient infrastructure consistently across the region.”

Since 2010, Amazon has invested more than 11 billion Singapore bucks into its cloud-computing infrastructure in that country. That has included the training of more than 400,000 cloud workers since 2017.

According to Amazon, the company is collaborating with the Singapore government, as well as organizations in the country’s public sector, to help boost the adoption of artificial intelligence (AI).

In addition, Amazon Web Services plans to similarly invest $5 billion in Thailand operations, as well as $6 billion in Malaysia.

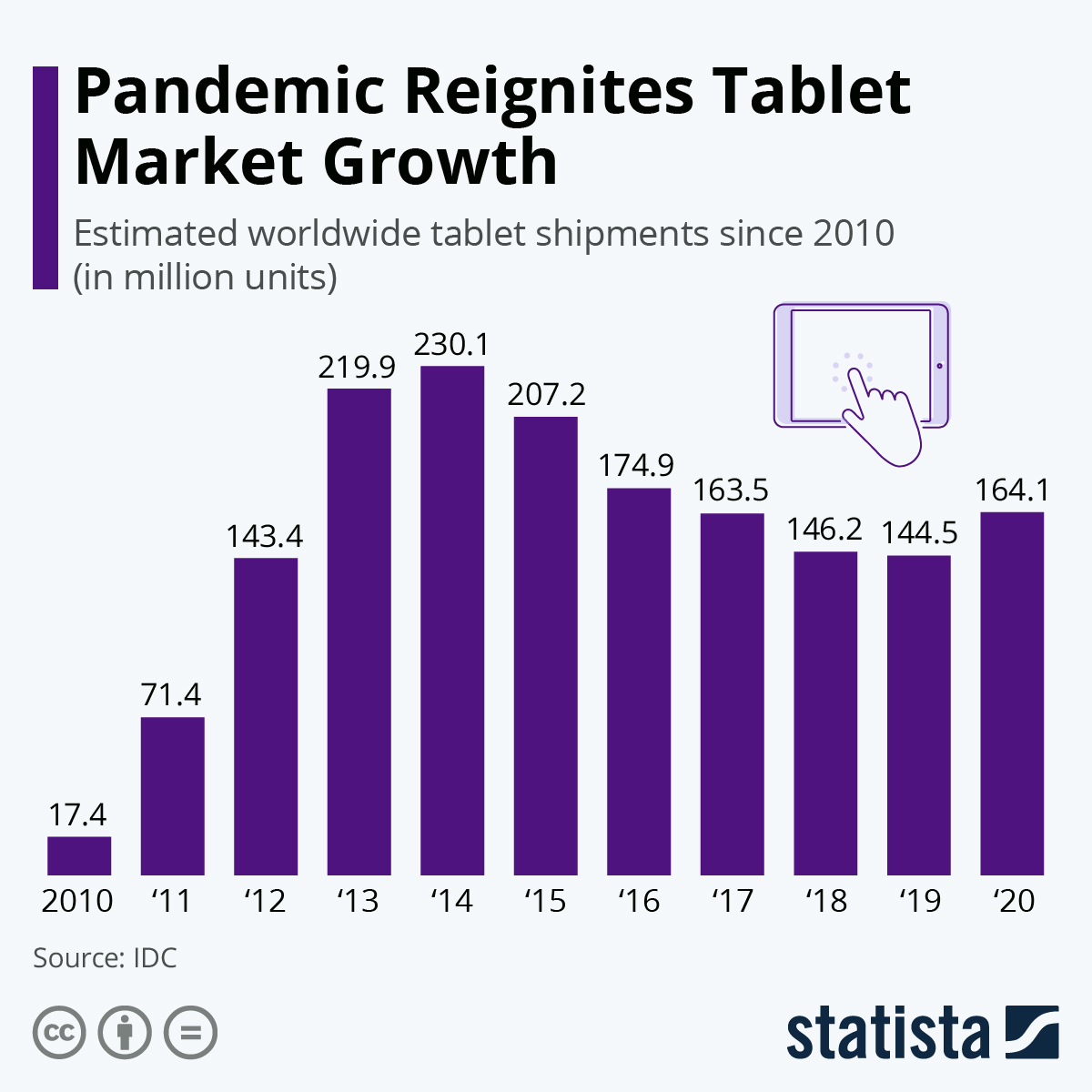

Tablet Shipments Fall to Lowest Level Since 2011

According to data from IDC, global tablet shipments continued to plunge in 2023, reaching the lowest level in more than 10 years.

Last year, Apple (NSDQ: AAPL), Samsung, and other tablet makers shipped just 128.5 million units — down from 161.6 million in 2022.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

It looks like this trend will continue to play out.

As IDC Senior Research Analyst Anuroopa Nataraj said, “With no significant improvements to the economy and consumers allocating their money to things beyond consumer electronics, tables may not be very high on the priority list.”

However, Nataraj pointed out that if economic conditions improve, there could be “some rebound opportunities” in 2024. That would especially be the case if Apple were to announce a new iPad model — which is a long shot.

P.S. Don’t miss out on the cryptocurrency boom. The gap between traditional and digital markets is narrowing, as Bitcoin (BTC) soars to new heights.

Bitcoin exchange-traded funds (ETFs) are reporting massive inflows of new capital. The cryptocurrency market has embarked on perhaps the most powerful bull market in its history.

It’s clear that every portfolio should contain crypto assets. However, you need to be informed, to make the right choices. Direct investments in crypto coins or crypto-linked ETFs can be volatile.

In our coverage of the crypto market, we separate fact from myth, the wheat from the chaff. Start receiving our FREE e-letter, Crypto Investing Daily. Click here now!