April’s CPI Report, Walmart Q1 Results, and More!

Editor’s Note: TGIF!

Let’s get to it!

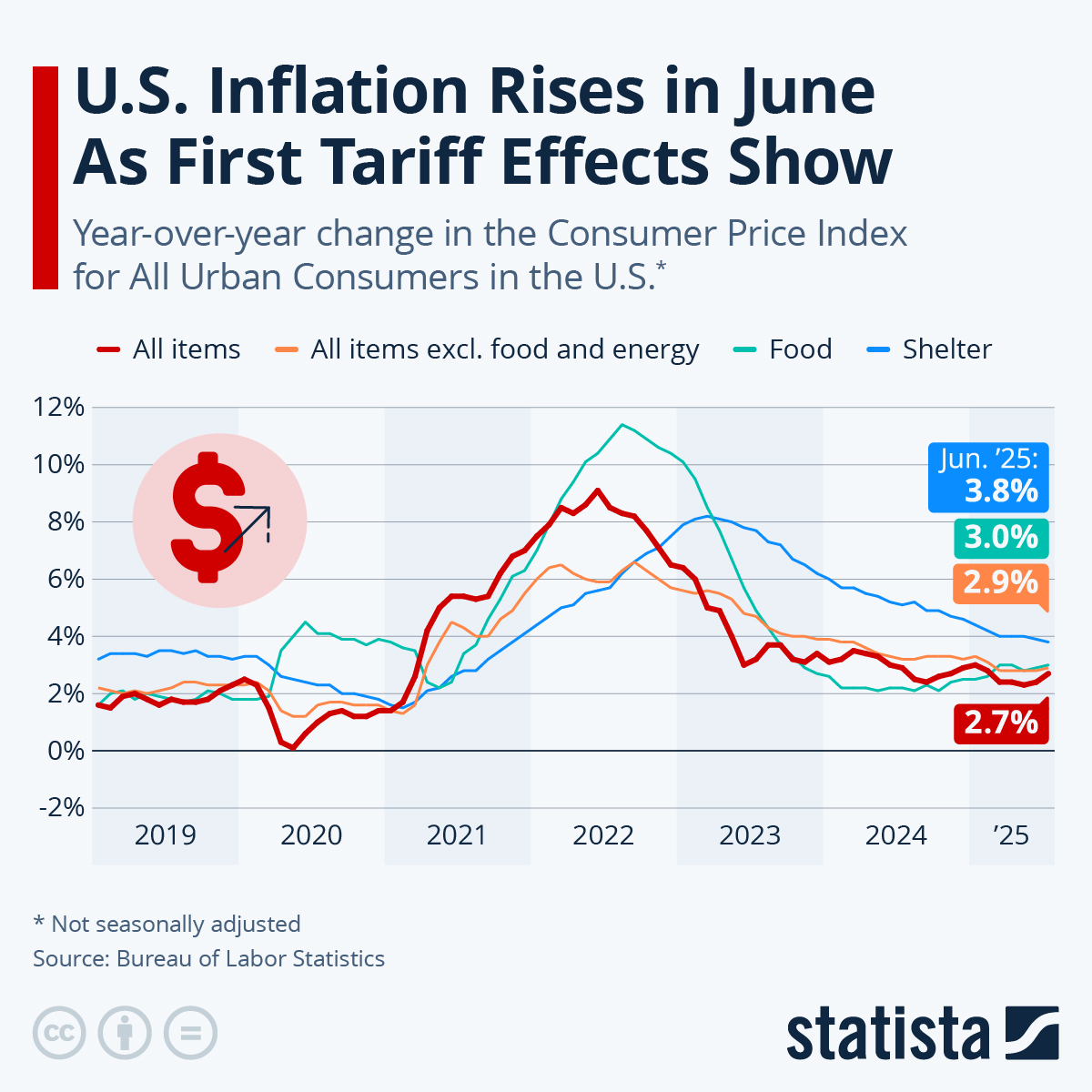

CPI Report Shows Inflation Slightly Eased in April

According to the U.S. Labor Department’s Bureau of Labor Statistics (BLS), inflation slightly eased off in April.

The BLS’s Consumer Price Index (CPI) — which measures the price changes among a broad basket of consumer goods and services — rose by 0.3% from March and 3.4% on a year-over-year basis.

Although inflation is still running hot, that was an improvement from the 3.5% annual and 0.4% monthly gains reported for March. The 0.3% month-over-month increase was also better than economists had expected (0.4%).

Stripping out volatile food and gas prices, the so-called “core” CPI showed a 0.3% rise from March and a 3.6% year-over-year gain. Again, that was cooler than March’s data showed.

Shelter costs have remained stubbornly high, according to the CPI. This category — which includes rent plus homeowner’s equivalent rent, or what homeowners would pay to rent their current homes — showed a 0.4% monthly increase plus a 5.5% year-over-year gain.

Broken down, rent and equivalent rent rose by 5.4% and 5.8% year over year, respectively. This is an ongoing trend; shelter costs have risen for 48 consecutive months.

What’s more, excluding shelter costs, the CPI would be a lot closer to the Federal Reserve’s inflation target of 2% year-over-year price growth.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

Meanwhile, energy prices rose by 1.1% from March and 2.6% from the previous April. In addition, food costs remained flat on a month-over-month basis but rose by 2.2% year over year.

According to Bloomberg, investors are now expecting the Federal Reserve to enact two 25-basis-point cuts to its benchmark interest rate.

At the beginning of the year, the markets had been anticipating six cuts. However, inflation has remained sticky while the labor market has remained in good shape.

After the BLS reported April’s CPI data, the markets began pricing in a greater likelihood that the Fed will start cutting rates at its September meeting.

McDonald’s to Offer Limited $5 Value Menu

McDonald’s (NYSE: MCD) announced this week that it is planning to offer a $5 value menu in the U.S. for one month only.

The promotion comes as the company — and other fast-food chains — face criticism for their ever-increasing prices.

McDonald’s used to be the place to go when you were down to your last $5 in spending money. However, since the COVID pandemic, prices at McDonald’s have soared. On average, the prices of the chain’s menu items have risen by more than 100% since 2020.

The new McDonald’s promotion will allow customers to buy a McChicken or McDouble sandwich, along with four Chicken McNuggets, fries, and a soda.

“We know how much it means to our customers when McDonald’s offers meaningful value and communicates it through national advertising,” a company statement said. “That’s been true since our very beginning and never more important than it is today.

Apparently, McDonald’s enlisted the help of Coca-Cola (NYSE: KO) to help pay for the marketing costs of the deal. In a statement, the soda giant said, “We routinely partner with our customers on marketing programs to meet consumer needs. This helps us grow our businesses together.”

McDonald’s recently reported a mixed bag of first-quarter results. Although higher menu prices added to the average restaurant transaction, same-store sales fell below expectations.

CEO Chris Kempczinski addressed this on the company’s earnings call. “Consumers continue to be even more discriminating with every dollar that they spend as they faced elevated prices in their day-to-day spending, which is putting pressure on the industry,” he remarked.

In a separate statement, John Pamaccio, chairperson of the McDonald’s Operator National Advertising Fund, touted the $5 meal promotion. “Great value and affordability have always been a hallmark of McDonald’s brand, and all three legs of the stool are coming together to deliver that at a time when our customers really need it. This is the power and promise of the Golden Arches.”

Walmart Reports Wall Street-Beating Results

Yesterday, Walmart (NYSE: WMT) reported quarterly earnings that beat the pants off Wall Street’s estimates. The knockout quarterly came courtesy both of an influx of higher-income shoppers and of significant gains in Walmart’s e-commerce business.

As a result, Walmart announced that it expects to reach — or even beat — the top end of its full-year guidance.

For Walmart’s fiscal first quarter, the company reported net income of $5.10 billion, or 63 cents per share. That’s a significant improvement over the net income of $1.67 billion, or 21 cents per share, reported for the year-ago quarter.

Revenue also rose by 6%, from $152.30 billion in the year-ago quarter to $161.51 billion. That’s higher than Wall Street’s expectations of $159.50 billion in revenue.

Same-store sales at Walmarts in the U.S. rose by 3.8%, excluding fuel. The company’s Sam’s Club chain saw a 4.4% year-over-year increase in same-store sales, excluding fuel.

Meanwhile, Walmart’s e-commerce division noted a 22% increase on a year-over-year basis. The company reported a notable increase in both in-store pickup and home delivery orders. In addition, Walmart’s e-commerce platform has a growing number of third-party vendors — similar to Amazon (NSDQ: AMZN).

The results show that customers in the U.S. made more trips to Walmart stores in the fiscal first quarter but spent about the same on each trip. The number of transactions increased by 3.8% year over year, while the average ticket amount remained roughly the same.

This week, Walmart Chief Financial Officer John David Rainey told CNBC that Walmart’s grocery business has been bringing in better-heeled customers than usual as food costs continue to stretch shoppers’ budgets.

“We’ve got customers that are coming to us more frequently than they have before and newer customers that we haven’t traditionally had, and they’re coming into a Walmart whether it’s a virtual store online, or whether it’s one of our physical stores,” Rainey remarked.

According to the CFO, shoppers are spending less on general merchandise and non-essential items while prioritizing spending on food, personal care, and health-related merchandise.

In the most recent full fiscal year, groceries accounted for roughly 60% of Walmart’s business, and the company has quickly become the largest grocery retailer in the U.S.

However, groceries aren’t as profitable for the company as non-essentials.

“We punched below our weight on general merchandise, specifically in apparel and home, for a really long time, maybe forever, and I think the progress we’re seeing right now is driven by the in-store remodels and e-commerce,” CEO Doug McMillion said on an earnings call this week.

P.S. Crypto is making ordinary investors rich… and it serves as an inflation hedge, to boot.

But you need to make your move now because the fuse is lit on this market. And every day you wait is literally costing you thousands in profits.

If you’re worried you can’t figure out crypto…don’t be.

Our in-house crypto expert, Alex Benfield, will make it easy for you. You won’t have to figure anything out on your own. He’ll walk you through everything, step by step.

Alex made a personal fortune on crypto. Now, his mission in life is to spread the word about crypto and make other people wealthy, too.

Get in on the crypto action…now. To learn more about Alex’s new trading service, Crypto Trend Investor, click here.