ConocoPhillips to Buy Most of Marathon, Q1 GDP Revisions, and More!

Editor’s Note: Happy Friday, dear reader! I am headed out today to do some camping with my daughter’s Girl Scout troop. Please keep me in your thoughts during this difficult time.

ConocoPhillips to Acquire Marathon Oil

Yesterday, ConocoPhillips (NYSE: COP) announced it had agreed to purchase Marathon Oil (NYSE: MRO). It’s the latest deal as oil production companies continue to consolidate.

The all-stock deal values ConocoPhillips at roughly $17 billion. That’s a nearly 15% premium to the company’s closing price on Tuesday afternoon.

Marathon’s shareholders will receive 0.255 shares of ConocoPhillips for each Marathon share they own.

“The acquisition of Marathon Oil further deepens our portfolio and fits within our financial framework, adding high-quality, low cost of supply inventory adjacent to our leading U.S. unconventional position,” ConocoPhillips CEO and Chair Ryan Lance said in a statement.

The acquisition will grant ConocoPhillips access to shale fields from North Dakota to Texas, as well as Marathon’s far-flung reserves.

The news is the latest in a trend of oil majors seeking to expand through M&A (merger and acquisition) activity. Back in October, ExxonMobil (NYSE: XOM) scooped up Pioneer Natural Resources in a deal worth $62 billion. The purchase helped the energy giant expand its holdings in the Permian Basin.

And in November, Chevron (NYSE: CVX) agreed to purchase Hess (NYSE: HES) in a deal worth $53 billion. In addition, Occidental Petroleum (NYSE: OXY) initiated its purchase of CrownRock in December, while in February Diamondback Energy (NSDQ: FANG) announced that it would buy Endeavor Energy Resources.

According to the U.S. Energy Information Administration, companies in the industry spent $234 billion on M&A deals in 2023. That’s the highest amount spent in more than a decade.

Thanks to high energy prices that have driven up profits, oil majors are flush with cash. They’re using that money to expand their businesses, despite the increasing call for renewable energy sources.

However, according to some analysts, this flurry of M&A activity is about to dry up.

Earlier this week, Danilo Onorino, portfolio manager of the Dogma Renovatio Equity Fund, predicted that a bid for Marathon would be the last of the major oil deals.

“The consolidation comes after the COVID period… that was the final ignition of the energy transition,” he said. “From now on, the energy transition will be more and more prevalent, therefore the oil-and-gas industry needs to consolidate even more.”

Of the ConocoPhillips deal, Onorino said,” It’s defensive, it’s an all-share deal, not designed to grow but to consolidate the industry. Because the industry is in defensive mode, because energy transition is irreversible. You can slow it down, but you can’t reverse it.”

BEA Lowers Q1 GDP

Yesterday, the U.S. Bureau of Economic Analysis (BEA) downwardly revised its estimate for the country’s first-quarter gross domestic product (GDP).

Back in April, the BEA estimated that the economy grew at an annualized pace of 1.6% during the first three months of 2024.

Now the bureau reports that first-quarter GDP actually grew by 1.3%.

According to the BEA, the revised percentage “primarily reflected a downward revision to consumer spending.” Rather than rising by 2.5% in the first quarter — as originally reported — personal consumption rose by only 2%.

“The increase in consumer spending reflected an increase in services that was partly offset by a decrease in goods,” the BEA said in a press release.

Meanwhile, the BEA has revised its GDP reading for the fourth quarter of 2023 to indicate 3.4% growth — higher than previously reported.

“The weaker headline growth statistic looks discouraging, but it belies solid underlying momentum as the economy’s core — private domestic sales to domestic purchasers — showed a healthy expansion of 2.5% annualized,” economist Oren Klachkin of Nationwide wrote in response to the revised data.

Despite the downward revision, economists broadly aren’t expecting the U.S. GDP to slow significantly. According to the Atlanta Federal Reserve Bank’s GDPNow tool, central bank economists are expecting 3.5% annualized growth in the second quarter.

Nationwide’s Klachkin concurs. “Monthly data beyond March generally point to a continued, albeit gently cooling, economic expansion,” he wrote. “We anticipate continued GDP gains this year and a healthy advance in 2024 overall.”

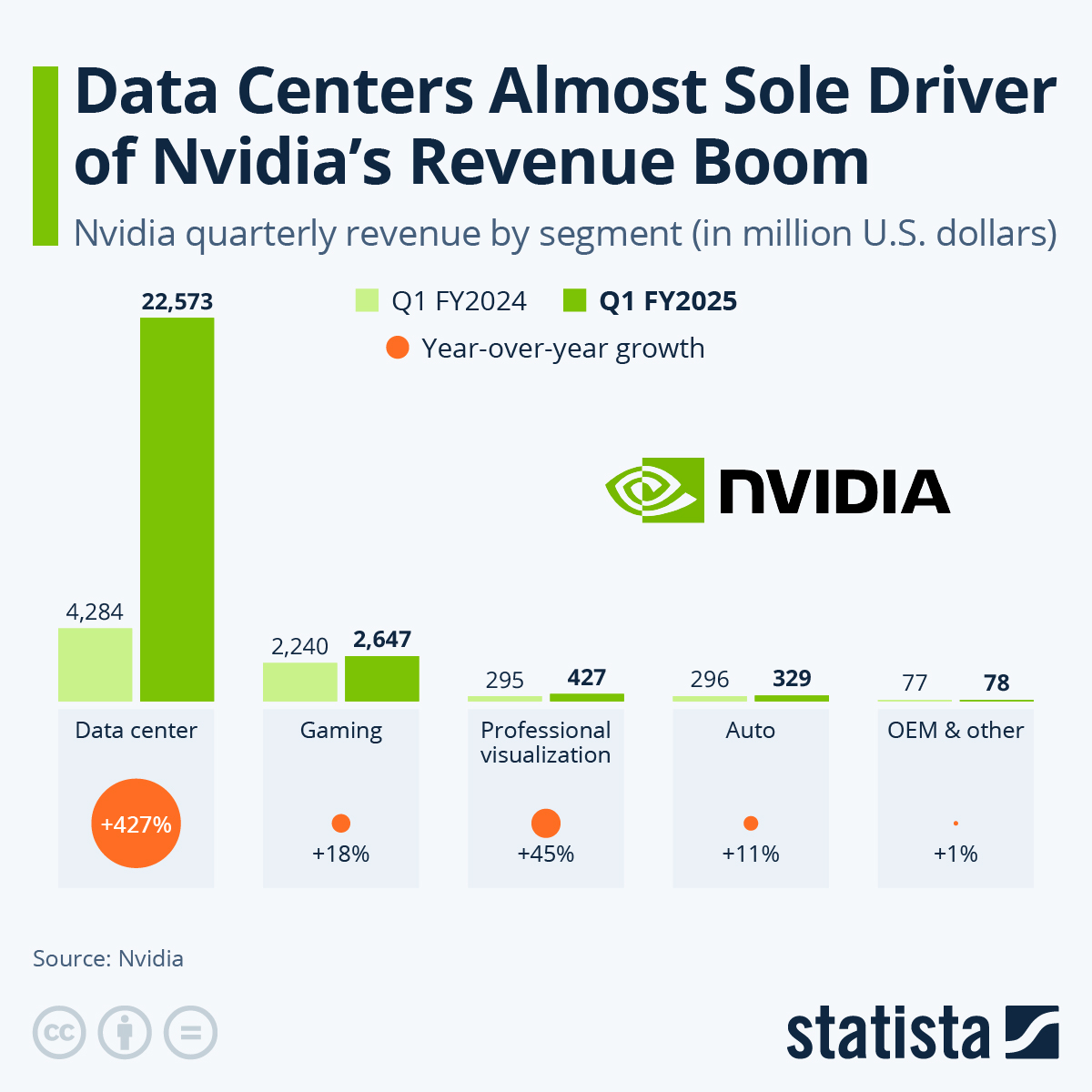

Nvidia’s Data Center Revenue

Last week, Nvidia (NSDQ: NVDA) reported quarterly earnings that again blew expectations out of the water.

The chipmaker reported revenue of $26 billion and net income of $15 billion for its fiscal fourth quarter.

However, Nvidia’s success rests squarely on just one of the company’s segments.

Nvidia’s data center segment includes the chips that the company creates specifically for the artificial intelligence (AI) industry, as well as other cloud-computing hardware.

In the fiscal first quarter, Nvidia’s data center segment accounted for $22.6 billion, or 87% of the company’s overall revenue.

I found an infographic that illustrates just how important Nvidia’s data center segment is to the company. Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Crypto is making ordinary investors rich… and it serves as an inflation hedge, to boot.

But you need to make your move now because the fuse is lit on this market. And every day you wait is literally costing you thousands in profits.

If you’re worried you can’t figure out crypto…don’t be.

Our in-house crypto expert, Alex Benfield, will make it easy for you. You won’t have to figure anything out on your own. He’ll walk you through everything, step by step.

Alex made a personal fortune on crypto. Now, his mission in life is to spread the word about crypto and make other people wealthy, too.

Get in on the crypto action…now. To learn more about Alex’s new trading service, Crypto Trend Investor, click here.