Apple Fines, Fed Rates, and More!

Editor’s Note: Happy Wednesday, dear reader!

I hope you’re having a great week so far. Let’s get to it!

Apple Hit by Brand-New EU Antitrust Rules

Apple (NSDQ: AAPL) had the dubious distinction of being the first company charged under new European Union antitrust rules.

The EU’s executive arm, the European Commission, first opened a probe into the Cupertino Giant — as well as Google parent Alphabet (NSDQ: GOOGL) and social media giant Meta Platforms (NSDQ: META) — back in March.

The investigations were to see if the tech companies had violated a new law, the Digital Markets Act (DMA). The DMA is an anti-steering law that forbids tech companies from preventing third parties from telling users about cheaper options to buy or subscribe to their products.

This week, the EU regulators determined that the preliminary findings of the Apple probe showed that the company’s App Store “prevent[ed] developers from freely steering consumers to alternative channels for offers and content.”

This is despite some changes Apple has made to its App Store policies with the DMA in mind.

For example, Apple does allow developers to display a link that will allow users to purchase subscriptions and content from their websites.

However, according to the European Commission, this is “subject to several restrictions imposed by Apple that prevent app developers from communicating, promoting offers, and concluding contracts through the distribution channel of their choice.”

In addition, the commission determined that Apple charges exorbitant fees to developers.

Apple released a statement on Monday that rebuffs the charges. “We are confident our plan complies with the law and estimate more than 99% of developers would pay the same or less in fees to Apple under the new business terms we created,” the company said.

“All developers doing business in the EU on the App Store have the opportunity to utilize the capabilities that we have introduced, including the ability to direct app users to the web to complete purchases at a very competitive rate.”

If the commission’s court determines Apple violated DMA rules, it could have to pay a fine of up to 10% of its annual global gross revenue.

Apple has already been levied a major fine by the EU this year. Back in March, regulators fined the Big Tech giant nearly $2 billion on separate antitrust charges.

Could We Get Another Rate Hike?

According to the CME Group’s (NSDQ: CME) FedWatch tool, the fed futures market is pricing in a nearly 60% chance that the Federal Reserve will trim rates in September.

However, there’s still a possibility that the Fed could surprise us with another rate hike in 2024.

This week, Federal Reserve Governor Michelle Bowman said in a speech in London that she would be “open” to raising rates again if inflation doesn’t retreat.

“I remain willing to raise the target range for the federal funds rate at a future meeting, should progress on inflation stall or even reverse,” she said. “Given the risks and uncertainties regarding my economic outlook, I will remain cautious in my approach to considering future changes in the stance of policy.”

Still, Bowman noted that she thinks it’s likely the Fed will continue to keep its overnight borrowing rate range between 5.25% and 5.50%.

Like the rest of her Fed colleagues, Bowman maintained that she would remain devoted to the data.

“Should the incoming data indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower the federal funds rate to prevent monetary policy from becoming overly restrictive,” Bowman noted in the speech.

“However, we are still not yet at the point where it is appropriate to lower the policy rate.”

This week, the Swiss National Bank initiated its second interest rate slash, and last week, the European Central Bank likewise lowered its benchmark rate.

However, Bowman noted in London that the Fed does not have to follow suit. “It is possible over the coming months that the path of monetary policy in the U.S. will diverge from that of other advanced economies,” she said.

This week, Mary Daly, president of the San Francisco Federal Reserve, also stuck to her guns against “preemptive” rate cutting.

“I do think that preemptive cutting is something that you do when you see risks,” Daily said at an event. “We’re going to be resolute until we finish the job. That’s why not taking preemptive action when it’s not necessary is so important.”

Consumer Conference Drops in June

Meanwhile, U.S. consumers are growing slightly more anxious about the economic future.

According to the Conference Board’s latest reading of its Consumer Confidence Index, confidence dropped from a downwardly revised 101.3 in May to 100.4 in June. For the record, that’s about what economists had been expecting.

It’s nearly impossible to overstate the importance of the consumer on the U.S. economy. After all, consumer spending accounts for roughly 70% of the country’s economic activity.

Breaking down the index results, the “present situations” metric rose from 140.8 to 141.5 — the highest reading the Conference Board has reported since March. However, the “expectations” index dropped to 73.

June’s reading marked the fifth consecutive reading in which this metric remained below 80. According to the Conference Board, readings below this threshold indicate that a recession may be ahead.

Don’t get too worried. since March 2022, the expectations index has been at or above 80 only six times.

“Consumers expressed mixed feelings this month: Their view of the present situation improved slightly overall, driven by an uptick in sentiment about the current labor market, but their assessment of current business conditions cooled,” the Conference Board’s chief economist, Dana Peterson,” noted in a statement.

According to the results, the percentage of consumers who said business conditions were “good” was 19.6% — a slight downturn from the 20.8% reported in May.

On the other hand, 17.7% said that current business conditions were “bad.” That also represented a slight dropoff, from 18.4% in May.

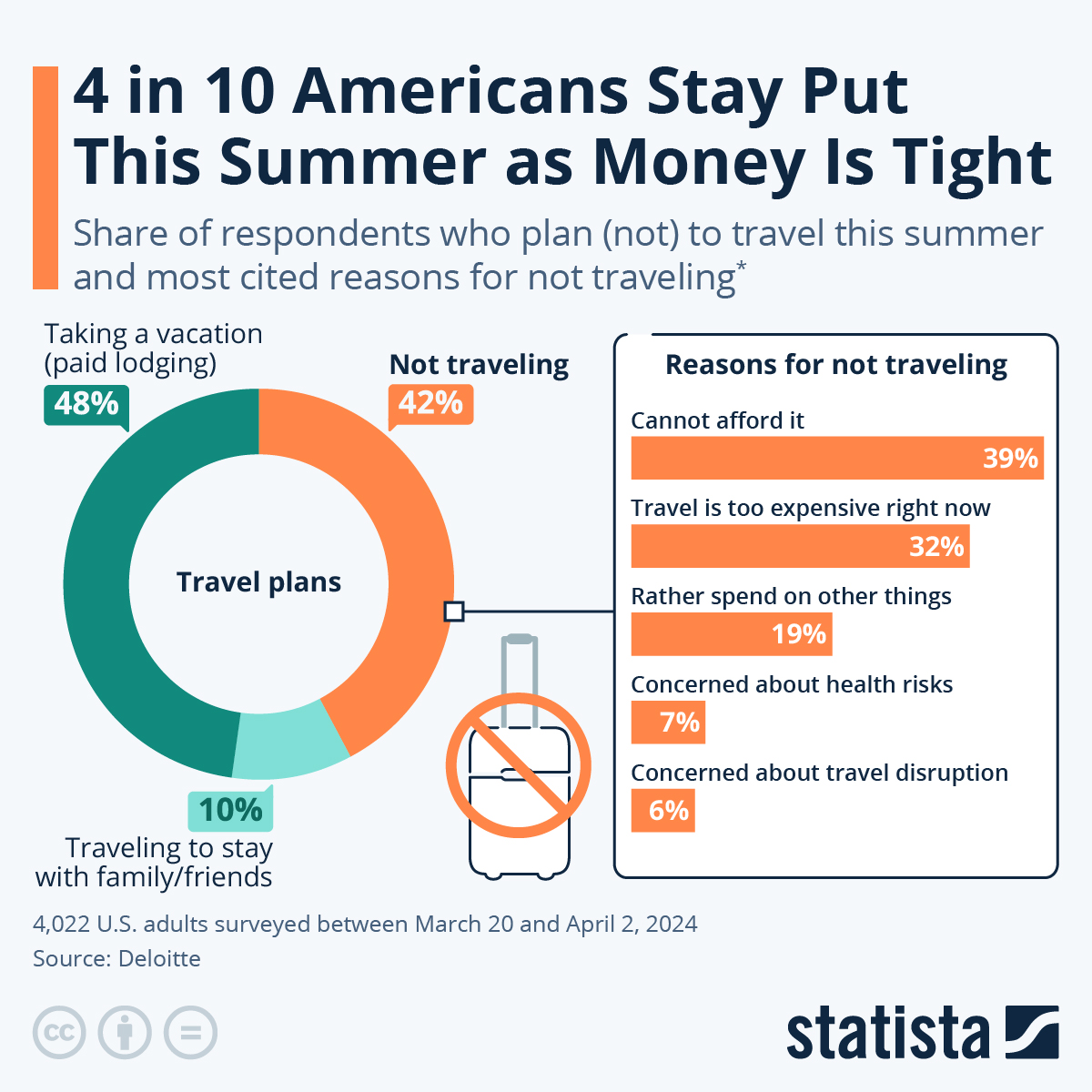

Why Are Americans Skipping Summer Vacation This Year?

It looks like we’ve collectively gotten over our COVID-era cabin fever.

According to a new report from Deloitte, 42% of Americans have no travel plans for this summer (defined as from Memorial Day until October 1). That’s up from last year’s 37% of homebodies.

Deloitte reports that high costs are keeping folks at home. 39% of the stay-at-homers said that they can’t afford to take a vacation this year, while 32% said that traveling in general is just “too expensive.” Another 19% said they’d rather spend the money on something else.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Crypto is making ordinary investors rich… and it serves as an inflation hedge, to boot.

But you need to make your move now because the fuse is lit on this market. And every day you wait is literally costing you thousands in profits.

If you’re worried you can’t figure out crypto…don’t be.

Our in-house crypto expert, Alex Benfield, will make it easy for you. You won’t have to figure anything out on your own. He’ll walk you through everything, step by step.

Alex made a personal fortune on crypto. Now, his mission in life is to spread the word about crypto and make other people wealthy, too.

Get in on the crypto action…now. To learn more about Alex’s new trading service, Crypto Trend Investor, click here.