Boeing to Buy Spirit, Redbox Bankruptcy, and More!

Editor’s Note: Dear reader, I hope you have a wonderful July 4 holiday!

Let’s get to it!

Boeing’s Bid to Buy Back Spirit AeroSystems

Boeing (NYSE: BA) announced late Sunday that it plans to re-acquire supplier Spirit AeroSystems (NYSE: SPR) for $4.7 billion.

Spirit was created back in 2005 when Boeing sold off its manufacturing operations in Wichita, Kansas, to Onex Corp. The business was renamed Spirit.

Over the years, Spirit has been a major fuselage supplier to Boeing, as well as to rival plane maker Airbus (OTCMKTS: EADSY).

However, Spirit has come under fire lately. Defects in the company’s products led to disaster for Boeing this year after a panel of a 737 Max jet fell off in mid-flight. As it turned out, the jet had been recently worked on by Spirit employees at a Boeing factory. Someone had failed to replace a few critical bolts that held the panel in place.

Whether the mistake was the fault of Spirit or Boeing workers is unclear. However, following the incident, the U.S. Federal Aviation Administration (FAA) grounded certain 737 Max 9 jets and increased its oversight of the two companies.

By repurchasing Spirit, Boeing hopes to improve the quality control issues and deflect some scrutiny from the FAA and other regulators.

“We believe this deal is in the best interest of the flying public, our airline customers, the employees of Spirit and Boeing, our shareholders, and the country more broadly,” Boeing President and CEO Dave Calhoun said in a statement.

“Bringing Spirit and Boeing together will enable greater integration of both companies’ manufacturing and engineering capabilities, including safety and quality systems.”

Boeing’s bid for Spirit values the supplier at roughly $37.25 per share — a slight premium to its stock’s current price.

However, including Spirit’s debt, the total value of the deal is roughly $8.3 billion, according to Boeing.

Redbox Parent Files for Bankruptcy

After years of financial struggles, Redbox parent company Chicken Soup for the Soul Entertainment (NSDQ: CSSE) has filed for bankruptcy.

According to a filing, the company owes nearly $1 billion in debt — with a list of more than 500 debtors, including Sony (NYSE: SONY), Warner Bros. Discovery (NSDQ: WBD), Walgreens (NSDQ: WBA), and Walmart (NYSE: WMT).

Now, Chicken Soup for the Soul Entertainment purchased Redbox only in 2022 from Apollo Global Management.

Chicken Soup, which owns several free streaming services, hoped to use its Redbox purchase to build an entertainment empire. The company already owned several free streaming services, such as Crackle, which it purchased from Sony.

However, the acquisition left Chicken Soup roughly $325 million in debt.

In addition, Redbox’s DVD sales have dropped due to a decline in consumer demand plus last year’s Hollywood strikes, which significantly shortened the list of new DVD releases. These are the conditions which led Netflix (NSDQ: NFLX) to finally abandon its DVD rental service last September.

The number of Redbox kiosks have also shrunk — from 36,000 when the acquisition was finalized in August 2022 to roughly 27,000 today.

In May, Chicken Soup reported a whopping 75% decrease in net revenue for the first quarter of 2024. The company had initially delayed reporting earnings due to excess “turnover” in its accounting department.

Year to date, Chicken Soup for the Soul Entertainment’s stock has plunged by nearly 50%. However, in the past 12 months, shares have lost more than 90% of their value.

China EV Makers Post Record Results

Tesla (NSDQ: TSLA) should be shaking in its stainless-steel boots.

Chinese electric vehicle (EV) rivals Nio (NYSE: NIO), BYD (OTCMKTS: BYDDY), and Zeekr (NYSE: ZK) reported record deliveries for June this week.

Nio delivered 21,209 EVs in June, bringing its first-half-of-the-year total to 87,426. That’s roughly 96% more vehicles than it delivered in June 2023 and topped Nio’s previous monthly sales record (May 2024’s 20,544 EV deliveries).

Nio’s June deliveries also marked a year-over-year increase of more than 60%.

The EV maker’s sales were boosted by an updated lineup of vehicles, as well as price adjustments.

In the second half of 2024, Nio expects to begin deliveries of its “budget” Onvo L60 SUV. Priced at roughly $30,500, the Onvo L60 is intended to rival the Tesla Model Y.

Of course, tariffs on Chinese EVs in the U.S. and Europe threaten the company’s expansion efforts.

As for Zeekr, it reported delivering 20,106 vehicles in June, bringing its year-to-date total to 87,870 EVs delivered. The company has Russia to thank for this sales boost.

Ever since Russia’s war on Ukraine began in February 2022, Western carmakers have pulled out from the market, leaving Chinese firms in a dominant position.

Meanwhile, BYD reported that it sold 341,658 NEVs (new energy vehicles) last month — again, a new record. That reflected a 35% increase in sales on a year-over-year basis.

According to BYD, it delivered 145,179 all-electric vehicles last month and 195,032 plug-in hybrids. BYD’s hybrid business saw a 58% improvement year-over-year, while EV sales reflected an 18% increase.

All told, BYD delivered 1.6 million NEVs in the first half of 2024. That’s a 29% increase on a year-over-year basis.

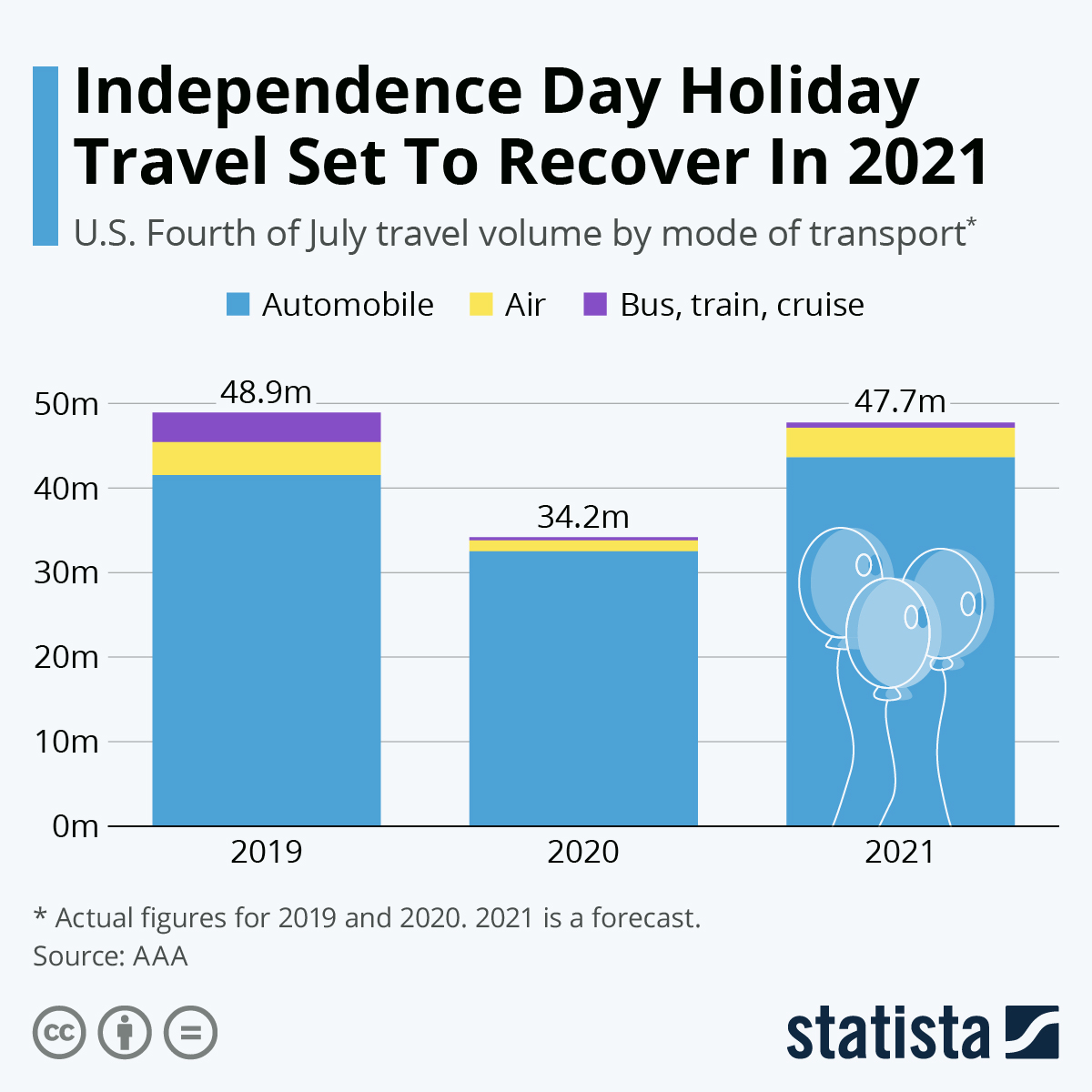

A Record Travel Week for July 4

This week, a record number of Americans are expected to travel more than 50 miles, according to the American Automobile Association (AAA).

The AAA forecasts that more than 70 million U.S. residents are either hitting the road, riding the rails, or taking to the skies.

Breaking it down, 60.6 million Americans are expected to be driving, while 5.7 million are flying to their destination. Another 4.6 million are traveling by train or another means of transportation.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

The total number of travelers represents a 5% year-over-year increase and an 8% boost from 2019 — the year before the COVID pandemic disrupted practically everything.

“With summer vacations in full swing and the flexibility of remote work, more Americans are taking extended trips around Independence Day,” AAA Senior Vice President Paula Twidale said in a statement.

“We anticipate this July 4th week will be the busiest ever with an additional 5.7 million people traveling compared to 2019.”

P.S. Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality… specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

However, to find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For his premium service Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

Don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.