Retail Sales, Bank Earnings, and More!

Editor’s Note: Happy Wednesday, dear reader!

Let’s get to it!

June Retail Sales Come In Better Than Expected

Once again, data from the U.S. Commerce Department proves that you can’t underestimate the American consumer.

According to the department, spending remained flat from May to June, defying Wall Street’s prediction of a consumer pullback last month.

What’s more, spending for May was revised upward to show a 0.3% increase. That follows last month’s report, in which April sales were revised downward by 0.2%.

Sales at automobile dealerships and gas stations weighed down overall spending. Sales at dealerships fell by 2.3% — likely affected by the cyberattack on car sales software company CDK — while gas station sales dropped by 3%.

Stripping out these categories, retail sales enjoyed a 0.8% boost last month.

In addition, a control group that excludes several typically volatile sales categories and that is used in determining quarterly gross domestic product (GDP) rose 0.9% in June — significantly higher than the 0.9% increase expected.

“Although retail sales were unchanged in June, the strong 0.9% rise in control group sales should ease concerns about the plight of the consumer in the wake of the renewed slump in sentiment,” Capital Economics economist Paul Ashworth wrote in a note to clients.

“Admittedly, both second-quarter consumption and GDP growth still appear to have been no better than 2% annualized, but the strong gain in June does set up for a better third-quarter performance.”

Goldman Sachs Beats Q2 Earnings Estimates

On Monday, Wall Street heavyweight Goldman Sachs (NYSE GS) reported that it beat estimates for second-quarter profit and revenue.

For the quarter, the bank reported earnings per share (EPS) of $8.62, versus analyst expectations of $8.34 per share, according to LSEG.

Net income for the quarter totaled $3 billion — again, beating the Wall Street forecast of $2.8 billion and a significant increase from the $1.2 billion the bank reported for the year-ago quarter.

In addition, Goldman’s revenue came in at $12.73 billion, versus estimates of $12.46 billion.

Goldman Sachs reported that revenues from its investment banking services fell short of forecasts, a $1.7 billion. However, that was still a whopping 21% improvement from the second quarter of 2023.

The bank also reported a 17% increase in revenue from fixed-income trading, to $3.2 billion, and a 7% increase in revenue from equities trading, to $3.2 billion again.

Those two results were better than what analysts had been expecting.

“We are pleased with our solid second-quarter results and our overall performance in the first half of the year, reflecting strong year-on-year growth in both global banking and markets and asset and wealth management,” CEO David Solomon said in a statement.

He must be relieved… last year, the bank’s poor performance led to calls for his ouster.

This earnings season, better-than-expected results thanks to increased investment banking fees and a revival of equities trading have also led Goldman’s Wall Street rivals Citigroup (NYSE: C) and JPMorgan Chase (NYSE: JPM) to report better-than-expected results.

Meanwhile, Morgan Stanley (NYSE: MS) had a mixed earnings report…

Morgan Stanley Stock Slides Despite Better-Than-Expected Q2

Shares of investment bank Morgan Stanley (NYSE: MS) fell yesterday despite reporting better-than-expected profit and revenue for the second quarter.

Morgan Stanley reported a 41% year-over-year increase in profits, to $3.08 billion, or $1.82 per share. Wall Street had been expecting earnings of only $1.65 per share, according to LSEG.

Revenue rose by 12%, to $15.02 billion.

However, Morgan Stanley’s wealth management unit reported revenue that missed estimates, sending the bank’s stock lower in morning trading.

Wealth management revenue rose on a year-over-year basis by 2%, to $6.79 billion. That was below the $6.88 billion Wall Street had been expecting.

In addition, the division’s income from interest dropped 17% on a year-over-year basis, to $1.79 billion.

According to Morgan Stanley, this decline was due to “cash redeployments by clients in a higher interest rate environment.” In other words, clients are seeking out higher-yielding investments.

Still, Morgan Stanley enjoyed an increase in revenue in its institutional securities division, thanks to increased trading activity in the quarter.

The bank’s equity trading activities saw an 18% increase in revenue, to $3.02 billion. That’s about $330 million more than what Wall Street had been expecting. In addition, revenue from fixed-income trading rose by 16%, to $1.99 billion.

Meanwhile, revenue from investment banking rose by a whopping 51% year over year, to $1.62 billion.

“The firm delivered another strong quarter in an improving capital markets environment,” CEO Ted Pick said in a statement. “We continue to execute on our strategy and remain well positioned to deliver growth and long-term value for our shareholders.”

A Rate Cut Looks More and More Likely

Last week, Federal Reserve officials signaled that they’re getting ready to cut interest rates.

The first cut is likely to occur when the Federal Open Market Committee (FOMC) holds its September meeting, rather than at the meeting slated for the end of this month.

However, policymakers are indicating that the central bank’s unprecedented anti-inflation campaign is nearing its end.

At a Congressional hearing last week, Fed Head Jerome Powell noted that the central bank must be wary of “two-sided risks” — which would include holding rates too high for too long, triggering a potential recession.

And San Francisco Fed President Mary Daly also remarked to reporters that an interest rate cut is now “warranted.”

Although the Producer Price Index (PPI) reading — which measures the costs of goods and services on a wholesale level — indicated that prices ticked higher in June, other inflation gauges have indicated that the Fed’s measures have worked.

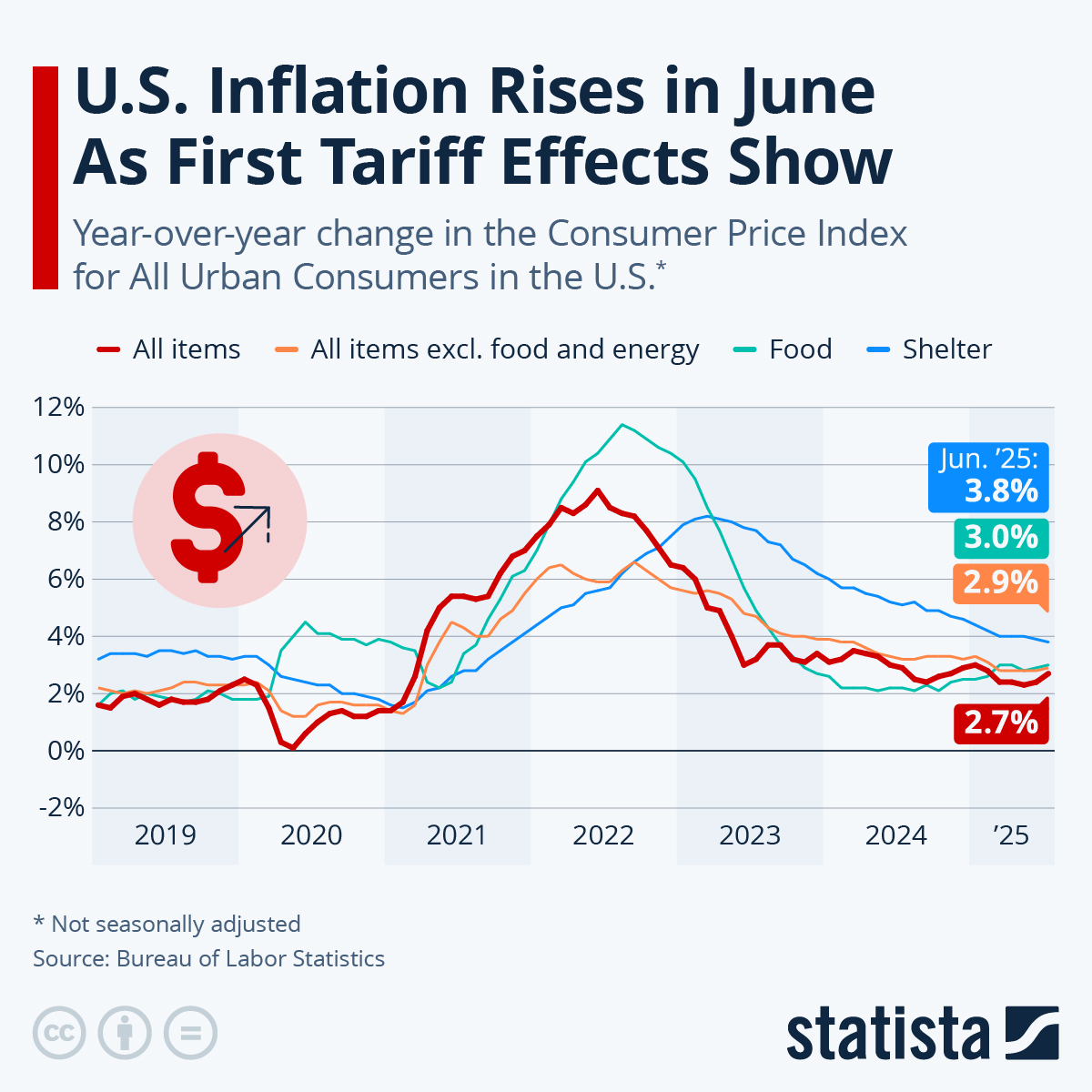

In fact, last week, the Bureau of Labor Statistics (BLS) reported that growth in core inflation — which excludes volatile energy and food costs — had fallen to its lowest point since April 2021.

Take a look:

You will find more infographics at Statista

You will find more infographics at Statista

P.S. Why are certain cannabis stocks jumping +1,000%? It has to do with seasonality…specifically, the U.S. presidential election.

It happens every four years. No matter who’s running for office. During the previous presidential election cycle, you had a chance to grab 569%… 1,020%… 2,426% and higher. Now it’s happening again, and you’ve no time to lose.

However, to find the best cannabis stocks, you need to conduct due diligence.

The good news is, my colleague John Persinos has done the homework for you. For his premium Marijuana Profit Alert, he’s put together a portfolio of the best-of-breed marijuana equities. These holdings are poised to soar during this political season. If you’re fortunate enough to own these companies, you’ll reap a windfall.

As the second half of 2024 gets underway, don’t leave money on the table. Make your move now, before the investment herd. Learn about John’s next trades. Click here.